Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group results<br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

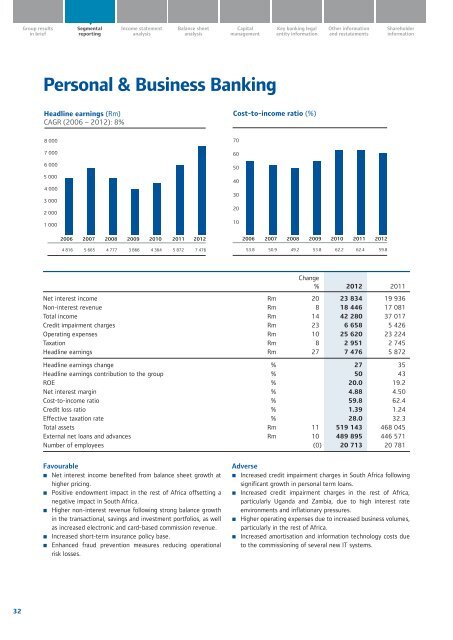

Personal & Business <strong>Bank</strong>ing<br />

Headline earnings (Rm)<br />

CAGR (2006 – 2012): 8%<br />

Cost-to-income ratio (%)<br />

8 000<br />

7 000<br />

6 000<br />

5 000<br />

4 000<br />

3 000<br />

2 000<br />

1 000<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

4 816 5 665 4 777 3 866 4 364 5 872 7 476<br />

53.8 50.9 49.2 53.8 62.2 62.4 59.8<br />

Change<br />

% 2012 2011<br />

Net interest income Rm 20 23 834 19 936<br />

Non-interest revenue Rm 8 18 446 17 081<br />

Total income Rm 14 42 280 37 017<br />

Credit impairment charges Rm 23 6 658 5 426<br />

Operating expenses Rm 10 25 620 23 224<br />

Taxation Rm 8 2 951 2 745<br />

Headline earnings Rm 27 7 476 5 872<br />

Headline earnings change % 27 35<br />

Headline earnings contribution to the group % 50 43<br />

ROE % 20.0 19.2<br />

Net interest margin % 4.88 4.50<br />

Cost-to-income ratio % 59.8 62.4<br />

Credit loss ratio % 1.39 1.24<br />

Effective taxation rate % 28.0 32.3<br />

Total assets Rm 11 519 143 468 045<br />

External net loans and advances Rm 10 489 895 446 571<br />

Number of employees (0) 20 713 20 781<br />

Favourable<br />

• Net interest income benefited from balance sheet growth at<br />

higher pricing.<br />

• Positive endowment impact in the rest of Africa offsetting a<br />

negative impact in South Africa.<br />

• Higher non-interest revenue following strong balance growth<br />

in the transactional, savings and investment portfolios, as well<br />

as increased electronic and card-based commission revenue.<br />

• Increased short-term insurance policy base.<br />

• Enhanced fraud prevention measures reducing operational<br />

risk losses.<br />

Adverse<br />

• Increased credit impairment charges in South Africa following<br />

significant growth in personal term loans.<br />

• Increased credit impairment charges in the rest of Africa,<br />

particularly Uganda and Zambia, due to high interest rate<br />

environments and inflationary pressures.<br />

• Higher operating expenses due to increased business volumes,<br />

particularly in the rest of Africa.<br />

• Increased amortisation and information technology costs due<br />

to the commissioning of several new IT systems.<br />

32