Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

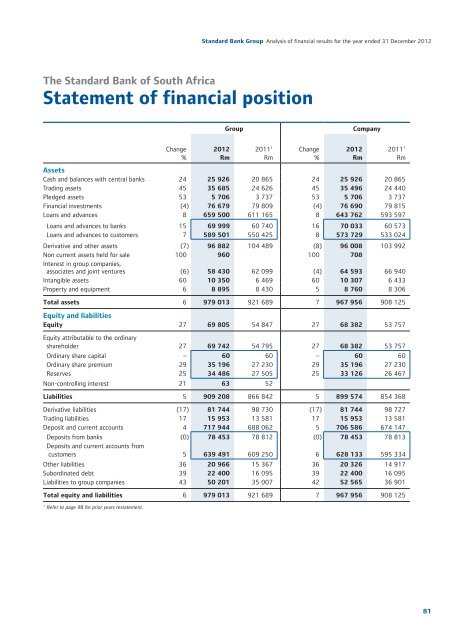

<strong>Standard</strong> <strong>Bank</strong> Group Analysis of financial results for the year ended 31 December 2012<br />

The <strong>Standard</strong> <strong>Bank</strong> of South Africa<br />

Statement of financial position<br />

Group<br />

Company<br />

Change<br />

%<br />

2012<br />

Rm<br />

2011 1<br />

Rm<br />

Change<br />

%<br />

2012<br />

Rm<br />

2011 1<br />

Rm<br />

Assets<br />

Cash and balances with central banks 24 25 926 20 865 24 25 926 20 865<br />

Trading assets 45 35 685 24 626 45 35 496 24 440<br />

Pledged assets 53 5 706 3 737 53 5 706 3 737<br />

Financial investments (4) 76 679 79 809 (4) 76 690 79 815<br />

Loans and advances 8 659 500 611 165 8 643 762 593 597<br />

Loans and advances to banks 15 69 999 60 740 16 70 033 60 573<br />

Loans and advances to customers 7 589 501 550 425 8 573 729 533 024<br />

Derivative and other assets (7) 96 882 104 489 (8) 96 008 103 992<br />

Non current assets held for sale 100 960 100 708<br />

Interest in group companies,<br />

associates and joint ventures (6) 58 430 62 099 (4) 64 593 66 940<br />

Intangible assets 60 10 350 6 469 60 10 307 6 433<br />

Property and equipment 6 8 895 8 430 5 8 760 8 306<br />

Total assets 6 979 013 921 689 7 967 956 908 125<br />

Equity and liabilities<br />

Equity 27 69 805 54 847 27 68 382 53 757<br />

Equity attributable to the ordinary<br />

shareholder 27 69 742 54 795 27 68 382 53 757<br />

Ordinary share capital – 60 60 – 60 60<br />

Ordinary share premium 29 35 196 27 230 29 35 196 27 230<br />

Reserves 25 34 486 27 505 25 33 126 26 467<br />

Non-controlling interest 21 63 52<br />

Liabilities 5 909 208 866 842 5 899 574 854 368<br />

Derivative liabilities (17) 81 744 98 730 (17) 81 744 98 727<br />

Trading liabilities 17 15 953 13 581 17 15 953 13 581<br />

Deposit and current accounts 4 717 944 688 062 5 706 586 674 147<br />

Deposits from banks (0) 78 453 78 812 (0) 78 453 78 813<br />

Deposits and current accounts from<br />

customers 5 639 491 609 250 6 628 133 595 334<br />

Other liabilities 36 20 966 15 367 36 20 326 14 917<br />

Subordinated debt 39 22 400 16 095 39 22 400 16 095<br />

Liabilities to group companies 43 50 201 35 007 42 52 565 36 901<br />

Total equity and liabilities 6 979 013 921 689 7 967 956 908 125<br />

1<br />

Refer to page 98 for prior years restatement.<br />

81