Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Standard</strong> <strong>Bank</strong> Group Analysis of financial results for the year ended 31 December 2012<br />

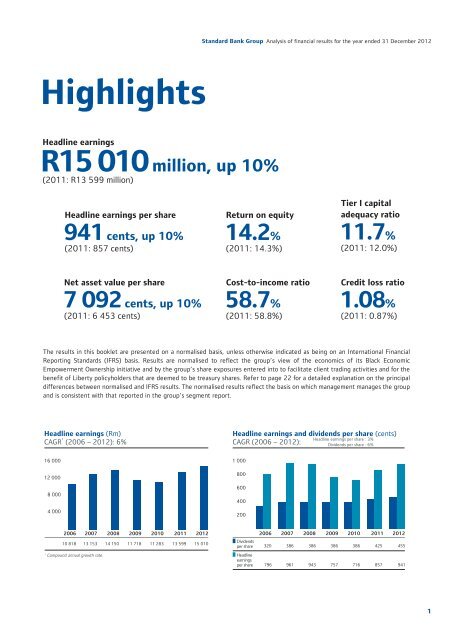

Highlights<br />

Headline earnings<br />

R15 010 million, up 10%<br />

(2011: R13 599 million)<br />

Headline earnings per share<br />

941 cents, up 10%<br />

(2011: 857 cents)<br />

Return on equity<br />

14.2%<br />

(2011: 14.3%)<br />

Tier I capital<br />

adequacy ratio<br />

11.7%<br />

(2011: 12.0%)<br />

Net asset value per share<br />

7 092 cents, up 10%<br />

(2011: 6 453 cents)<br />

Cost-to-income ratio<br />

58.7%<br />

(2011: 58.8%)<br />

Credit loss ratio<br />

1.08%<br />

(2011: 0.87%)<br />

The results in this booklet are presented on a normalised basis, unless otherwise indicated as being on an International Financial<br />

Reporting <strong>Standard</strong>s (IFRS) basis. Results are normalised to reflect the group’s view of the economics of its Black Economic<br />

Empowerment Ownership initiative and by the group’s share exposures entered into to facilitate client trading activities and for the<br />

benefit of Liberty policyholders that are deemed to be treasury shares. Refer to page 22 for a detailed explanation on the principal<br />

differences between normalised and IFRS results. The normalised results reflect the basis on which management manages the group<br />

and is consistent with that reported in the group’s segment report.<br />

Headline earnings (Rm)<br />

CAGR<br />

1<br />

(2006 – 2012): 6%<br />

Headline earnings and dividends per share (cents)<br />

CAGR (2006 – 2012):<br />

Headline earnings per share : 3%<br />

Dividends per share : 6%<br />

16 000<br />

12 000<br />

8 000<br />

4 000<br />

1 000<br />

800<br />

600<br />

400<br />

200<br />

2006 2007 2008 2009 2010 2011 2012<br />

10 818 13 153 14 150 11 718 11 283 13 599 15 010<br />

1<br />

Compound annual growth rate.<br />

Dividends<br />

per share<br />

Headline<br />

earnings<br />

per share<br />

2006 2007 2008 2009 2010 2011 2012<br />

320 386 386 386 386 425 455<br />

796 961 943 757 716 857 941<br />

1