Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Standard</strong> <strong>Bank</strong> Group Analysis of financial results for the year ended 31 December 2012<br />

The <strong>Standard</strong> <strong>Bank</strong> of South Africa<br />

Risk-weighted assets<br />

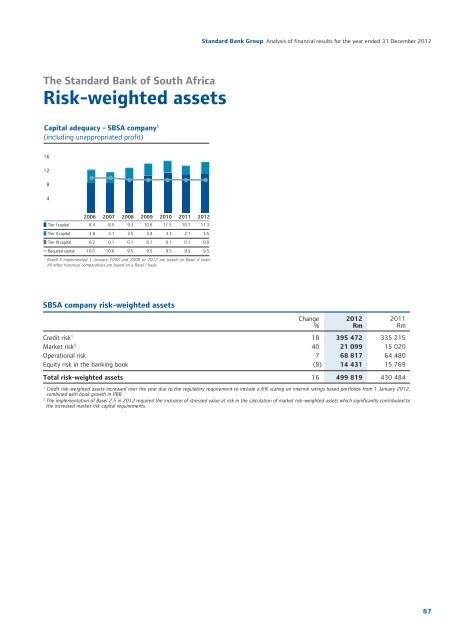

Capital adequacy - SBSA company 1<br />

(including unappropriated profit)<br />

16<br />

12<br />

8<br />

4<br />

2006 2007 2008 2009 2010 2011 2012<br />

Tier I capital 8.4 8.5 9.3 10.6 11.5 10.7 11.3<br />

Tier II capital 3.8 3.1 3.5 3.4 3.3 2.7 3.5<br />

Tier III capital 0.2 0.1 0.1 0.1 0.1 0.1 0.0<br />

Required capital 10.0 10.0 9.5 9.5 9.5 9.5 9.5<br />

1<br />

Basell II implemented 1 January 2008 and 2008 to 2012 are based on Basel II basis.<br />

All other historical comparatives are based on a Basel I basis.<br />

SBSA company risk-weighted assets<br />

Change<br />

%<br />

2012<br />

Rm<br />

Credit risk 1 18 395 472 335 215<br />

Market risk 2 40 21 099 15 020<br />

Operational risk 7 68 817 64 480<br />

Equity risk in the banking book (8) 14 431 15 769<br />

Total risk-weighted assets 16 499 819 430 484<br />

1<br />

Credit risk-weighted assets increased over the year due to the regulatory requirement to include a 6% scaling on internal ratings based portfolios from 1 January 2012,<br />

combined with book growth in PBB.<br />

2<br />

The implementation of Basel 2.5 in 2012 required the inclusion of stressed value at risk in the calculation of market risk-weighted assets which significantly contributed to<br />

the increased market risk capital requirements.<br />

2011<br />

Rm<br />

87