Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group results<br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

The <strong>Standard</strong> <strong>Bank</strong> of South Africa<br />

Capital adequacy<br />

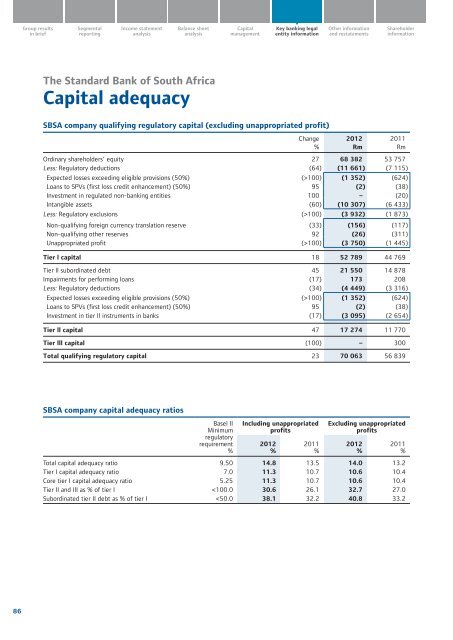

SBSA company qualifying regulatory capital (excluding unappropriated profit)<br />

Change<br />

%<br />

Ordinary shareholders’ equity 27 68 382 53 757<br />

Less: Regulatory deductions (64) (11 661) (7 115)<br />

Expected losses exceeding eligible provisions (50%) (>100) (1 352) (624)<br />

Loans to SPVs (first loss credit enhancement) (50%) 95 (2) (38)<br />

Investment in regulated non-banking entities 100 – (20)<br />

Intangible assets (60) (10 307) (6 433)<br />

Less: Regulatory exclusions (>100) (3 932) (1 873)<br />

Non-qualifying foreign currency translation reserve (33) (156) (117)<br />

Non-qualifying other reserves 92 (26) (311)<br />

Unappropriated profit (>100) (3 750) (1 445)<br />

Tier l capital 18 52 789 44 769<br />

Tier ll subordinated debt 45 21 550 14 878<br />

Impairments for performing loans (17) 173 208<br />

Less: Regulatory deductions (34) (4 449) (3 316)<br />

Expected losses exceeding eligible provisions (50%) (>100) (1 352) (624)<br />

Loans to SPVs (first loss credit enhancement) (50%) 95 (2) (38)<br />

Investment in tier II instruments in banks (17) (3 095) (2 654)<br />

Tier ll capital 47 17 274 11 770<br />

Tier lll capital (100) – 300<br />

Total qualifying regulatory capital 23 70 063 56 839<br />

2012<br />

Rm<br />

2011<br />

Rm<br />

SBSA company capital adequacy ratios<br />

Basel II<br />

Minimum<br />

regulatory<br />

requirement<br />

%<br />

Including unappropriated<br />

profits<br />

Excluding unappropriated<br />

profits<br />

2012<br />

%<br />

2011<br />

%<br />

2012<br />

%<br />

2011<br />

%<br />

Total capital adequacy ratio 9.50 14.8 13.5 14.0 13.2<br />

Tier I capital adequacy ratio 7.0 11.3 10.7 10.6 10.4<br />

Core tier I capital adequacy ratio 5.25 11.3 10.7 10.6 10.4<br />

Tier II and III as % of tier I