Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group results<br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

Explanation of principal differences between normalised and IFRS results<br />

continued<br />

In terms of IAS 32 Financial Instruments: Presentation (IAS 32),<br />

trades by subsidiaries in the group’s shares held on behalf of<br />

policyholders and group share exposures to facilitate client<br />

trading activities are deemed to be treasury shares for accounting<br />

purposes. The accounting consequences in the consolidated IFRS<br />

group financial statements are:<br />

• the cost price of shares purchased by subsidiaries as well as<br />

any funds received by subsidiaries from selling the group’s<br />

shares short are deducted from or added to ordinary<br />

shareholders’ equity and non-controlling interest respectively<br />

in the group’s financial statements<br />

• all the fair value movements are eliminated from the income<br />

statement, reserves and non-controlling interests where<br />

applicable<br />

• dividends received on group shares are eliminated against<br />

dividends paid.<br />

No corresponding adjustment is made to the policyholders’<br />

liabilities or trading positions with clients. As a result, the<br />

application of IAS 32 gives rise to a mismatch in the overall<br />

equity and income statement of the group. The liability to<br />

policyholders and client trading positions, along with the change<br />

in policyholders’ liabilities and profit or loss recognised on the<br />

client trading positions, is therefore not eliminated, even though<br />

the corresponding interest in the group’s shares is eliminated and<br />

treated as treasury shares acquired or issued.<br />

With regard to the group shares held for the benefit of Liberty<br />

policyholders, the weighted average number of shares in issue for<br />

per share figures is calculated by deducting the full number of<br />

group shares held (100%), not the IFRS effective 54.4% owned<br />

by the group, as IAS 33 Earnings per Share does not contemplate<br />

non-controlling interest portions of treasury shares. This treatment<br />

exaggerates the reduction in the weighted average number of<br />

shares used to calculate per share ratios.<br />

For purposes of calculating the normalised results, the adjustments<br />

described above are reversed, and the group shares held on<br />

behalf of policyholders and to facilitate client trading activities are<br />

treated as issued to parties external to the group.<br />

The impact of the normalised adjustments on the issued and<br />

weighted number of shares is provided on page 12.<br />

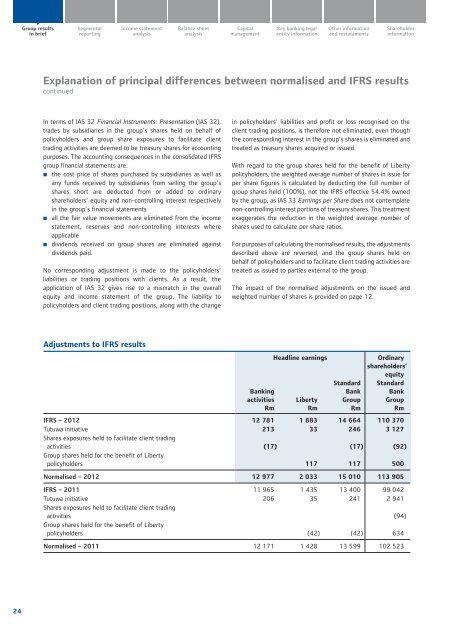

Adjustments to IFRS results<br />

<strong>Bank</strong>ing<br />

activities<br />

Rm<br />

Headline earnings<br />

Liberty<br />

Rm<br />

<strong>Standard</strong><br />

<strong>Bank</strong><br />

Group<br />

Rm<br />

Ordinary<br />

shareholders’<br />

equity<br />

<strong>Standard</strong><br />

<strong>Bank</strong><br />

Group<br />

Rm<br />

IFRS – 2012 12 781 1 883 14 664 110 370<br />

Tutuwa initiative 213 33 246 3 127<br />

Shares exposures held to facilitate client trading<br />

activities (17) (17) (92)<br />

Group shares held for the benefit of Liberty<br />

policyholders 117 117 500<br />

Normalised – 2012 12 977 2 033 15 010 113 905<br />

IFRS – 2011 11 965 1 435 13 400 99 042<br />

Tutuwa initiative 206 35 241 2 941<br />

Shares exposures held to facilitate client trading<br />

activities (94)<br />

Group shares held for the benefit of Liberty<br />

policyholders (42) (42) 634<br />

Normalised – 2011 12 171 1 428 13 599 102 523<br />

24