Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Group results<br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

<strong>Standard</strong> <strong>Bank</strong> Group Analysis of financial results for the year ended 31 December 2012<br />

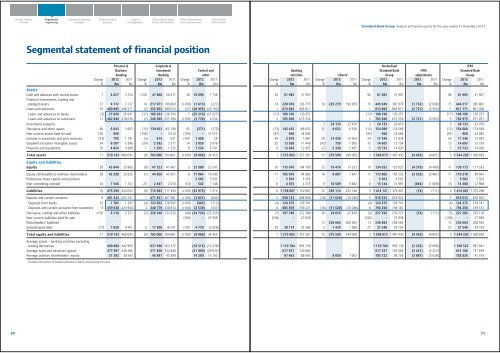

Segmental statement of financial position<br />

Change<br />

%<br />

Personal &<br />

Business<br />

<strong>Bank</strong>ing<br />

2012<br />

Rm<br />

2011<br />

Rm<br />

Change<br />

%<br />

Corporate &<br />

Investment<br />

<strong>Bank</strong>ing<br />

2012<br />

Rm<br />

2011<br />

Rm<br />

Change<br />

%<br />

Central and<br />

other<br />

2012 2011<br />

Rm Rm<br />

Assets<br />

Cash and balances with central banks 7 4 027 3 754 >100 47 868 20 417 30 10 090 7 736<br />

Financial investments, trading and<br />

pledged assets 37 4 312 3 137 14 217 971 190 860 (>100) (1 613) (227)<br />

Loans and advances 10 489 895 446 571 (7) 352 952 380 033 (27) (28 955) (22 793)<br />

Loans and advances to banks (5) 27 049 28 541 (17) 106 363 128 743 7 (25 216) (27 027)<br />

Loans and advances to customers 11 462 846 418 030 (2) 246 589 251 290 (>100) (3 739) 4 234<br />

Investment property<br />

Derivative and other assets 68 6 043 3 607 (15) 139 663 165 198 65 (271) (772)<br />

Non-current assets held for sale 100 960 (100) – 3 010 (100) – 31 075<br />

Interest in associates and joint ventures (33) 795 1 191 (3) 615 631 >100 1 400 59<br />

Goodwill and other intangible assets 54 8 287 5 396 (24) 2 582 3 377 14 3 059 2 676<br />

Property and equipment 10 4 824 4 389 1 1 355 1 335 8 7 224 6 701<br />

Total assets 11 519 143 468 045 (0) 763 006 764 861 (>100) (9 066) 24 455<br />

Equity and liabilities<br />

Equity 29 43 844 33 992 (0) 47 323 47 467 3 23 909 23 241<br />

Equity attributable to ordinary shareholders 29 42 298 32 835 (1) 44 856 45 457 8 17 864 16 590<br />

Preference share capital and premium – 5 503 5 503<br />

Non-controlling interest 34 1 546 1 157 23 2 467 2 010 (53) 542 1 148<br />

Liabilities 10 475 299 434 053 (0) 715 683 717 394 (>100) (32 975) 1 214<br />

Deposit and current accounts 9 461 343 422 231 1 471 831 467 381 (>100) (3 021) (644)<br />

Deposits from banks 32 1 705 1 287 (4) 123 052 128 567 (>100) (482) (113)<br />

Deposits and current accounts from customers 9 459 638 420 944 3 348 779 338 814 (>100) (2 539) (531)<br />

Derivative, trading and other liabilities >100 6 118 2 371 (3) 226 346 233 272 (49) (34 724) (23 255)<br />

Non-current liabilities held for sale (100) – 27 939<br />

Policyholders’ liabilities<br />

Subordinated debt (17) 7 838 9 451 5 17 506 16 741 >100 4 770 (2 826)<br />

Total equity and liabilities 11 519 143 468 045 (0) 763 006 764 861 (>100) (9 066) 24 455<br />

Average assets – banking activities excluding<br />

trading derivatives 489 809 442 995 637 490 563 372 (16 515) (13 228)<br />

Average loans and advances (gross) 477 697 436 266 371 820 332 848 (31 990) (29 032)<br />

Average ordinary shareholders’ equity 37 392 30 542 45 981 42 389 14 290 15 162<br />

1<br />

Includes elimination of balances between Liberty and banking activities.<br />

Change<br />

%<br />

<strong>Bank</strong>ing<br />

activities Liberty 1 Normalised<br />

<strong>Standard</strong> <strong>Bank</strong><br />

Group<br />

2011 Change 2012 2011 Change 2012<br />

Rm % Rm Rm % Rm<br />

2012<br />

Rm<br />

2011<br />

Rm<br />

IFRS<br />

adjustments<br />

2012 2011<br />

Rm Rm<br />

Change<br />

%<br />

IFRS<br />

<strong>Standard</strong> <strong>Bank</strong><br />

Group<br />

94 61 985 31 907 94 61 985 31 907 94 61 985 31 907<br />

14 220 670 193 770 16 225 279 194 209 15 445 949 387 979 (1 732) (2 098) 15 444 217 385 881<br />

1 813 892 803 811 1 813 892 803 811 (2 721) (2 503) 1 811 171 801 308<br />

(17) 108 196 130 257 (17) 108 196 130 257 (17) 108 196 130 257<br />

5 705 696 673 554 5 705 696 673 554 (2 721) (2 503) 5 702 975 671 051<br />

3 24 133 23 470 3 24 133 23 470 3 24 133 23 470<br />

(13) 145 435 168 033 32 8 653 6 536 (12) 154 088 174 569 (12) 154 088 174 569<br />

(97) 960 34 085 (97) 960 34 085 (97) 960 34 085<br />

49 2 810 1 881 20 14 436 12 054 24 17 246 13 935 24 17 246 13 935<br />

22 13 928 11 449 (42) 759 1 305 15 14 687 12 754 15 14 687 12 754<br />

8 13 403 12 425 (7) 2 330 2 495 5 15 733 14 920 5 15 733 14 920<br />

1 1 273 083 1 257 361 15 275 590 240 069 3 1 548 673 1 497 430 (4 453) (4 601) 3 1 544 220 1 492 829<br />

10 115 076 104 700 12 19 476 17 323 10 134 552 122 023 (4 379) (4 490) 11 130 173 117 533<br />

11 105 018 94 882 16 8 887 7 641 11 113 905 102 523 (3 535) (3 481) 11 110 370 99 042<br />

– 5 503 5 503 – 5 503 5 503 – 5 503 5 503<br />

6 4 555 4 315 9 10 589 9 682 8 15 144 13 997 (844) (1 009) 10 14 300 12 988<br />

0 1 158 007 1 152 661 15 256 114 222 746 3 1 414 121 1 375 407 (74) (111) 3 1 414 047 1 375 296<br />

5 930 153 888 968 (16) (11 620) (10 046) 5 918 533 878 922 5 918 533 878 922<br />

(4) 124 275 129 741 (4) 124 275 129 741 (4) 124 275 129 741<br />

6 805 878 759 227 (16) (11 620) (10 046) 6 794 258 749 181 6 794 258 749 181<br />

(7) 197 740 212 388 30 29 616 22 839 (3) 227 356 235 227 (74) (111) (3) 227 282 235 116<br />

(100) – 27 939 (100) – 27 939 (100) – 27 939<br />

13 236 684 208 565 13 236 684 208 565 13 236 684 208 565<br />

29 30 114 23 366 3 1 434 1 388 27 31 548 24 754 27 31 548 24 754<br />

1 1 273 083 1 257 361 15 275 590 240 069 3 1 548 673 1 497 430 (4 453) (4 601) 3 1 544 220 1 492 829<br />

1 110 784 993 139 1 110 784 993 139 (2 262) (2 098) 1 108 522 991 041<br />

817 527 740 082 817 527 740 082 (2 421) (2 253) 815 106 737 829<br />

97 663 88 093 8 059 7 063 105 722 95 156 (3 687) (3 638) 102 035 91 518<br />

2012<br />

Rm<br />

2011<br />

Rm<br />

30<br />

31