Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group results<br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

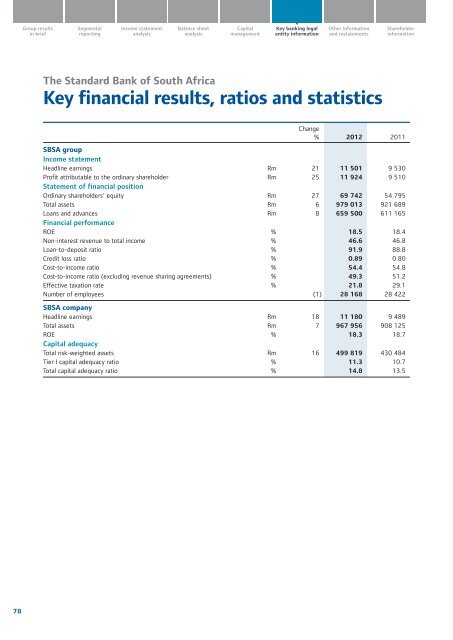

The <strong>Standard</strong> <strong>Bank</strong> of South Africa<br />

Key financial results, ratios and statistics<br />

Change<br />

% 2012 2011<br />

SBSA group<br />

Income statement<br />

Headline earnings Rm 21 11 501 9 530<br />

Profit attributable to the ordinary shareholder Rm 25 11 924 9 510<br />

Statement of financial position<br />

Ordinary shareholders’ equity Rm 27 69 742 54 795<br />

Total assets Rm 6 979 013 921 689<br />

Loans and advances Rm 8 659 500 611 165<br />

Financial performance<br />

ROE % 18.5 18.4<br />

Non-interest revenue to total income % 46.6 46.8<br />

Loan-to-deposit ratio % 91.9 88.8<br />

Credit loss ratio % 0.89 0.80<br />

Cost-to-income ratio % 54.4 54.8<br />

Cost-to-income ratio (excluding revenue sharing agreements) % 49.3 51.2<br />

Effective taxation rate % 21.8 29.1<br />

Number of employees (1) 28 168 28 422<br />

SBSA company<br />

Headline earnings Rm 18 11 180 9 489<br />

Total assets Rm 7 967 956 908 125<br />

ROE % 18.3 18.7<br />

Capital adequacy<br />

Total risk-weighted assets Rm 16 499 819 430 484<br />

Tier I capital adequacy ratio % 11.3 10.7<br />

Total capital adequacy ratio % 14.8 13.5<br />

78