Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Standard</strong> <strong>Bank</strong> Group Analysis of financial results for the year ended 31 December 2012<br />

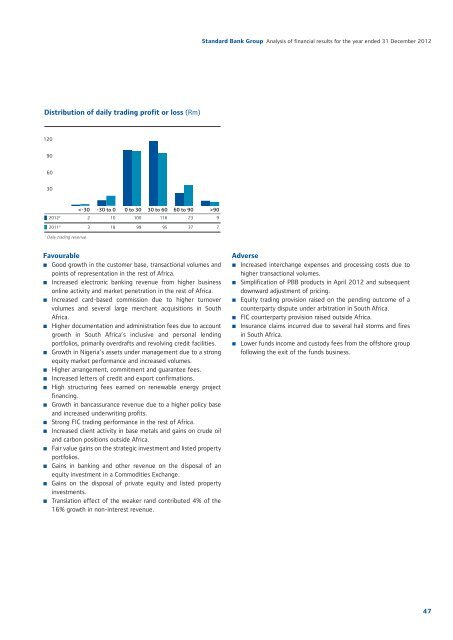

Distribution of daily trading profit or loss (Rm)<br />

120<br />

90<br />

60<br />

30<br />

20121<br />

20111<br />

90<br />

2 10 100 116 23 9<br />

3 18 99 95 37 7<br />

1<br />

Daily trading revenue.<br />

Favourable<br />

• Good growth in the customer base, transactional volumes and<br />

points of representation in the rest of Africa.<br />

• Increased electronic banking revenue from higher business<br />

online activity and market penetration in the rest of Africa.<br />

• Increased card-based commission due to higher turnover<br />

volumes and several large merchant acquisitions in South<br />

Africa.<br />

• Higher documentation and administration fees due to account<br />

growth in South Africa’s inclusive and personal lending<br />

portfolios, primarily overdrafts and revolving credit facilities.<br />

• Growth in Nigeria’s assets under management due to a strong<br />

equity market performance and increased volumes.<br />

• Higher arrangement, commitment and guarantee fees.<br />

• Increased letters of credit and export confirmations.<br />

• High structuring fees earned on renewable energy project<br />

financing.<br />

• Growth in bancassurance revenue due to a higher policy base<br />

and increased underwriting profits.<br />

• Strong FIC trading performance in the rest of Africa.<br />

• Increased client activity in base metals and gains on crude oil<br />

and carbon positions outside Africa.<br />

• Fair value gains on the strategic investment and listed property<br />

portfolios.<br />

• Gains in banking and other revenue on the disposal of an<br />

equity investment in a Commodities Exchange.<br />

• Gains on the disposal of private equity and listed property<br />

investments.<br />

• Translation effect of the weaker rand contributed 4% of the<br />

16% growth in non-interest revenue.<br />

Adverse<br />

• Increased interchange expenses and processing costs due to<br />

higher transactional volumes.<br />

• Simplification of PBB products in April 2012 and subsequent<br />

downward adjustment of pricing.<br />

• Equity trading provision raised on the pending outcome of a<br />

counterparty dispute under arbitration in South Africa.<br />

• FIC counterparty provision raised outside Africa.<br />

• Insurance claims incurred due to several hail storms and fires<br />

in South Africa.<br />

• Lower funds income and custody fees from the offshore group<br />

following the exit of the funds business.<br />

47