Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Group results<br />

in brief<br />

Segmental<br />

reporting<br />

Income statement<br />

analysis<br />

Balance sheet<br />

analysis<br />

Capital<br />

management<br />

Key banking legal<br />

entity information<br />

Other information<br />

and restatements<br />

Shareholder<br />

information<br />

Corporate & Investment <strong>Bank</strong>ing continued<br />

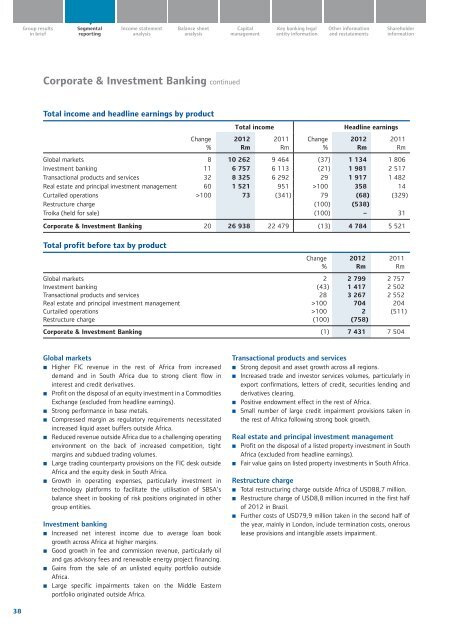

Total income and headline earnings by product<br />

Change<br />

%<br />

Total income<br />

2012<br />

Rm<br />

2011<br />

Rm<br />

Change<br />

%<br />

Headline earnings<br />

Global markets 8 10 262 9 464 (37) 1 134 1 806<br />

Investment banking 11 6 757 6 113 (21) 1 981 2 517<br />

Transactional products and services 32 8 325 6 292 29 1 917 1 482<br />

Real estate and principal investment management 60 1 521 951 >100 358 14<br />

Curtailed operations >100 73 (341) 79 (68) (329)<br />

Restructure charge (100) (538)<br />

Troika (held for sale) (100) – 31<br />

Corporate & Investment <strong>Bank</strong>ing 20 26 938 22 479 (13) 4 784 5 521<br />

Total profit before tax by product<br />

Change 2012 2011<br />

% Rm Rm<br />

Global markets 2 2 799 2 757<br />

Investment banking (43) 1 417 2 502<br />

Transactional products and services 28 3 267 2 552<br />

Real estate and principal investment management >100 704 204<br />

Curtailed operations >100 2 (511)<br />

Restructure charge (100) (758)<br />

Corporate & Investment <strong>Bank</strong>ing (1) 7 431 7 504<br />

2012<br />

Rm<br />

2011<br />

Rm<br />

Global markets<br />

• Higher FIC revenue in the rest of Africa from increased<br />

demand and in South Africa due to strong client flow in<br />

interest and credit derivatives.<br />

• Profit on the disposal of an equity investment in a Commodities<br />

Exchange (excluded from headline earnings).<br />

• Strong performance in base metals.<br />

• Compressed margin as regulatory requirements necessitated<br />

increased liquid asset buffers outside Africa.<br />

• Reduced revenue outside Africa due to a challenging operating<br />

environment on the back of increased competition, tight<br />

margins and subdued trading volumes.<br />

• Large trading counterparty provisions on the FIC desk outside<br />

Africa and the equity desk in South Africa.<br />

• Growth in operating expenses, particularly investment in<br />

technology platforms to facilitate the utilisation of SBSA’s<br />

balance sheet in booking of risk positions originated in other<br />

group entities.<br />

Investment banking<br />

• Increased net interest income due to average loan book<br />

growth across Africa at higher margins.<br />

• Good growth in fee and commission revenue, particularly oil<br />

and gas advisory fees and renewable energy project financing.<br />

• Gains from the sale of an unlisted equity portfolio outside<br />

Africa.<br />

• Large specific impairments taken on the Middle Eastern<br />

portfolio originated outside Africa.<br />

Transactional products and services<br />

• Strong deposit and asset growth across all regions.<br />

• Increased trade and investor services volumes, particularly in<br />

export confirmations, letters of credit, securities lending and<br />

derivatives clearing.<br />

• Positive endowment effect in the rest of Africa.<br />

• Small number of large credit impairment provisions taken in<br />

the rest of Africa following strong book growth.<br />

Real estate and principal investment management<br />

• Profit on the disposal of a listed property investment in South<br />

Africa (excluded from headline earnings).<br />

• Fair value gains on listed property investments in South Africa.<br />

Restructure charge<br />

• Total restructuring charge outside Africa of USD88,7 million.<br />

• Restructure charge of USD8,8 million incurred in the first half<br />

of 2012 in Brazil.<br />

• Further costs of USD79,9 million taken in the second half of<br />

the year, mainly in London, include termination costs, onerous<br />

lease provisions and intangible assets impairment.<br />

38