Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

Standardbank Cover.indd - Standard Bank - Investor Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Standard</strong> <strong>Bank</strong> Group Analysis of financial results for the year ended 31 December 2012<br />

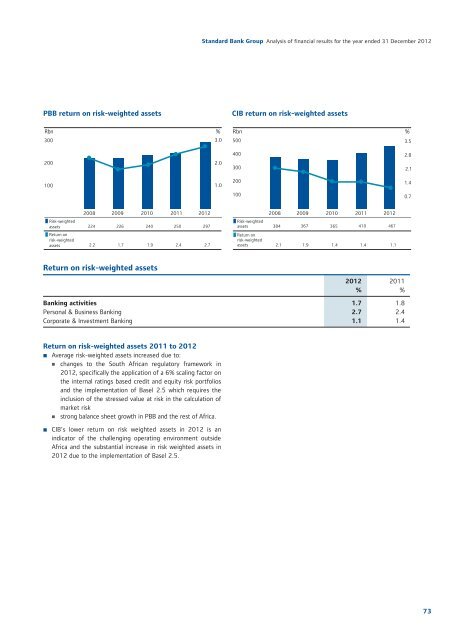

PBB return on risk-weighted assets<br />

CIB return on risk-weighted assets<br />

Rbn<br />

300<br />

%<br />

3.0<br />

Rbn %<br />

500<br />

3.5<br />

400<br />

2.8<br />

200<br />

2.0<br />

300<br />

2.1<br />

100<br />

1.0<br />

200<br />

1.4<br />

100<br />

0.7<br />

Risk-weighted<br />

assets<br />

Return on<br />

risk-weighted<br />

assets<br />

2008<br />

1 Compound annual growth rate<br />

2009<br />

2010<br />

2011<br />

2012<br />

224 226 240 250 297<br />

2.2 1.7 1.9 2.4<br />

2.7<br />

Risk-weighted<br />

assets<br />

Return on<br />

risk-weighted<br />

assets<br />

2008 2009 2010 2011 2012<br />

384 367 365 410 467<br />

2.1 1.9 1.4 1.4<br />

1.1<br />

Return on risk-weighted assets<br />

2012 2011<br />

% %<br />

<strong>Bank</strong>ing activities 1.7 1.8<br />

Personal & Business <strong>Bank</strong>ing 2.7 2.4<br />

Corporate & Investment <strong>Bank</strong>ing 1.1 1.4<br />

Return on risk-weighted assets 2011 to 2012<br />

• Average risk-weighted assets increased due to:<br />

• changes to the South African regulatory framework in<br />

2012, specifically the application of a 6% scaling factor on<br />

the internal ratings based credit and equity risk portfolios<br />

and the implementation of Basel 2.5 which requires the<br />

inclusion of the stressed value at risk in the calculation of<br />

market risk<br />

• strong balance sheet growth in PBB and the rest of Africa.<br />

• CIB’s lower return on risk weighted assets in 2012 is an<br />

indicator of the challenging operating environment outside<br />

Africa and the substantial increase in risk weighted assets in<br />

2012 due to the implementation of Basel 2.5.<br />

73