Title Financing Small and Medium Enterprises in Myanmar Author(s ...

Title Financing Small and Medium Enterprises in Myanmar Author(s ...

Title Financing Small and Medium Enterprises in Myanmar Author(s ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

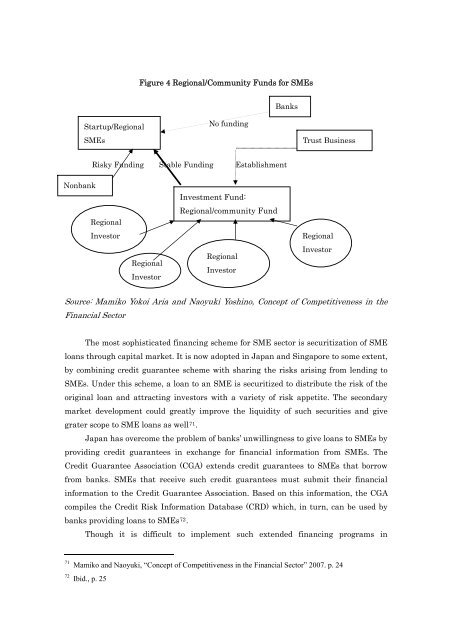

Figure 4 Regional/Community Funds for SMEs<br />

Banks<br />

Startup/Regional<br />

SMEs<br />

No fund<strong>in</strong>g<br />

Trust Bus<strong>in</strong>ess<br />

Risky Fund<strong>in</strong>g Stable Fund<strong>in</strong>g Establishment<br />

Nonbank<br />

Regional<br />

Investor<br />

Regional<br />

Investor<br />

Investment Fund:<br />

Regional/community Fund<br />

Regional<br />

Investor<br />

Regional<br />

Investor<br />

Source: Mamiko Yokoi Aria <strong>and</strong> Naoyuki Yosh<strong>in</strong>o, Concept of Competitiveness <strong>in</strong> the<br />

F<strong>in</strong>ancial Sector<br />

The most sophisticated f<strong>in</strong>anc<strong>in</strong>g scheme for SME sector is securitization of SME<br />

loans through capital market. It is now adopted <strong>in</strong> Japan <strong>and</strong> S<strong>in</strong>gapore to some extent,<br />

by comb<strong>in</strong><strong>in</strong>g credit guarantee scheme with shar<strong>in</strong>g the risks aris<strong>in</strong>g from lend<strong>in</strong>g to<br />

SMEs. Under this scheme, a loan to an SME is securitized to distribute the risk of the<br />

orig<strong>in</strong>al loan <strong>and</strong> attract<strong>in</strong>g <strong>in</strong>vestors with a variety of risk appetite. The secondary<br />

market development could greatly improve the liquidity of such securities <strong>and</strong> give<br />

grater scope to SME loans as well 71 .<br />

Japan has overcome the problem of banks’ unwill<strong>in</strong>gness to give loans to SMEs by<br />

provid<strong>in</strong>g credit guarantees <strong>in</strong> exchange for f<strong>in</strong>ancial <strong>in</strong>formation from SMEs. The<br />

Credit Guarantee Association (CGA) extends credit guarantees to SMEs that borrow<br />

from banks. SMEs that receive such credit guarantees must submit their f<strong>in</strong>ancial<br />

<strong>in</strong>formation to the Credit Guarantee Association. Based on this <strong>in</strong>formation, the CGA<br />

compiles the Credit Risk Information Database (CRD) which, <strong>in</strong> turn, can be used by<br />

banks provid<strong>in</strong>g loans to SMEs 72 .<br />

Though it is difficult to implement such extended f<strong>in</strong>anc<strong>in</strong>g programs <strong>in</strong><br />

71 Mamiko <strong>and</strong> Naoyuki, “Concept of Competitiveness <strong>in</strong> the F<strong>in</strong>ancial Sector” 2007. p. 24<br />

72 Ibid., p. 25

![Title [書評] 廣田義人著『東アジア工作機械工業の技術形成 ... - ARRIDE](https://img.yumpu.com/47139953/1/184x260/title-arride.jpg?quality=85)