Gaming the Float: How Managers Respond to EPS-based Incentives

Gaming the Float: How Managers Respond to EPS-based Incentives

Gaming the Float: How Managers Respond to EPS-based Incentives

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

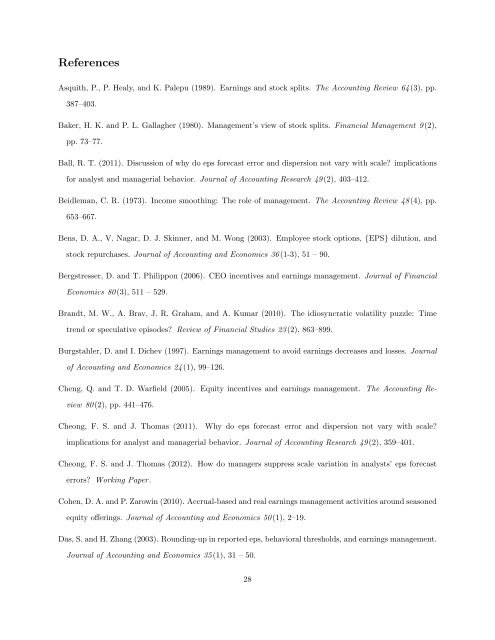

References<br />

Asquith, P., P. Healy, and K. Palepu (1989). Earnings and s<strong>to</strong>ck splits. The Accounting Review 64 (3), pp.<br />

387–403.<br />

Baker, H. K. and P. L. Gallagher (1980). Management’s view of s<strong>to</strong>ck splits. Financial Management 9 (2),<br />

pp. 73–77.<br />

Ball, R. T. (2011). Discussion of why do eps forecast error and dispersion not vary with scale? implications<br />

for analyst and managerial behavior. Journal of Accounting Research 49 (2), 403–412.<br />

Beidleman, C. R. (1973). Income smoothing: The role of management. The Accounting Review 48 (4), pp.<br />

653–667.<br />

Bens, D. A., V. Nagar, D. J. Skinner, and M. Wong (2003). Employee s<strong>to</strong>ck options, {<strong>EPS</strong>} dilution, and<br />

s<strong>to</strong>ck repurchases. Journal of Accounting and Economics 36 (1-3), 51 – 90.<br />

Bergstresser, D. and T. Philippon (2006). CEO incentives and earnings management. Journal of Financial<br />

Economics 80 (3), 511 – 529.<br />

Brandt, M. W., A. Brav, J. R. Graham, and A. Kumar (2010). The idiosyncratic volatility puzzle: Time<br />

trend or speculative episodes? Review of Financial Studies 23 (2), 863–899.<br />

Burgstahler, D. and I. Dichev (1997). Earnings management <strong>to</strong> avoid earnings decreases and losses. Journal<br />

of Accounting and Economics 24 (1), 99–126.<br />

Cheng, Q. and T. D. Warfield (2005). Equity incentives and earnings management. The Accounting Review<br />

80 (2), pp. 441–476.<br />

Cheong, F. S. and J. Thomas (2011).<br />

Why do eps forecast error and dispersion not vary with scale?<br />

implications for analyst and managerial behavior. Journal of Accounting Research 49 (2), 359–401.<br />

Cheong, F. S. and J. Thomas (2012). <strong>How</strong> do managers suppress scale variation in analysts’ eps forecast<br />

errors? Working Paper.<br />

Cohen, D. A. and P. Zarowin (2010). Accrual-<strong>based</strong> and real earnings management activities around seasoned<br />

equity offerings. Journal of Accounting and Economics 50 (1), 2–19.<br />

Das, S. and H. Zhang (2003). Rounding-up in reported eps, behavioral thresholds, and earnings management.<br />

Journal of Accounting and Economics 35 (1), 31 – 50.<br />

28