Gaming the Float: How Managers Respond to EPS-based Incentives

Gaming the Float: How Managers Respond to EPS-based Incentives

Gaming the Float: How Managers Respond to EPS-based Incentives

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

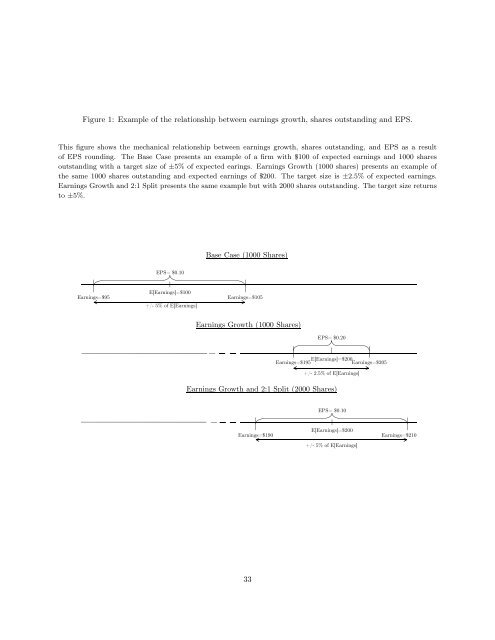

Figure 1: Example of <strong>the</strong> relationship between earnings growth, shares outstanding and <strong>EPS</strong>.<br />

This figure shows <strong>the</strong> mechanical relationship between earnings growth, shares outstanding, and <strong>EPS</strong> as a result<br />

of <strong>EPS</strong> rounding. The Base Case presents an example of a firm with $100 of expected earnings and 1000 shares<br />

outstanding with a target size of ±5% of expected earings. Earnings Growth (1000 shares) presents an example of<br />

<strong>the</strong> same 1000 shares outstanding and expected earnings of $200. The target size is ±2.5% of expected earnings.<br />

Earnings Growth and 2:1 Split presents <strong>the</strong> same example but with 2000 shares outstanding. The target size returns<br />

<strong>to</strong> ±5%.<br />

Base Case (1000 Shares)<br />

<strong>EPS</strong>= $0.10<br />

Earnings=$95<br />

E[Earnings]=$100<br />

+/- 5% of E[Earnings]<br />

Earnings=$105<br />

Earnings Growth (1000 Shares)<br />

<strong>EPS</strong>= $0.20<br />

E[Earnings]=$200<br />

Earnings=$195<br />

Earnings=$205<br />

+/- 2.5% of E[Earnings]<br />

Earnings Growth and 2:1 Split (2000 Shares)<br />

<strong>EPS</strong>= $0.10<br />

Earnings=$190<br />

E[Earnings]=$200<br />

+/- 5% of E[Earnings]<br />

Earnings=$210<br />

33