CARROTS AND STICKS – PROMOTING ... - Global Reporting Initiative

CARROTS AND STICKS – PROMOTING ... - Global Reporting Initiative

CARROTS AND STICKS – PROMOTING ... - Global Reporting Initiative

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

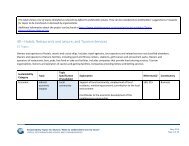

Country/Region Standards, Codes and Guidelines<br />

reporting requirements for US-listed companies to<br />

increase corporate transparency (mainly corporate<br />

governance). Its Section 404 requirements for top<br />

executives to sign off on detailed internal controls<br />

have been accused of imposing too heavy a<br />

regulatory burden on companies, for example by not<br />

explaining the scope of internal and external checks<br />

required. Available at<br />

http://news.findlaw.com/hdocs/docs/gwbush/<br />

sarbanesoxley072302.pdf<br />

The<br />

� Securities & Exchange Commission (SEC)<br />

<strong>–</strong> The Securities & Exchange Commission (SEC) <strong>–</strong><br />

Under Regulation S-K, the SEC requires “appropriate<br />

disclosure...as to the material effects that compliance<br />

with Federal, State and local provisions which have<br />

been enacted or adopted regulating the discharge of<br />

materials into the environment, or otherwise relating<br />

to the protection of the environment, may have upon<br />

the capital expenditures, earnings and competitive<br />

position of the registrant and its subsidiaries.” In<br />

Form K-10 the SEC requires disclosure on legislative<br />

compliance, judicial proceedings and liabilities relating<br />

to the environment.<br />

More specifically, SEC Rule S-K, Item 103 Instruction<br />

5 (Environmental Claims) requires companies to<br />

disclose proceedings involving monetary sanctions<br />

over $100 000.<br />

In addition, disclosure is required for any material<br />

estimated capital expenditure for environmental<br />

control facilities and for select legal proceedings on<br />

environmental matters. For foreign issuers in the<br />

United States, Form 20-F requires companies to<br />

“describe any environmental issues that may affect<br />

the company’s utilisation of the assets.” Compliance<br />

and Disclosure Interpretations (C&Dis) were reviewed<br />

and updated as needed and republished as of<br />

3 July 2008. The last revision was 14 August 2009.<br />

These changes have not impacted CSR reporting.<br />

In October 2009 SEC reversed the existing policy<br />

under Rule 14a-8(i)(7) that had allowed companies<br />

to exclude shareholder resolutions requesting<br />

information on the financial risks associated with<br />

environmental, human rights and other social<br />

issues facing companies. In January 2010 the SEC<br />

announced that they will provide public companies<br />

Carrots and Sticks - Promoting Transparency and Sustainability<br />

71