ANNUAL REPORT - HSE

ANNUAL REPORT - HSE

ANNUAL REPORT - HSE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.8.2 Income statement<br />

General<br />

Information on the basis for the preparation of the<br />

income statement and on specific accounting policies<br />

selected and applied to the company’s significant<br />

operations and other business events are presented<br />

in disclosures of individual significant revenue and expense<br />

items.<br />

Revaluation operating revenue mainly comprises<br />

revenue from the reversal of provisions for guarantees<br />

of origin.<br />

Finance income from interests mainly relates to the<br />

payment of profit by subsidiaries.<br />

Finance income from loans given mainly relates to<br />

accounted for interest on deposits.<br />

The company’s income statement has been prepared<br />

using Format I as defined in SAS 2006 25.5.<br />

The amount of expenses is also subject to methods,<br />

accounting policies and estimates presented in balance<br />

sheet disclosures. The company did not change<br />

the methods and accounting policies, but it did change<br />

an accounting assessment by extending the useful life<br />

of a fixed asset recorded as equipment.<br />

Revenue<br />

€ 856,652,784<br />

Revenue from the sale of electricity in Slovenia accounts<br />

for 99.7% of the company’s revenue.<br />

Revenue from services rendered was mostly generated<br />

through services associated with electricity and<br />

performance of certain functions on behalf of subsidiaries.<br />

Finance income from operating receivables is mainly<br />

comprised of default interest and gains on trading in<br />

CO 2<br />

emission coupons.<br />

Other revenue mainly relates to the realisation of a<br />

bank guarantee under a contract for the sale of an interest<br />

in the company TDR-Metalurgija d.d.<br />

The management estimates that there is doubt as<br />

to the collection of a receivable arising from market<br />

research services and electricity sales services performed<br />

in 2008 for the associate Toplofikatsia Ruse<br />

AD in the amount € 930 thousand because the legal<br />

basis has not yet been fully agreed. Until this doubt<br />

has been removed, the management estimates that<br />

there is a significant risk of this receivable not being<br />

collected within the meaning of SAS 5.24 and SAS<br />

18.12. The receivable and revenue arising from it have<br />

therefore not been included in <strong>HSE</strong>’s financial statements<br />

for the year 2008.<br />

<strong>ANNUAL</strong> <strong>REPORT</strong> <strong>HSE</strong> | FINANCIAL <strong>REPORT</strong> OF THE COMPANY <strong>HSE</strong><br />

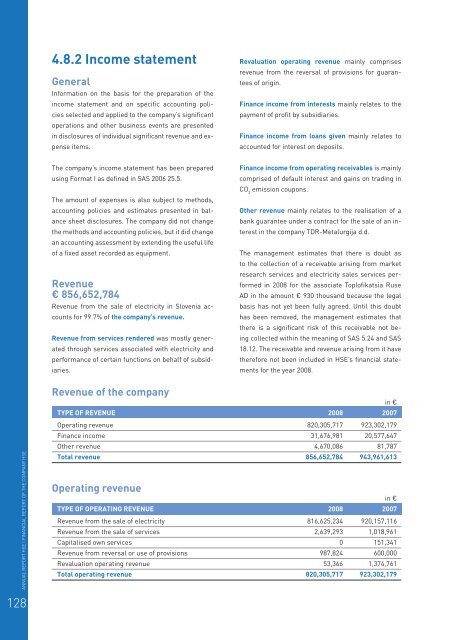

Revenue of the company<br />

TYPE OF REVENUE 2008 2007<br />

Operating revenue 820,305,717 923,302,179<br />

Finance income 31,676,981 20,577,647<br />

Other revenue 4,670,086 81,787<br />

Total revenue 856,652,784 943,961,613<br />

Operating revenue<br />

TYPE OF OPERATING REVENUE 2008 2007<br />

Revenue from the sale of electricity 816,625,234 920,157,116<br />

Revenue from the sale of services 2,639,293 1,018,961<br />

Capitalised own services 0 151,341<br />

Revenue from reversal or use of provisions 987,824 600,000<br />

Revaluation operating revenue 53,366 1,374,761<br />

Total operating revenue 820,305,717 923,302,179<br />

in €<br />

in €<br />

128