Brambles 2006 Annual Report - Alle jaarverslagen

Brambles 2006 Annual Report - Alle jaarverslagen

Brambles 2006 Annual Report - Alle jaarverslagen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

<strong>Brambles</strong><br />

<strong>2006</strong> <strong>Annual</strong> <strong>Report</strong><br />

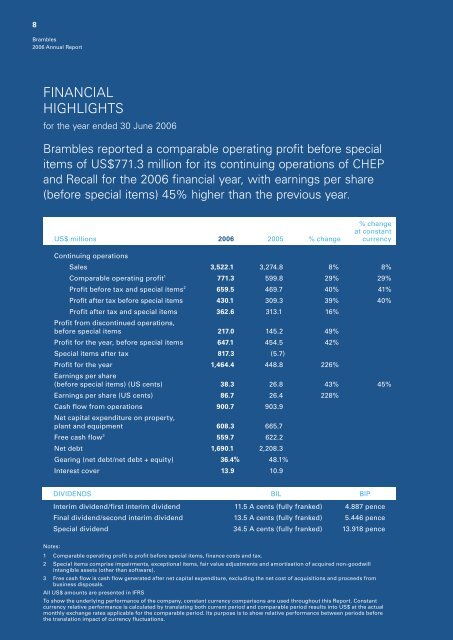

FINANCIAL<br />

HIGHLIGHTS<br />

for the year ended 30 June <strong>2006</strong><br />

<strong>Brambles</strong> reported a comparable operating profit before special<br />

items of US$771.3 million for its continuing operations of CHEP<br />

and Recall for the <strong>2006</strong> financial year, with earnings per share<br />

(before special items) 45% higher than the previous year.<br />

US$ millions <strong>2006</strong> 2005 % change<br />

% change<br />

at constant<br />

currency<br />

Continuing operations<br />

Sales 3,522.1 3,274.8 8% 8%<br />

Comparable operating profit 1 771.3 599.8 29% 29%<br />

Profit before tax and special items 2 659.5 469.7 40% 41%<br />

Profit after tax before special items 430.1 309.3 39% 40%<br />

Profit after tax and special items 362.6 313.1 16%<br />

Profit from discontinued operations,<br />

before special items 217.0 145.2 49%<br />

Profit for the year, before special items 647.1 454.5 42%<br />

Special items after tax 817.3 (5.7)<br />

Profit for the year 1,464.4 448.8 226%<br />

Earnings per share<br />

(before special items) (US cents) 38.3 26.8 43% 45%<br />

Earnings per share (US cents) 86.7 26.4 228%<br />

Cash flow from operations 900.7 903.9<br />

Net capital expenditure on property,<br />

plant and equipment 608.3 665.7<br />

Free cash flow 3 559.7 622.2<br />

Net debt 1,690.1 2,208.3<br />

Gearing (net debt/net debt + equity) 36.4% 48.1%<br />

Interest cover 13.9 10.9<br />

DIVIDENDS BIL BIP<br />

Interim dividend/first interim dividend 11.5 A cents (fully franked) 4.887 pence<br />

Final dividend/second interim dividend 13.5 A cents (fully franked) 5.446 pence<br />

Special dividend 34.5 A cents (fully franked) 13.918 pence<br />

Notes:<br />

1 Comparable operating profit is profit before special items, finance costs and tax.<br />

2 Special items comprise impairments, exceptional items, fair value adjustments and amortisation of acquired non-goodwill<br />

intangible assets (other than software).<br />

3 Free cash flow is cash flow generated after net capital expenditure, excluding the net cost of acquisitions and proceeds from<br />

business disposals.<br />

All US$ amounts are presented in IFRS<br />

To show the underlying performance of the company, constant currency comparisons are used throughout this <strong>Report</strong>. Constant<br />

currency relative performance is calculated by translating both current period and comparable period results into US$ at the actual<br />

monthly exchange rates applicable for the comparable period. Its purpose is to show relative performance between periods before<br />

the translation impact of currency fluctuations.