Brambles 2006 Annual Report - Alle jaarverslagen

Brambles 2006 Annual Report - Alle jaarverslagen

Brambles 2006 Annual Report - Alle jaarverslagen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

110<br />

<strong>Brambles</strong><br />

<strong>2006</strong> <strong>Annual</strong> <strong>Report</strong><br />

NOTES TO AND FORMING PART OF<br />

THE CONSOLIDATED FINANCIAL STATEMENTS continued<br />

for the year ended 30 June <strong>2006</strong><br />

Note 12.<br />

Discontinued operations continued<br />

2005<br />

US$m<br />

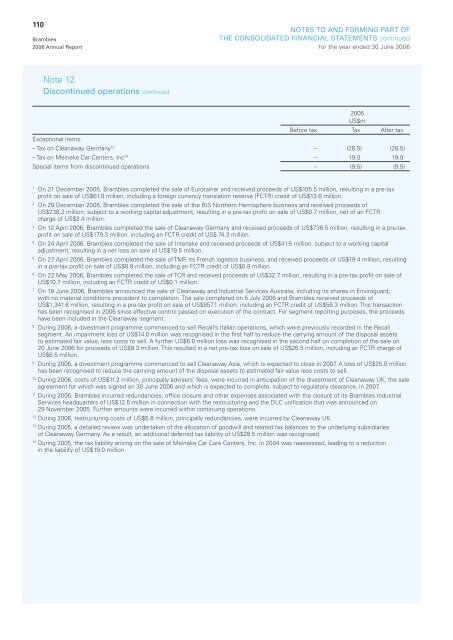

Before tax Tax After tax<br />

Exceptional items:<br />

– Tax on Cleanaway Germany 13 – (28.5) (28.5)<br />

– Tax on Meineke Car Centers, Inc 14 – 19.0 19.0<br />

Special items from discontinued operations – (9.5) (9.5)<br />

1<br />

On 21 December 2005, <strong>Brambles</strong> completed the sale of Eurotainer and received proceeds of US$105.5 million, resulting in a pre-tax<br />

profit on sale of US$61.0 million, including a foreign currency translation reserve (FCTR) credit of US$13.6 million.<br />

2<br />

On 29 December 2005, <strong>Brambles</strong> completed the sale of the BIS Northern Hemisphere business and received proceeds of<br />

US$238.2 million, subject to a working capital adjustment, resulting in a pre-tax profit on sale of US$0.7 million, net of an FCTR<br />

charge of US$3.4 million.<br />

3<br />

On 12 April <strong>2006</strong>, <strong>Brambles</strong> completed the sale of Cleanaway Germany and received proceeds of US$738.5 million, resulting in a pre-tax<br />

profit on sale of US$179.3 million, including an FCTR credit of US$ 74.3 million.<br />

4<br />

On 24 April <strong>2006</strong>, <strong>Brambles</strong> completed the sale of Interlake and received proceeds of US$41.5 million, subject to a working capital<br />

adjustment, resulting in a net loss on sale of US$19.5 million.<br />

5<br />

On 27 April <strong>2006</strong>, <strong>Brambles</strong> completed the sale of TMF, its French logistics business, and received proceeds of US$19.4 million, resulting<br />

in a pre-tax profit on sale of US$8.8 million, including an FCTR credit of US$0.8 million.<br />

6<br />

On 22 May <strong>2006</strong>, <strong>Brambles</strong> completed the sale of TCR and received proceeds of US$32.7 million, resulting in a pre-tax profit on sale of<br />

US$10.7 million, including an FCTR credit of US$0.1 million.<br />

7<br />

On 19 June <strong>2006</strong>, <strong>Brambles</strong> announced the sale of Cleanaway and Industrial Services Australia, including its shares in Enviroguard,<br />

with no material conditions precedent to completion. The sale completed on 5 July <strong>2006</strong> and <strong>Brambles</strong> received proceeds of<br />

US$1,341.6 million, resulting in a pre-tax profit on sale of US$857.1 million, including an FCTR credit of US$56.3 million. This transaction<br />

has been recognised in <strong>2006</strong> since effective control passed on execution of the contract. For segment reporting purposes, the proceeds<br />

have been included in the Cleanaway segment.<br />

8<br />

During <strong>2006</strong>, a divestment programme commenced to sell Recall’s Italian operations, which were previously recorded in the Recall<br />

segment. An impairment loss of US$14.0 million was recognised in the first half to reduce the carrying amount of the disposal assets<br />

to estimated fair value, less costs to sell. A further US$6.0 million loss was recognised in the second half on completion of the sale on<br />

20 June <strong>2006</strong> for proceeds of US$9.3 million. This resulted in a net pre-tax loss on sale of US$26.5 million, including an FCTR charge of<br />

US$6.5 million.<br />

9<br />

During <strong>2006</strong>, a divestment programme commenced to sell Cleanaway Asia, which is expected to close in 2007. A loss of US$25.0 million<br />

has been recognised to reduce the carrying amount of the disposal assets to estimated fair value less costs to sell.<br />

10<br />

During <strong>2006</strong>, costs of US$11.2 million, principally advisers’ fees, were incurred in anticipation of the divestment of Cleanaway UK, the sale<br />

agreement for which was signed on 30 June <strong>2006</strong> and which is expected to complete, subject to regulatory clearance, in 2007.<br />

11<br />

During <strong>2006</strong>, <strong>Brambles</strong> incurred redundancies, office closure and other expenses associated with the closure of its <strong>Brambles</strong> Industrial<br />

Services headquarters of US$12.5 million in connection with the restructuring and the DLC unification that was announced on<br />

29 November 2005. Further amounts were incurred within continuing operations.<br />

12<br />

During <strong>2006</strong>, restructuring costs of US$5.8 million, principally redundancies, were incurred by Cleanaway UK.<br />

13<br />

During 2005, a detailed review was undertaken of the allocation of goodwill and related tax balances to the underlying subsidiaries<br />

of Cleanaway Germany. As a result, an additional deferred tax liability of US$28.5 million was recognised.<br />

14<br />

During 2005, the tax liability arising on the sale of Meineke Car Care Centers, Inc. in 2004 was reassessed, leading to a reduction<br />

in the liability of US$19.0 million.