Brambles 2006 Annual Report - Alle jaarverslagen

Brambles 2006 Annual Report - Alle jaarverslagen

Brambles 2006 Annual Report - Alle jaarverslagen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

40<br />

<strong>Brambles</strong><br />

<strong>2006</strong> <strong>Annual</strong> <strong>Report</strong><br />

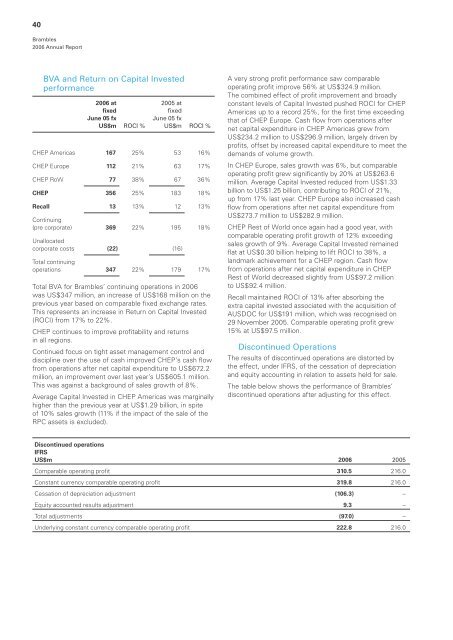

BVA and Return on Capital Invested<br />

performance<br />

<strong>2006</strong> at<br />

fixed<br />

June 05 fx<br />

US$m ROCI %<br />

2005 at<br />

fixed<br />

June 05 fx<br />

US$m ROCI %<br />

CHEP Americas 167 25% 53 16%<br />

CHEP Europe 112 21% 63 17%<br />

CHEP RoW 77 38% 67 36%<br />

CHEP 356 25% 183 18%<br />

Recall 13 13% 12 13%<br />

Continuing<br />

(pre corporate) 369 22% 195 18%<br />

Unallocated<br />

corporate costs (22) (16)<br />

Total continuing<br />

operations 347 22% 179 17%<br />

Total BVA for <strong>Brambles</strong>’ continuing operations in <strong>2006</strong><br />

was US$347 million, an increase of US$168 million on the<br />

previous year based on comparable fixed exchange rates.<br />

This represents an increase in Return on Capital Invested<br />

(ROCI) from 17% to 22%.<br />

CHEP continues to improve profitability and returns<br />

in all regions.<br />

Continued focus on tight asset management control and<br />

discipline over the use of cash improved CHEP’s cash flow<br />

from operations after net capital expenditure to US$672.2<br />

million, an improvement over last year’s US$605.1 million.<br />

This was against a background of sales growth of 8%.<br />

Average Capital Invested in CHEP Americas was marginally<br />

higher than the previous year at US$1.29 billion, in spite<br />

of 10% sales growth (11% if the impact of the sale of the<br />

RPC assets is excluded).<br />

A very strong profit performance saw comparable<br />

operating profit improve 56% at US$324.9 million.<br />

The combined effect of profit improvement and broadly<br />

constant levels of Capital Invested pushed ROCI for CHEP<br />

Americas up to a record 25%, for the first time exceeding<br />

that of CHEP Europe. Cash flow from operations after<br />

net capital expenditure in CHEP Americas grew from<br />

US$234.2 million to US$296.9 million, largely driven by<br />

profits, offset by increased capital expenditure to meet the<br />

demands of volume growth.<br />

In CHEP Europe, sales growth was 6%, but comparable<br />

operating profit grew significantly by 20% at US$263.6<br />

million. Average Capital Invested reduced from US$1.33<br />

billion to US$1.25 billion, contributing to ROCI of 21%,<br />

up from 17% last year. CHEP Europe also increased cash<br />

flow from operations after net capital expenditure from<br />

US$273.7 million to US$282.9 million.<br />

CHEP Rest of World once again had a good year, with<br />

comparable operating profit growth of 12% exceeding<br />

sales growth of 9%. Average Capital Invested remained<br />

flat at US$0.30 billion helping to lift ROCI to 38%, a<br />

landmark achievement for a CHEP region. Cash flow<br />

from operations after net capital expenditure in CHEP<br />

Rest of World decreased slightly from US$97.2 million<br />

to US$92.4 million.<br />

Recall maintained ROCI of 13% after absorbing the<br />

extra capital invested associated with the acquisition of<br />

AUSDOC for US$191 million, which was recognised on<br />

29 November 2005. Comparable operating profit grew<br />

15% at US$97.5 million.<br />

Discontinued Operations<br />

The results of discontinued operations are distorted by<br />

the effect, under IFRS, of the cessation of depreciation<br />

and equity accounting in relation to assets held for sale.<br />

The table below shows the performance of <strong>Brambles</strong>’<br />

discontinued operations after adjusting for this effect.<br />

Discontinued operations<br />

IFRS<br />

US$m <strong>2006</strong> 2005<br />

Comparable operating profit 310.5 216.0<br />

Constant currency comparable operating profit 319.8 216.0<br />

Cessation of depreciation adjustment (106.3) –<br />

Equity accounted results adjustment 9.3 –<br />

Total adjustments (97.0) –<br />

Underlying constant currency comparable operating profit 222.8 216.0