Original GBL Prospectus - Gabelli

Original GBL Prospectus - Gabelli

Original GBL Prospectus - Gabelli

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

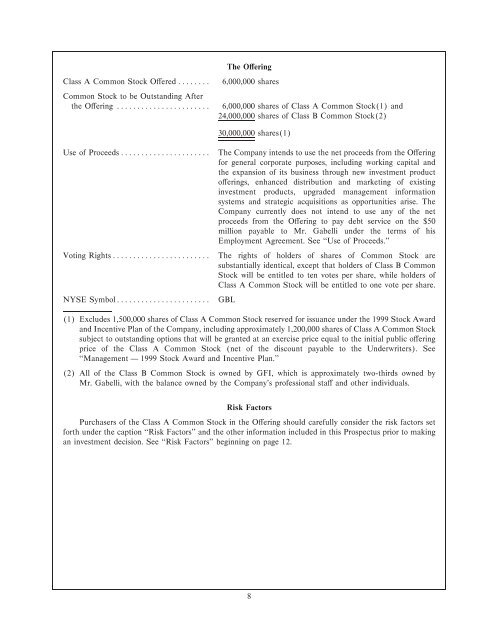

Class A Common Stock OÅered ÏÏÏÏÏÏÏÏ<br />

Common Stock to be Outstanding After<br />

the OÅering ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ<br />

The OÅering<br />

6,000,000 shares<br />

6,000,000 shares of Class A Common Stock(1) and<br />

24,000,000 shares of Class B Common Stock(2)<br />

30,000,000 shares(1)<br />

Use of Proceeds ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ<br />

Voting RightsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ<br />

NYSE SymbolÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ<br />

The Company intends to use the net proceeds from the OÅering<br />

for general corporate purposes, including working capital and<br />

the expansion of its business through new investment product<br />

oÅerings, enhanced distribution and marketing of existing<br />

investment products, upgraded management information<br />

systems and strategic acquisitions as opportunities arise. The<br />

Company currently does not intend to use any of the net<br />

proceeds from the OÅering to pay debt service on the $50<br />

million payable to Mr. <strong>Gabelli</strong> under the terms of his<br />

Employment Agreement. See ""Use of Proceeds.''<br />

The rights of holders of shares of Common Stock are<br />

substantially identical, except that holders of Class B Common<br />

Stock will be entitled to ten votes per share, while holders of<br />

Class A Common Stock will be entitled to one vote per share.<br />

<strong>GBL</strong><br />

(1) Excludes 1,500,000 shares of Class A Common Stock reserved for issuance under the 1999 Stock Award<br />

and Incentive Plan of the Company, including approximately 1,200,000 shares of Class A Common Stock<br />

subject to outstanding options that will be granted at an exercise price equal to the initial public oÅering<br />

price of the Class A Common Stock (net of the discount payable to the Underwriters). See<br />

""Management Ì 1999 Stock Award and Incentive Plan.''<br />

(2) All of the Class B Common Stock is owned by GFI, which is approximately two-thirds owned by<br />

Mr. <strong>Gabelli</strong>, with the balance owned by the Company's professional staÅ and other individuals.<br />

Risk Factors<br />

Purchasers of the Class A Common Stock in the OÅering should carefully consider the risk factors set<br />

forth under the caption ""Risk Factors'' and the other information included in this <strong>Prospectus</strong> prior to making<br />

an investment decision. See ""Risk Factors'' beginning on page 12.<br />

8