Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16<br />

Business review<br />

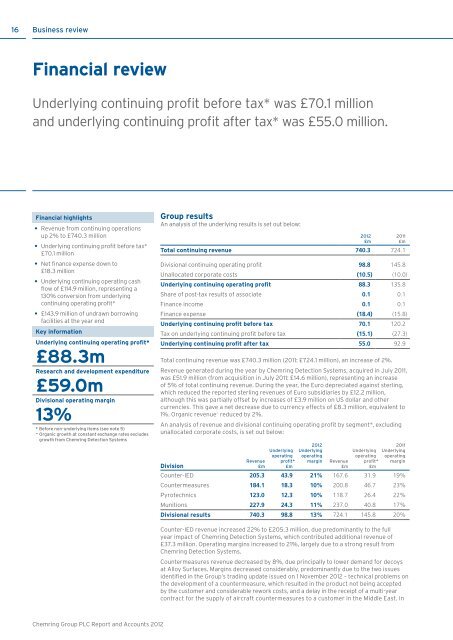

Financial review<br />

Underlying continuing profit before tax* was £70.1 million<br />

<strong>and</strong> underlying continuing profit after tax* was £55.0 million.<br />

Financial highlights<br />

• Revenue from continuing operations<br />

up 2% to £740.3 million<br />

• Underlying continuing profit before tax*<br />

£70.1 million<br />

• Net finance expense down to<br />

£18.3 million<br />

• Underlying continuing operating cash<br />

flow of £114.9 million, representing a<br />

130% conversion from underlying<br />

continuing operating profit*<br />

• £143.9 million of undrawn borrowing<br />

facilities at the year end<br />

Key information<br />

Underlying continuing operating profit*<br />

£88.3m<br />

Research <strong>and</strong> development expenditure<br />

£59.0m<br />

Divisional operating margin<br />

13%<br />

* Before non-underlying items (see note 5)<br />

~ Organic growth at constant exchange rates excludes<br />

growth from <strong>Chemring</strong> Detection Systems<br />

<strong>Group</strong> results<br />

An analysis of the underlying results is set out below:<br />

Total continuing revenue 740.3 724.1<br />

Divisional continuing operating profit 98.8 145.8<br />

Unallocated corporate costs (10.5) (10.0)<br />

Underlying continuing operating profit 88.3 135.8<br />

Share of post-tax results of associate 0.1 0.1<br />

Finance income 0.1 0.1<br />

Finance expense (18.4) (15.8)<br />

Underlying continuing profit before tax 70.1 120.2<br />

Tax on underlying continuing profit before tax (15.1) (27.3)<br />

Underlying continuing profit after tax 55.0 92.9<br />

Total continuing revenue was £740.3 million (2011: £724.1 million), an increase of 2%.<br />

Revenue generated during the year by <strong>Chemring</strong> Detection Systems, acquired in July 2011,<br />

was £51.9 million (from acquisition in July 2011: £14.6 million), representing an increase<br />

of 5% of total continuing revenue. During the year, the Euro depreciated against sterling,<br />

which reduced the reported sterling revenues of Euro subsidiaries by £12.2 million,<br />

although this was partially offset by increases of £3.9 million on US dollar <strong>and</strong> other<br />

currencies. This gave a net decrease due to currency effects of £8.3 million, equivalent to<br />

1%. Organic revenue ~ reduced by 2%.<br />

An analysis of revenue <strong>and</strong> divisional continuing operating profit by segment*, excluding<br />

unallocated corporate costs, is set out below:<br />

Underlying<br />

operating<br />

profit*<br />

£m<br />

<strong>2012</strong><br />

Underlying<br />

operating<br />

margin<br />

Division<br />

Revenue<br />

Revenue<br />

£m<br />

£m<br />

Counter-IED 205.3 43.9 21% 167.6 31.9 19%<br />

Countermeasures 184.1 18.3 10% 200.8 46.7 23%<br />

Pyrotechnics 123.0 12.3 10% 118.7 26.4 22%<br />

Munitions 227.9 24.3 11% 237.0 40.8 17%<br />

Divisional results 740.3 98.8 13% 724.1 145.8 20%<br />

<strong>2012</strong><br />

£m<br />

Underlying<br />

operating<br />

profit*<br />

£m<br />

2011<br />

£m<br />

2011<br />

Underlying<br />

operating<br />

margin<br />

Counter-IED revenue increased 22% to £205.3 million, due predominantly to the full<br />

year impact of <strong>Chemring</strong> Detection Systems, which contributed additional revenue of<br />

£37.3 million. Operating margins increased to 21%, largely due to a strong result from<br />

<strong>Chemring</strong> Detection Systems.<br />

Countermeasures revenue decreased by 8%, due principally to lower dem<strong>and</strong> for decoys<br />

at Alloy Surfaces. Margins decreased considerably, predominantly due to the two issues<br />

identified in the <strong>Group</strong>’s trading update issued on 1 November <strong>2012</strong> – technical problems on<br />

the development of a countermeasure, which resulted in the product not being accepted<br />

by the customer <strong>and</strong> considerable rework costs, <strong>and</strong> a delay in the receipt of a multi-year<br />

contract for the supply of aircraft countermeasures to a customer in the Middle East. In<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>