Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

68<br />

Financial statements<br />

Notes to the group financial statements<br />

5. Business segments continued<br />

The accounting policies of the reportable segments are the same as the <strong>Group</strong>’s accounting policies described in note 3. Segment profit<br />

represents the profit earned by each segment, without allocation of corporate costs including directors’ salaries, exceptional items, the share<br />

of profit of associates, finance income <strong>and</strong> expense, <strong>and</strong> income tax expense. This is the measure reported to the <strong>Group</strong> Chief Executive for<br />

the purpose of resource allocation <strong>and</strong> assessment of segment performance.<br />

Unallocated corporate costs<br />

Unallocated corporate costs were £10.5 million, slightly up on 2011, due largely to the costs associated with the <strong>Group</strong>’s London office,<br />

which has been vacated since the year end.<br />

Intra-group transactions<br />

There are no material intra-group transactions included within the above figures for revenue <strong>and</strong> profit.<br />

Restructuring <strong>and</strong> incident costs<br />

In <strong>2012</strong>, the restructuring costs related to the closure of the <strong>Group</strong>’s Marshall, Texas site (£3.3 million), the restructuring of the <strong>Group</strong>’s US<br />

countermeasures businesses (£2.5 million), the restructuring of the <strong>Group</strong>’s UK operations (£2.6 million), <strong>and</strong> an additional £1.5 million<br />

relating to several smaller restructuring projects. There were also a number of Board changes during the year, resulting in associated<br />

costs of £2.0 million. Further details of the compensation for loss of office payments of £1.1 million <strong>and</strong> deferred share awards worth<br />

£0.3 million received by two of the former executive directors are set out in the directors’ remuneration report. The balance of the costs<br />

relate to recruitment, <strong>and</strong> various other legal <strong>and</strong> professional fees. There is a £1.8 million difference between the expense in the income<br />

statement <strong>and</strong> the amount appearing in the cash flow statement which relates to timing differences <strong>and</strong> non-cash movements.<br />

Information about major customers<br />

Included in revenues arising from the segments are revenues of approximately £289.6 million (2011: £246.6 million) <strong>and</strong> £89.7 million<br />

(2011: £103.6 million), which arose from sales to the <strong>Group</strong>’s two largest customers respectively. The largest customer had sales reported<br />

in all four of the <strong>Group</strong>’s reporting segments, whilst sales to the second largest customer were primarily from the Munitions segment.<br />

These were the only individual customers where direct sales account for more than 10% of the total <strong>Group</strong> revenue for the year.<br />

The <strong>Group</strong> does not disclose assets or liabilities by segment in the monthly management accounts provided to the Executive Committee<br />

or the Board of Directors. The Improvements to IFRSs issued in April 2009 only requires information provided to the chief operating<br />

decision maker as a key decision making tool to be disclosed. The <strong>Group</strong> has adopted this amendment in order to clarify that the<br />

chief operational decision makers do not use this as a key decision tool. IFRS 8 Operating Segments requires a geographic analysis of<br />

non‐current assets, <strong>and</strong> a disclosure of non-current assets by location is therefore shown below.<br />

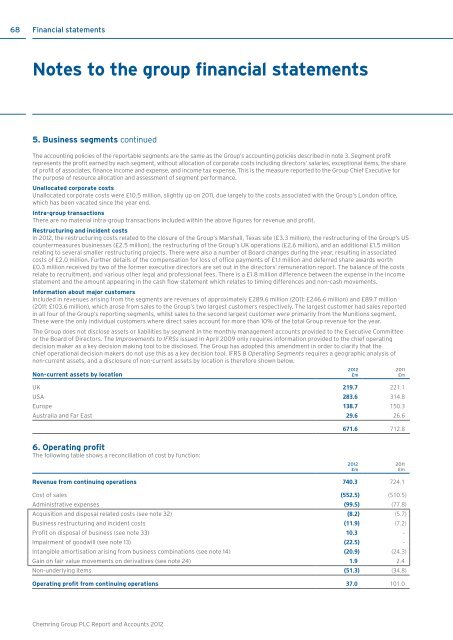

Non-current assets by location<br />

UK 219.7 221.1<br />

USA 283.6 314.8<br />

Europe 138.7 150.3<br />

Australia <strong>and</strong> Far East 29.6 26.6<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

671.6 712.8<br />

6. Operating profit<br />

The following table shows a reconciliation of cost by function:<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Revenue from continuing operations 740.3 724.1<br />

Cost of sales (552.5) (510.5)<br />

Administrative expenses (99.5) (77.8)<br />

Acquisition <strong>and</strong> disposal related costs (see note 32) (8.2) (5.7)<br />

Business restructuring <strong>and</strong> incident costs (11.9) (7.2)<br />

Profit on disposal of business (see note 33) 10.3 -<br />

Impairment of goodwill (see note 13) (22.5) -<br />

Intangible amortisation arising from business combinations (see note 14) (20.9) (24.3)<br />

Gain on fair value movements on derivatives (see note 24) 1.9 2.4<br />

Non-underlying items (51.3) (34.8)<br />

Operating profit from continuing operations 37.0 101.0<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>