Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

93<br />

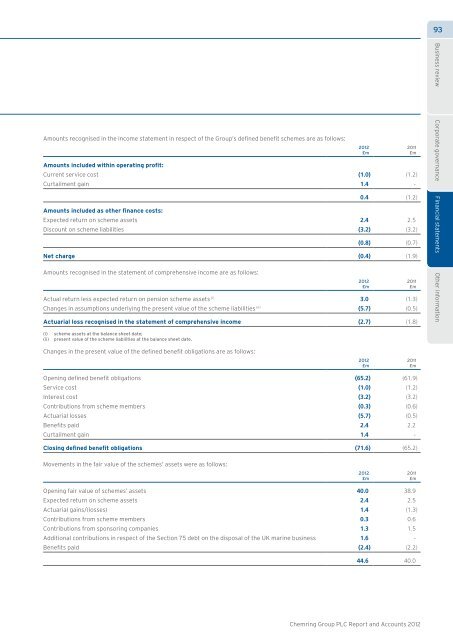

Amounts recognised in the income statement in respect of the <strong>Group</strong>’s defined benefit schemes are as follows:<br />

Amounts included within operating profit:<br />

Current service cost (1.0) (1.2)<br />

Curtailment gain 1.4 -<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

0.4 (1.2)<br />

Amounts included as other finance costs:<br />

Expected return on scheme assets 2.4 2.5<br />

Discount on scheme liabilities (3.2) (3.2)<br />

(0.8) (0.7)<br />

Net charge (0.4) (1.9)<br />

Amounts recognised in the statement of comprehensive income are as follows:<br />

Actual return less expected return on pension scheme assets (i) 3.0 (1.3)<br />

Changes in assumptions underlying the present value of the scheme liabilities (ii) (5.7) (0.5)<br />

Actuarial loss recognised in the statement of comprehensive income (2.7) (1.8)<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Business review Corporate governance Financial statements Other information<br />

(i)<br />

(ii)<br />

scheme assets at the balance sheet date;<br />

present value of the scheme liabilities at the balance sheet date.<br />

Changes in the present value of the defined benefit obligations are as follows:<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Opening defined benefit obligations (65.2) (61.9)<br />

Service cost (1.0) (1.2)<br />

Interest cost (3.2) (3.2)<br />

Contributions from scheme members (0.3) (0.6)<br />

Actuarial losses (5.7) (0.5)<br />

Benefits paid 2.4 2.2<br />

Curtailment gain 1.4 -<br />

Closing defined benefit obligations (71.6) (65.2)<br />

Movements in the fair value of the schemes’ assets were as follows:<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Opening fair value of schemes’ assets 40.0 38.9<br />

Expected return on scheme assets 2.4 2.5<br />

Actuarial gains/(losses) 1.4 (1.3)<br />

Contributions from scheme members 0.3 0.6<br />

Contributions from sponsoring companies 1.3 1.5<br />

Additional contributions in respect of the Section 75 debt on the disposal of the UK marine business 1.6 -<br />

Benefits paid (2.4) (2.2)<br />

44.6 40.0<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>