Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

86<br />

Financial statements<br />

Notes to the group financial statements<br />

24. Financial instruments <strong>and</strong> risk management continued<br />

The counterparties are monitored on an ongoing basis for credit risk, <strong>and</strong> as at the balance sheet date the risk was deemed to be low.<br />

Ongoing credit evaluation is performed on the financial condition of accounts receivable <strong>and</strong>, when appropriate, action is taken to<br />

minimise the credit risk to the <strong>Group</strong>.<br />

The <strong>Group</strong>’s accounting policies <strong>and</strong> control procedures require letters of credit to be put in place for the majority of contracts with<br />

overseas customers. Any departures from this policy require approval by the <strong>Group</strong> finance function.<br />

The <strong>Group</strong>’s price risk is primarily in relation to the cost of raw materials <strong>and</strong> is not considered significant. Price risk is managed through<br />

negotiations with suppliers <strong>and</strong>, where appropriate, the agreement of fixed price supply contracts.<br />

Capital management<br />

The Board’s policy is to maintain a strong capital base so as to maintain investor, creditor <strong>and</strong> market confidence <strong>and</strong> to sustain future<br />

development of the business. The Board monitors both the demographic spread of shareholders, as well as the return on capital. From<br />

time to time, the <strong>Group</strong> purchases its own shares on the market; the timing of these purchases depends on the market prices. Primarily,<br />

the shares are intended to be used for satisfying awards under the <strong>Group</strong>’s share-based incentive schemes. Buy <strong>and</strong> sell decisions are<br />

made on a specific transaction basis by the Board.<br />

Neither the Company nor any of its subsidiaries are subject to externally imposed capital requirements.<br />

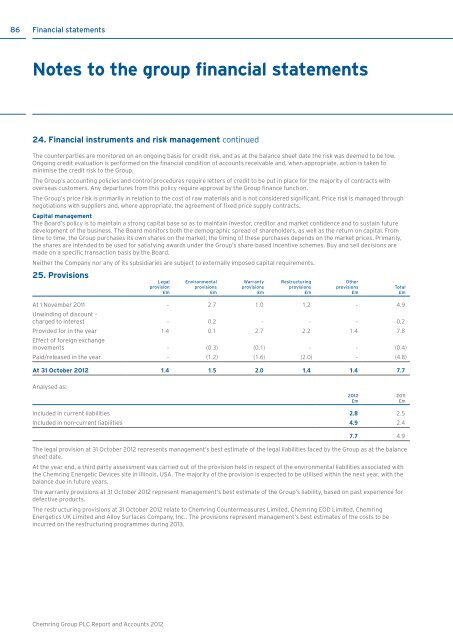

25. Provisions<br />

Legal<br />

provision<br />

£m<br />

Environmental<br />

provisions<br />

£m<br />

Warranty<br />

provisions<br />

£m<br />

Restructuring<br />

provisions<br />

£m<br />

Other<br />

provisions<br />

£m<br />

At 1 November 2011 - 2.7 1.0 1.2 - 4.9<br />

Unwinding of discount –<br />

charged to interest - 0.2 - - - 0.2<br />

Provided for in the year 1.4 0.1 2.7 2.2 1.4 7.8<br />

Effect of foreign exchange<br />

movements - (0.3) (0.1) - - (0.4)<br />

Paid/released in the year - (1.2) (1.6) (2.0) - (4.8)<br />

At 31 October <strong>2012</strong> 1.4 1.5 2.0 1.4 1.4 7.7<br />

Total<br />

£m<br />

Analysed as:<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Included in current liabilities 2.8 2.5<br />

Included in non-current liabilities 4.9 2.4<br />

7.7 4.9<br />

The legal provision at 31 October <strong>2012</strong> represents management’s best estimate of the legal liabilities faced by the <strong>Group</strong> as at the balance<br />

sheet date.<br />

At the year end, a third party assessment was carried out of the provision held in respect of the environmental liabilities associated with<br />

the <strong>Chemring</strong> Energetic Devices site in Illinois, USA. The majority of the provision is expected to be utilised within the next year, with the<br />

balance due in future years.<br />

The warranty provisions at 31 October <strong>2012</strong> represent management’s best estimate of the <strong>Group</strong>’s liability, based on past experience for<br />

defective products.<br />

The restructuring provisions at 31 October <strong>2012</strong> relate to <strong>Chemring</strong> Countermeasures Limited, <strong>Chemring</strong> EOD Limited, <strong>Chemring</strong><br />

Energetics UK Limited <strong>and</strong> Alloy Surfaces Company, Inc.. The provisions represent management’s best estimates of the costs to be<br />

incurred on the restructuring programmes during 2013.<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>