Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

75<br />

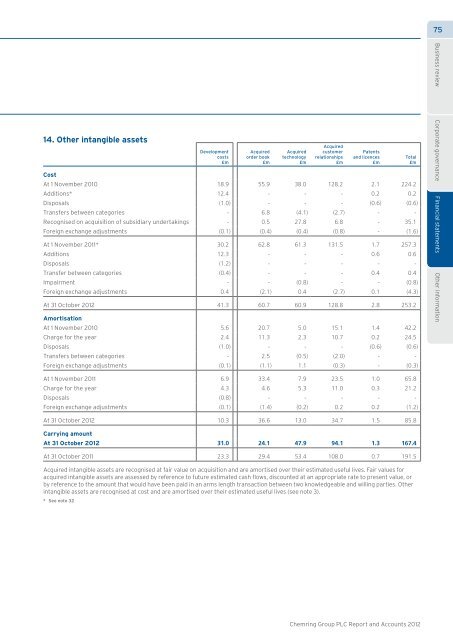

14. Other intangible assets<br />

Development<br />

costs<br />

£m<br />

Acquired<br />

order book<br />

£m<br />

Acquired<br />

technology<br />

£m<br />

Acquired<br />

customer<br />

relationships<br />

£m<br />

Patents<br />

<strong>and</strong> licences<br />

£m<br />

Cost<br />

At 1 November 2010 18.9 55.9 38.0 128.2 2.1 224.2<br />

Additions* 12.4 - - - 0.2 0.2<br />

Disposals (1.0) - - - (0.6) (0.6)<br />

Transfers between categories - 6.8 (4.1) (2.7) - -<br />

Recognised on acquisition of subsidiary undertakings - 0.5 27.8 6.8 - 35.1<br />

Foreign exchange adjustments (0.1) (0.4) (0.4) (0.8) - (1.6)<br />

At 1 November 2011* 30.2 62.8 61.3 131.5 1.7 257.3<br />

Additions 12.3 - - - 0.6 0.6<br />

Disposals (1.2) - - - - -<br />

Transfer between categories (0.4) - - - 0.4 0.4<br />

Impairment - - (0.8) - - (0.8)<br />

Foreign exchange adjustments 0.4 (2.1) 0.4 (2.7) 0.1 (4.3)<br />

At 31 October <strong>2012</strong> 41.3 60.7 60.9 128.8 2.8 253.2<br />

Amortisation<br />

At 1 November 2010 5.6 20.7 5.0 15.1 1.4 42.2<br />

Charge for the year 2.4 11.3 2.3 10.7 0.2 24.5<br />

Disposals (1.0) - - - (0.6) (0.6)<br />

Transfers between categories - 2.5 (0.5) (2.0) - -<br />

Foreign exchange adjustments (0.1) (1.1) 1.1 (0.3) - (0.3)<br />

Total<br />

£m<br />

Business review Corporate governance Financial statements Other information<br />

At 1 November 2011 6.9 33.4 7.9 23.5 1.0 65.8<br />

Charge for the year 4.3 4.6 5.3 11.0 0.3 21.2<br />

Disposals (0.8) - - - - -<br />

Foreign exchange adjustments (0.1) (1.4) (0.2) 0.2 0.2 (1.2)<br />

At 31 October <strong>2012</strong> 10.3 36.6 13.0 34.7 1.5 85.8<br />

Carrying amount<br />

At 31 October <strong>2012</strong> 31.0 24.1 47.9 94.1 1.3 167.4<br />

At 31 October 2011 23.3 29.4 53.4 108.0 0.7 191.5<br />

Acquired intangible assets are recognised at fair value on acquisition <strong>and</strong> are amortised over their estimated useful lives. Fair values for<br />

acquired intangible assets are assessed by reference to future estimated cash flows, discounted at an appropriate rate to present value, or<br />

by reference to the amount that would have been paid in an arms length transaction between two knowledgeable <strong>and</strong> willing parties. Other<br />

intangible assets are recognised at cost <strong>and</strong> are amortised over their estimated useful lives (see note 3).<br />

* See note 32<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>