Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20<br />

Business review<br />

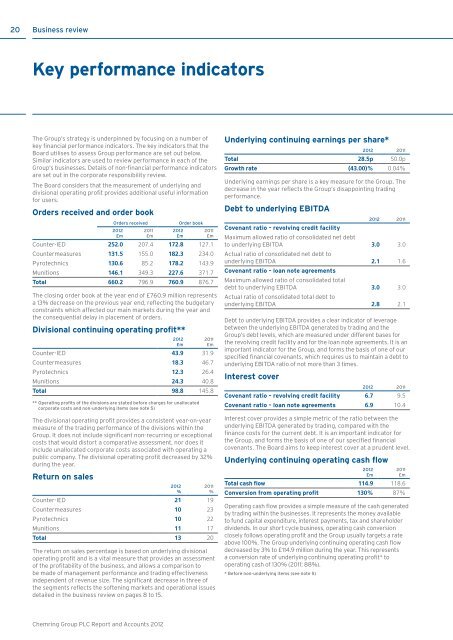

Key performance indicators<br />

The <strong>Group</strong>’s strategy is underpinned by focusing on a number of<br />

key financial performance indicators. The key indicators that the<br />

Board utilises to assess <strong>Group</strong> performance are set out below.<br />

Similar indicators are used to review performance in each of the<br />

<strong>Group</strong>’s businesses. Details of non-financial performance indicators<br />

are set out in the corporate responsibility review.<br />

The Board considers that the measurement of underlying <strong>and</strong><br />

divisional operating profit provides additional useful information<br />

for users.<br />

Orders received <strong>and</strong> order book<br />

Orders received<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Order book<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Counter-IED 252.0 207.4 172.8 127.1<br />

Countermeasures 131.5 155.0 182.3 234.0<br />

Pyrotechnics 130.6 85.2 178.2 143.9<br />

Munitions 146.1 349.3 227.6 371.7<br />

Total 660.2 796.9 760.9 876.7<br />

The closing order book at the year end of £760.9 million represents<br />

a 13% decrease on the previous year end, reflecting the budgetary<br />

constraints which affected our main markets during the year <strong>and</strong><br />

the consequential delay in placement of orders.<br />

Divisional continuing operating profit**<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Counter-IED 43.9 31.9<br />

Countermeasures 18.3 46.7<br />

Pyrotechnics 12.3 26.4<br />

Munitions 24.3 40.8<br />

Total 98.8 145.8<br />

** Operating profits of the divisions are stated before charges for unallocated<br />

corporate costs <strong>and</strong> non-underlying items (see note 5)<br />

The divisional operating profit provides a consistent year-on-year<br />

measure of the trading performance of the divisions within the<br />

<strong>Group</strong>. It does not include significant non-recurring or exceptional<br />

costs that would distort a comparative assessment, nor does it<br />

include unallocated corporate costs associated with operating a<br />

public company. The divisional operating profit decreased by 32%<br />

during the year.<br />

Return on sales<br />

<strong>2012</strong><br />

%<br />

2011<br />

%<br />

Counter-IED 21 19<br />

Countermeasures 10 23<br />

Pyrotechnics 10 22<br />

Munitions 11 17<br />

Total 13 20<br />

The return on sales percentage is based on underlying divisional<br />

operating profit <strong>and</strong> is a vital measure that provides an assessment<br />

of the profitability of the business, <strong>and</strong> allows a comparison to<br />

be made of management performance <strong>and</strong> trading effectiveness<br />

independent of revenue size. The significant decrease in three of<br />

the segments reflects the softening markets <strong>and</strong> operational issues<br />

detailed in the business review on pages 8 to 15.<br />

Underlying continuing earnings per share*<br />

<strong>2012</strong> 2011<br />

Total 28.5p 50.0p<br />

Growth rate (43.00)% 0.04%<br />

Underlying earnings per share is a key measure for the <strong>Group</strong>. The<br />

decrease in the year reflects the <strong>Group</strong>’s disappointing trading<br />

performance.<br />

Debt to underlying EBITDA<br />

<strong>2012</strong> 2011<br />

Covenant ratio – revolving credit facility<br />

Maximum allowed ratio of consolidated net debt<br />

to underlying EBITDA 3.0 3.0<br />

Actual ratio of consolidated net debt to<br />

underlying EBITDA 2.1 1.6<br />

Covenant ratio – loan note agreements<br />

Maximum allowed ratio of consolidated total<br />

debt to underlying EBITDA 3.0 3.0<br />

Actual ratio of consolidated total debt to<br />

underlying EBITDA 2.8 2.1<br />

Debt to underlying EBITDA provides a clear indicator of leverage<br />

between the underlying EBITDA generated by trading <strong>and</strong> the<br />

<strong>Group</strong>’s debt levels, which are measured under different bases for<br />

the revolving credit facility <strong>and</strong> for the loan note agreements. It is an<br />

important indicator for the <strong>Group</strong>, <strong>and</strong> forms the basis of one of our<br />

specified financial covenants, which requires us to maintain a debt to<br />

underlying EBITDA ratio of not more than 3 times.<br />

Interest cover<br />

<strong>2012</strong> 2011<br />

Covenant ratio – revolving credit facility 6.7 9.5<br />

Covenant ratio – loan note agreements 6.9 10.4<br />

Interest cover provides a simple metric of the ratio between the<br />

underlying EBITDA generated by trading, compared with the<br />

finance costs for the current debt. It is an important indicator for<br />

the <strong>Group</strong>, <strong>and</strong> forms the basis of one of our specified financial<br />

covenants. The Board aims to keep interest cover at a prudent level.<br />

Underlying continuing operating cash flow<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Total cash flow 114.9 118.6<br />

Conversion from operating profit 130% 87%<br />

Operating cash flow provides a simple measure of the cash generated<br />

by trading within the businesses. It represents the money available<br />

to fund capital expenditure, interest payments, tax <strong>and</strong> shareholder<br />

dividends. In our short cycle business, operating cash conversion<br />

closely follows operating profit <strong>and</strong> the <strong>Group</strong> usually targets a rate<br />

above 100%. The <strong>Group</strong> underlying continuing operating cash flow<br />

decreased by 3% to £114.9 million during the year. This represents<br />

a conversion rate of underlying continuing operating profit* to<br />

operating cash of 130% (2011: 88%).<br />

* Before non-underlying items (see note 5)<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>