Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

40<br />

Corporate governance<br />

Directors’ remuneration report<br />

continued<br />

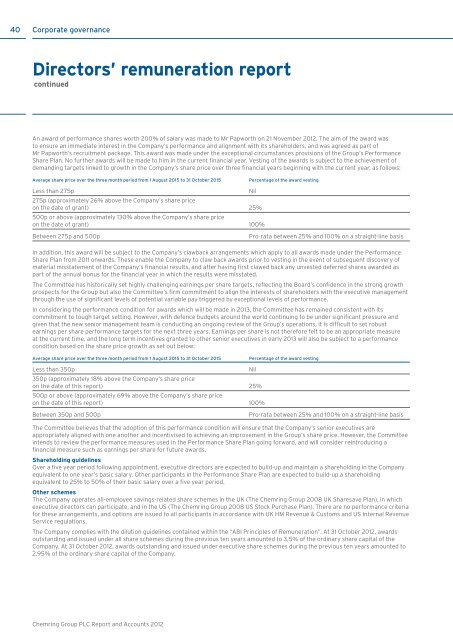

An award of performance shares worth 200% of salary was made to Mr Papworth on 21 November <strong>2012</strong>. The aim of the award was<br />

to ensure an immediate interest in the Company’s performance <strong>and</strong> alignment with its shareholders, <strong>and</strong> was agreed as part of<br />

Mr Papworth’s recruitment package. This award was made under the exceptional circumstances provisions of the <strong>Group</strong>’s Performance<br />

Share Plan. No further awards will be made to him in the current financial year. Vesting of the awards is subject to the achievement of<br />

dem<strong>and</strong>ing targets linked to growth in the Company’s share price over three financial years beginning with the current year, as follows:<br />

Average share price over the three month period from 1 August 2015 to 31 October 2015<br />

Percentage of the award vesting<br />

Less than 275p<br />

Nil<br />

275p (approximately 26% above the Company’s share price<br />

on the date of grant) 25%<br />

500p or above (approximately 130% above the Company’s share price<br />

on the date of grant) 100%<br />

Between 275p <strong>and</strong> 500p<br />

Pro-rata between 25% <strong>and</strong> 100% on a straight-line basis<br />

In addition, this award will be subject to the Company’s clawback arrangements which apply to all awards made under the Performance<br />

Share Plan from 2011 onwards. These enable the Company to claw back awards prior to vesting in the event of subsequent discovery of<br />

material misstatement of the Company’s financial results, <strong>and</strong> after having first clawed back any unvested deferred shares awarded as<br />

part of the annual bonus for the financial year in which the results were misstated.<br />

The Committee has historically set highly challenging earnings per share targets, reflecting the Board’s confidence in the strong growth<br />

prospects for the <strong>Group</strong> but also the Committee’s firm commitment to align the interests of shareholders with the executive management<br />

through the use of significant levels of potential variable pay triggered by exceptional levels of performance.<br />

In considering the performance condition for awards which will be made in 2013, the Committee has remained consistent with its<br />

commitment to tough target setting. However, with defence budgets around the world continuing to be under significant pressure <strong>and</strong><br />

given that the new senior management team is conducting an ongoing review of the <strong>Group</strong>’s operations, it is difficult to set robust<br />

earnings per share performance targets for the next three years. Earnings per share is not therefore felt to be an appropriate measure<br />

at the current time, <strong>and</strong> the long term incentives granted to other senior executives in early 2013 will also be subject to a performance<br />

condition based on the share price growth as set out below:<br />

Average share price over the three month period from 1 August 2015 to 31 October 2015<br />

Percentage of the award vesting<br />

Less than 350p<br />

Nil<br />

350p (approximately 18% above the Company’s share price<br />

on the date of this report) 25%<br />

500p or above (approximately 69% above the Company’s share price<br />

on the date of this report) 100%<br />

Between 350p <strong>and</strong> 500p<br />

Pro-rata between 25% <strong>and</strong> 100% on a straight-line basis<br />

The Committee believes that the adoption of this performance condition will ensure that the Company’s senior executives are<br />

appropriately aligned with one another <strong>and</strong> incentivised to achieving an improvement in the <strong>Group</strong>’s share price. However, the Committee<br />

intends to review the performance measures used in the Performance Share Plan going forward, <strong>and</strong> will consider reintroducing a<br />

financial measure such as earnings per share for future awards.<br />

Shareholding guidelines<br />

Over a five year period following appointment, executive directors are expected to build-up <strong>and</strong> maintain a shareholding in the Company<br />

equivalent to one year’s basic salary. Other participants in the Performance Share Plan are expected to build-up a shareholding<br />

equivalent to 25% to 50% of their basic salary over a five year period.<br />

Other schemes<br />

The Company operates all-employee savings-related share schemes in the UK (The <strong>Chemring</strong> <strong>Group</strong> 2008 UK Sharesave Plan), in which<br />

executive directors can participate, <strong>and</strong> in the US (The <strong>Chemring</strong> <strong>Group</strong> 2008 US Stock Purchase Plan). There are no performance criteria<br />

for these arrangements, <strong>and</strong> options are issued to all participants in accordance with UK HM Revenue & Customs <strong>and</strong> US Internal Revenue<br />

Service regulations.<br />

The Company complies with the dilution guidelines contained within the “ABI Principles of Remuneration”. At 31 October <strong>2012</strong>, awards<br />

outst<strong>and</strong>ing <strong>and</strong> issued under all share schemes during the previous ten years amounted to 3.5% of the ordinary share capital of the<br />

Company. At 31 October <strong>2012</strong>, awards outst<strong>and</strong>ing <strong>and</strong> issued under executive share schemes during the previous ten years amounted to<br />

2.95% of the ordinary share capital of the Company.<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>