Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

71<br />

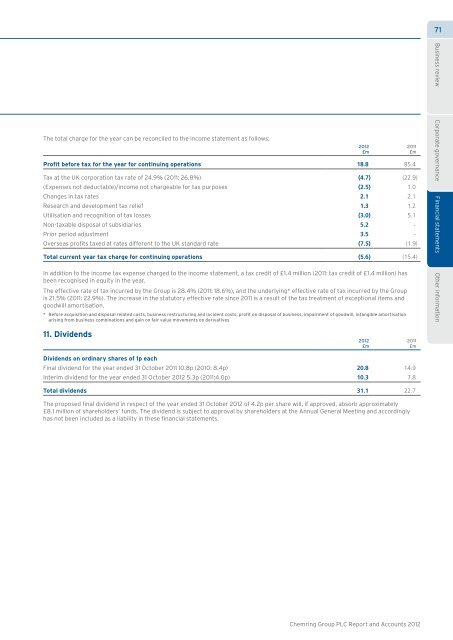

The total charge for the year can be reconciled to the income statement as follows:<br />

Profit before tax for the year for continuing operations 18.8 85.4<br />

Tax at the UK corporation tax rate of 24.9% (2011: 26.8%) (4.7) (22.9)<br />

(Expenses not deductable)/income not chargeable for tax purposes (2.5) 1.0<br />

Changes in tax rates 2.1 2.1<br />

Research <strong>and</strong> development tax relief 1.3 1.2<br />

Utilisation <strong>and</strong> recognition of tax losses (3.0) 5.1<br />

Non-taxable disposal of subsidiaries 5.2 -<br />

Prior period adjustment 3.5 -<br />

Overseas profits taxed at rates different to the UK st<strong>and</strong>ard rate (7.5) (1.9)<br />

Total current year tax charge for continuing operations (5.6) (15.4)<br />

In addition to the income tax expense charged to the income statement, a tax credit of £1.4 million (2011: tax credit of £1.4 million) has<br />

been recognised in equity in the year.<br />

The effective rate of tax incurred by the <strong>Group</strong> is 28.4% (2011: 18.6%), <strong>and</strong> the underlying* effective rate of tax incurred by the <strong>Group</strong><br />

is 21.5% (2011: 22.9%). The increase in the statutory effective rate since 2011 is a result of the tax treatment of exceptional items <strong>and</strong><br />

goodwill amortisation.<br />

* Before acquisition <strong>and</strong> disposal related costs, business restructuring <strong>and</strong> incident costs, profit on disposal of business, impairment of goodwill, intangible amortisation<br />

arising from business combinations <strong>and</strong> gain on fair value movements on derivatives<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Business review Corporate governance Financial statements Other information<br />

11. Dividends<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Dividends on ordinary shares of 1p each<br />

Final dividend for the year ended 31 October 2011 10.8p (2010: 8.4p) 20.8 14.9<br />

Interim dividend for the year ended 31 October <strong>2012</strong> 5.3p (2011:4.0p) 10.3 7.8<br />

Total dividends 31.1 22.7<br />

The proposed final dividend in respect of the year ended 31 October <strong>2012</strong> of 4.2p per share will, if approved, absorb approximately<br />

£8.1 million of shareholders’ funds. The dividend is subject to approval by shareholders at the Annual General Meeting <strong>and</strong> accordingly<br />

has not been included as a liability in these financial statements.<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>