Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Chemring Group PLC |Annual Report and Accounts 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

74<br />

Financial statements<br />

Notes to the group financial statements<br />

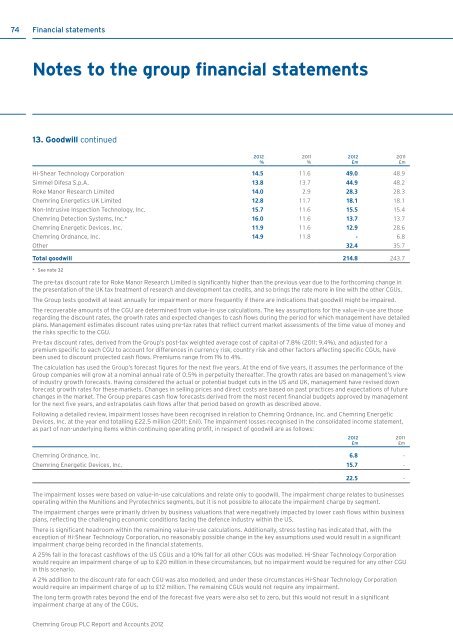

13. Goodwill continued<br />

<strong>2012</strong><br />

%<br />

2011<br />

%<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Hi-Shear Technology Corporation 14.5 11.6 49.0 48.9<br />

Simmel Difesa S.p.A. 13.8 13.7 44.9 48.2<br />

Roke Manor Research Limited 14.0 2.9 28.3 28.3<br />

<strong>Chemring</strong> Energetics UK Limited 12.8 11.7 18.1 18.1<br />

Non-Intrusive Inspection Technology, Inc. 15.7 11.6 15.5 15.4<br />

<strong>Chemring</strong> Detection Systems, Inc.* 16.0 11.6 13.7 13.7<br />

<strong>Chemring</strong> Energetic Devices, Inc. 11.9 11.6 12.9 28.6<br />

<strong>Chemring</strong> Ordnance, Inc. 14.9 11.8 - 6.8<br />

Other 32.4 35.7<br />

Total goodwill 214.8 243.7<br />

* See note 32<br />

The pre-tax discount rate for Roke Manor Research Limited is significantly higher than the previous year due to the forthcoming change in<br />

the presentation of the UK tax treatment of research <strong>and</strong> development tax credits, <strong>and</strong> so brings the rate more in line with the other CGUs.<br />

The <strong>Group</strong> tests goodwill at least annually for impairment or more frequently if there are indications that goodwill might be impaired.<br />

The recoverable amounts of the CGU are determined from value-in-use calculations. The key assumptions for the value-in-use are those<br />

regarding the discount rates, the growth rates <strong>and</strong> expected changes to cash flows during the period for which management have detailed<br />

plans. Management estimates discount rates using pre-tax rates that reflect current market assessments of the time value of money <strong>and</strong><br />

the risks specific to the CGU.<br />

Pre-tax discount rates, derived from the <strong>Group</strong>’s post-tax weighted average cost of capital of 7.8% (2011: 9.4%), <strong>and</strong> adjusted for a<br />

premium specific to each CGU to account for differences in currency risk, country risk <strong>and</strong> other factors affecting specific CGUs, have<br />

been used to discount projected cash flows. Premiums range from 1% to 4%.<br />

The calculation has used the <strong>Group</strong>’s forecast figures for the next five years. At the end of five years, it assumes the performance of the<br />

<strong>Group</strong> companies will grow at a nominal annual rate of 0.5% in perpetuity thereafter. The growth rates are based on management’s view<br />

of industry growth forecasts. Having considered the actual or potential budget cuts in the US <strong>and</strong> UK, management have revised down<br />

forecast growth rates for these markets. Changes in selling prices <strong>and</strong> direct costs are based on past practices <strong>and</strong> expectations of future<br />

changes in the market. The <strong>Group</strong> prepares cash flow forecasts derived from the most recent financial budgets approved by management<br />

for the next five years, <strong>and</strong> extrapolates cash flows after that period based on growth as described above.<br />

Following a detailed review, impairment losses have been recognised in relation to <strong>Chemring</strong> Ordnance, Inc. <strong>and</strong> <strong>Chemring</strong> Energetic<br />

Devices, Inc. at the year end totalling £22.5 million (2011: £nil). The impairment losses recognised in the consolidated income statement,<br />

as part of non-underlying items within continuing operating profit, in respect of goodwill are as follows:<br />

<strong>Chemring</strong> Ordnance, Inc. 6.8 -<br />

<strong>Chemring</strong> Energetic Devices, Inc. 15.7 -<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

22.5 -<br />

The impairment losses were based on value-in-use calculations <strong>and</strong> relate only to goodwill. The impairment charge relates to businesses<br />

operating within the Munitions <strong>and</strong> Pyrotechnics segments, but it is not possible to allocate the impairment charge by segment.<br />

The impairment charges were primarily driven by business valuations that were negatively impacted by lower cash flows within business<br />

plans, reflecting the challenging economic conditions facing the defence industry within the US.<br />

There is significant headroom within the remaining value-in-use calculations. Additionally, stress testing has indicated that, with the<br />

exception of Hi-Shear Technology Corporation, no reasonably possible change in the key assumptions used would result in a significant<br />

impairment charge being recorded in the financial statements.<br />

A 25% fall in the forecast cashflows of the US CGUs <strong>and</strong> a 10% fall for all other CGUs was modelled. Hi-Shear Technology Corporation<br />

would require an impairment charge of up to £20 million in these circumstances, but no impairment would be required for any other CGU<br />

in this scenario.<br />

A 2% addition to the discount rate for each CGU was also modelled, <strong>and</strong> under these circumstances Hi-Shear Technology Corporation<br />

would require an impairment charge of up to £12 million. The remaining CGUs would not require any impairment.<br />

The long term growth rates beyond the end of the forecast five years were also set to zero, but this would not result in a significant<br />

impairment charge at any of the CGUs.<br />

<strong>Chemring</strong> <strong>Group</strong> <strong>PLC</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>