Annual Report 2006-2007 - Cafcass

Annual Report 2006-2007 - Cafcass

Annual Report 2006-2007 - Cafcass

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

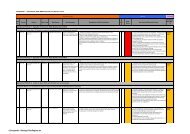

7 Tangible fixed assets<br />

Freehold land and<br />

buildings<br />

£000<br />

Leasehold land,<br />

buildings and<br />

improvements<br />

£000<br />

Computer<br />

and telecoms<br />

equipment<br />

£000<br />

Other assets<br />

£000<br />

Total<br />

£000<br />

Cost<br />

At 1st April <strong>2006</strong> 2,540 1,333 7,469 67 11,409<br />

Additions 593 - 1,923 20 2,536<br />

Disposal - - (5) (21) (26)<br />

Revaluation (148) - (516) - (664)<br />

At 31st March <strong>2007</strong> 2,985 1,333 8,871 66 13,255<br />

Depreciation<br />

At 1st April <strong>2006</strong> 150 681 5,458 67 6,356<br />

Charged in year 26 159 765 - 950<br />

Disposals - - (4) (21) (25)<br />

Revaluation - - (428) - (428)<br />

At 31st March <strong>2007</strong> 176 840 5,791 46 6,853<br />

Net book value<br />

At 31st March <strong>2007</strong> 2,809 493 3,080 20 6,402<br />

At 31st March <strong>2006</strong> 2,390 652 2,011 - 5,053<br />

The cost of additions to fixed assets is funded through<br />

(capital) grant-in-aid (see Note 16).<br />

Permanent diminutions charged to the Income and<br />

Expenditure Account of £0.093m include diminution of<br />

computer and telecommunications equipment.<br />

Freehold land at 31st March <strong>2007</strong> was valued at £0.953m<br />

(2005–06: £0.823m).<br />

Property assets were independently revalued by the<br />

Valuation Office Agency as at 1st April <strong>2007</strong> in<br />

accordance with the RICS Appraisal and Valuation<br />

Manual, published by the Royal Institution of Chartered<br />

Surveyors, insofar as this is consistent with current<br />

Treasury accounting guidance.<br />

The property values have been provided on the basis of<br />

Existing Use Value (EUV), apportioned between the land<br />

and the buildings with an assessment of the remaining life<br />

of the latter (Practice Statement 4.3).<br />

contractors, they are responsible for meeting travel, office<br />

and all other expenses related to their work, as well as<br />

related tax and national insurance liabilities.<br />

9 Partnership costs<br />

Partnership costs represent the cost of services totalling<br />

£1.099m (2005–06: £0.960m), provided by <strong>Cafcass</strong> through<br />

third party organisations such as contact centres and<br />

mediation centres.<br />

10 Operating surplus/(deficit)<br />

<strong>Cafcass</strong>’ payments for <strong>2006</strong>–07 were met primarily from<br />

the cash funding available from the Department for<br />

Education and Skills.<br />

Excluding the pension adjustment and related cost of<br />

capital, on a resource basis <strong>Cafcass</strong> overspent against its<br />

£106.012m resource budget by £0.043m/0.04%.<br />

8 Self-employed contractors<br />

In <strong>2006</strong>–07 we contracted the services of 395 selfemployed<br />

contractors of which amounts paid amounted to<br />

£9.730m in the year (2005–06: £11.736m). As self-employed<br />

Section 6: Accounts <strong>2006</strong>–07 | 59