Annual Report 2006-2007 - Cafcass

Annual Report 2006-2007 - Cafcass

Annual Report 2006-2007 - Cafcass

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Other commitments<br />

<strong>Cafcass</strong> had a three-year contract with Unisys Ltd, ending 31st March <strong>2006</strong>. <strong>Cafcass</strong> has exercised the option of a twoyear<br />

extension to continue to provide finance, payroll and IT managed services. The commitment in <strong>2007</strong>–08 is £2.872m<br />

(including VAT).<br />

20 Pension liabilities (FRS17)<br />

WYPF’s actuary, Mercer Human Resource Consulting carried out a FRS 17 valuation for <strong>Cafcass</strong> as at 31st March <strong>2007</strong>.<br />

The scheme provides funded defined benefits based on final pensionable salary. The assets of the scheme are held<br />

separately from those of <strong>Cafcass</strong> and are invested in managed funds. Employer contribution rates are determined by a<br />

qualified actuary on the basis of triennial valuations.<br />

<strong>Cafcass</strong> accounts for scheme liabilities in accordance with FRS 17 – Retirement benefits. This is the second year a FRS<br />

17 disclosure has been made and as such there is limited history of movements in liabilities. The in year service cost<br />

has been reflected in the Income and Expenditure Account.<br />

In addition to the disclosure contained in the primary statements, the following disclosures are in accordance with that<br />

standard.<br />

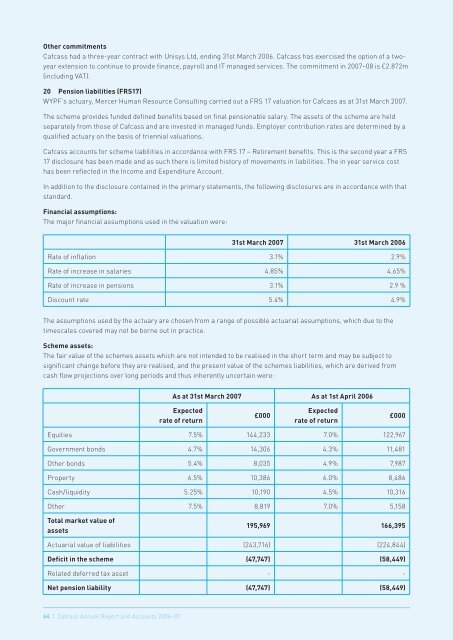

Financial assumptions:<br />

The major financial assumptions used in the valuation were:<br />

31st March <strong>2007</strong> 31st March <strong>2006</strong><br />

Rate of inflation 3.1% 2.9%<br />

Rate of increase in salaries 4.85% 4.65%<br />

Rate of increase in pensions 3.1% 2.9 %<br />

Discount rate 5.4% 4.9%<br />

The assumptions used by the actuary are chosen from a range of possible actuarial assumptions, which due to the<br />

timescales covered may not be borne out in practice.<br />

Scheme assets:<br />

The fair value of the schemes assets which are not intended to be realised in the short term and may be subject to<br />

significant change before they are realised, and the present value of the schemes liabilities, which are derived from<br />

cash flow projections over long periods and thus inherently uncertain were:<br />

As at 31st March <strong>2007</strong> As at 1st April <strong>2006</strong><br />

Expected<br />

rate of return<br />

£000<br />

Expected<br />

rate of return<br />

£000<br />

Equities 7.5% 144,233 7.0% 122,967<br />

Government bonds 4.7% 14,306 4.3% 11,481<br />

Other bonds 5.4% 8,035 4.9% 7,987<br />

Property 6.5% 10,386 6.0% 8,486<br />

Cash/liquidity 5.25% 10,190 4.5% 10,316<br />

Other 7.5% 8,819 7.0% 5,158<br />

Total market value of<br />

assets<br />

195,969 166,395<br />

Actuarial value of liabilities (243,716) (224,844)<br />

Deficit in the scheme (47,747) (58,449)<br />

Related deferred tax asset - -<br />

Net pension liability (47,747) (58,449)<br />

64 | <strong>Cafcass</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2006</strong>–07