Annual Report 2004-2005 - Forensicare

Annual Report 2004-2005 - Forensicare

Annual Report 2004-2005 - Forensicare

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

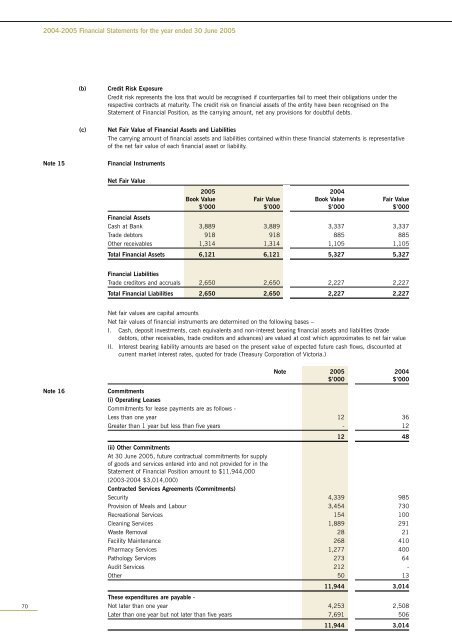

<strong>2004</strong>-<strong>2005</strong> Financial Statements for the year ended 30 June <strong>2005</strong><br />

(b)<br />

Credit Risk Exposure<br />

Credit risk represents the loss that would be recognised if counterparties fail to meet their obligations under the<br />

respective contracts at maturity. The credit risk on financial assets of the entity have been recognised on the<br />

Statement of Financial Position, as the carrying amount, net any provisions for doubtful debts.<br />

(c)<br />

Net Fair Value of Financial Assets and Liabilities<br />

The carrying amount of financial assets and liabilities contained within these financial statements is representative<br />

of the net fair value of each financial asset or liability.<br />

Note 15<br />

Financial Instruments<br />

Net Fair Value<br />

<strong>2005</strong> <strong>2004</strong><br />

Book Value Fair Value Book Value Fair Value<br />

$’000 $’000 $’000 $’000<br />

Financial Assets<br />

Cash at Bank 3,889 3,889 3,337 3,337<br />

Trade debtors 918 918 885 885<br />

Other receivables 1,314 1,314 1,105 1,105<br />

Total Financial Assets 6,121 6,121 5,327 5,327<br />

Financial Liabilities<br />

Trade creditors and accruals 2,650 2,650 2,227 2,227<br />

Total Financial Liabilities 2,650 2,650 2,227 2,227<br />

Net fair values are capital amounts<br />

Net fair values of financial instruments are determined on the following bases –<br />

I. Cash, deposit investments, cash equivalents and non-interest bearing financial assets and liabilities (trade<br />

debtors, other receivables, trade creditors and advances) are valued at cost which approximates to net fair value<br />

II. Interest bearing liability amounts are based on the present value of expected future cash flows, discounted at<br />

current market interest rates, quoted for trade (Treasury Corporation of Victoria.)<br />

Note <strong>2005</strong> <strong>2004</strong><br />

$’000 $’000<br />

Note 16<br />

Commitments<br />

(i) Operating Leases<br />

Commitments for lease payments are as follows -<br />

Less than one year 12 36<br />

Greater than 1 year but less than five years - 12<br />

12 48<br />

(ii) Other Commitments<br />

At 30 June <strong>2005</strong>, future contractual commitments for supply<br />

of goods and services entered into and not provided for in the<br />

Statement of Financial Position amount to $11,944,000<br />

(2003-<strong>2004</strong> $3,014,000)<br />

Contracted Services Agreements (Commitments)<br />

Security 4,339 985<br />

Provision of Meals and Labour 3,454 730<br />

Recreational Services 154 100<br />

Cleaning Services 1,889 291<br />

Waste Removal 28 21<br />

Facility Maintenance 268 410<br />

Pharmacy Services 1,277 400<br />

Pathology Services 273 64<br />

Audit Services 212 -<br />

Other 50 13<br />

11,944 3,014<br />

70<br />

These expenditures are payable -<br />

Not later than one year 4,253 2,508<br />

Later than one year but not later than five years 7,691 506<br />

11,944 3,014