Å kodaAuto ANNUAL REPORT 2006 - Skoda Auto

Å kodaAuto ANNUAL REPORT 2006 - Skoda Auto

Å kodaAuto ANNUAL REPORT 2006 - Skoda Auto

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

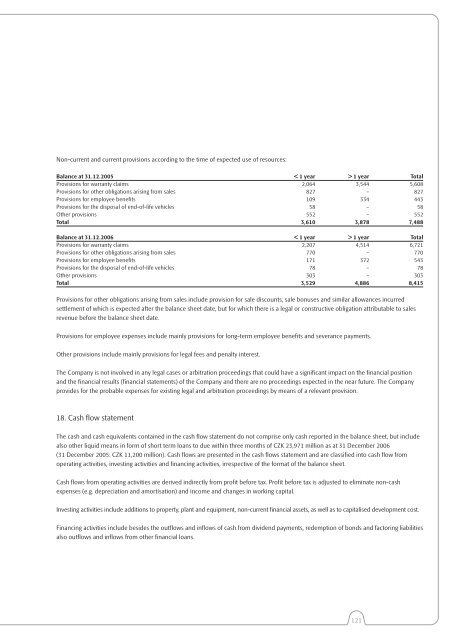

Non-current and current provisions according to the time of expected use of resources:<br />

Balance at 31.12.2005 < 1 year > 1 year Total<br />

Provisions for warranty claims 2,064 3,544 5,608<br />

Provisions for other obligations arising from sales 827 – 827<br />

Provisions for employee benefits 109 334 443<br />

Provisions for the disposal of end-of-life vehicles 58 – 58<br />

Other provisions 552 – 552<br />

Total 3,610 3,878 7,488<br />

Balance at 31.12.<strong>2006</strong> < 1 year > 1 year Total<br />

Provisions for warranty claims 2,207 4,514 6,721<br />

Provisions for other obligations arising from sales 770 – 770<br />

Provisions for employee benefits 171 372 543<br />

Provisions for the disposal of end-of-life vehicles 78 – 78<br />

Other provisions 303 – 303<br />

Total 3,529 4,886 8,415<br />

Provisions for other obligations arising from sales include provision for sale discounts, sale bonuses and similar allowances incurred<br />

settlement of which is expected after the balance sheet date, but for which there is a legal or constructive obligation attributable to sales<br />

revenue before the balance sheet date.<br />

Provisions for employee expenses include mainly provisions for long-term employee benefits and severance payments.<br />

Other provisions include mainly provisions for legal fees and penalty interest.<br />

The Company is not involved in any legal cases or arbitration proceedings that could have a significant impact on the financial position<br />

and the financial results (financial statements) of the Company and there are no proceedings expected in the near future. The Company<br />

provides for the probable expenses for existing legal and arbitration proceedings by means of a relevant provision.<br />

18. Cash flow statement<br />

The cash and cash equivalents contained in the cash flow statement do not comprise only cash reported in the balance sheet, but include<br />

also other liquid means in form of short term loans to due within three months of CZK 23,971 million as at 31 December <strong>2006</strong><br />

(31 December 2005: CZK 11,200 million). Cash flows are presented in the cash flows statement and are classified into cash flow from<br />

operating activities, investing activities and financing activities, irrespective of the format of the balance sheet.<br />

Cash flows from operating activities are derived indirectly from profit before tax. Profit before tax is adjusted to eliminate non-cash<br />

expenses (e.g. depreciation and amortisation) and income and changes in working capital.<br />

Investing activities include additions to property, plant and equipment, non-current financial assets, as well as to capitalised development cost.<br />

Financing activities include besides the outflows and inflows of cash from dividend payments, redemption of bonds and factoring liabilities<br />

also outflows and inflows from other financial loans.<br />

121