Å kodaAuto ANNUAL REPORT 2006 - Skoda Auto

Å kodaAuto ANNUAL REPORT 2006 - Skoda Auto

Å kodaAuto ANNUAL REPORT 2006 - Skoda Auto

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Situation of Individual<br />

Group Companies<br />

This part of the Annual Report comments<br />

on the financial performance figures of the<br />

parent company, Škoda <strong>Auto</strong>, and its<br />

subsidiaries. These figures are in<br />

accordance with International Financial<br />

Reporting Standards.<br />

Škoda <strong>Auto</strong><br />

Like the previous year, <strong>2006</strong> was one<br />

of the most successful years in the<br />

Company’s over 100-year history –<br />

both in terms of sales and production<br />

indicators and in terms of financial<br />

performance. Sales revenues were up by<br />

over 6.7% to reach a record level of<br />

CZK 189.8 billion. The operating result<br />

reached a level of CZK 13.8 billion and<br />

profit before income tax rose 43.6%<br />

year-on-year. Growth in cash flow<br />

resulted in improved net liquidity. In view<br />

of the fact that the parent company<br />

accounts for approximately 90% of the<br />

Group’s overall results, there is a large<br />

degree of correlation between its<br />

financial performance and that of the<br />

Group as a whole.<br />

Balance Sheet and Financing<br />

The total assets figure, CZK 97.4 billion,<br />

was up 16% compared to its level as of<br />

31 December 2005 (CZK 84 billion). Fixed<br />

assets fell from CZK 55.0 billion to<br />

CZK 53.7 billion. Inventories expanded<br />

slightly (+5.5% year-on-year) due to<br />

increased production volumes in existing<br />

models and commencement of<br />

production of the new Škoda Roomster.<br />

Loans to Volkswagen Group companies<br />

grew by CZK 12.8 billion (+113.8%).<br />

Receivables shrank slightly (-3.1%) as<br />

a result of increased use of factoring.<br />

Shareholders’ equity developed in line<br />

with the Company’s overall performance<br />

during the year. Compared to the previous<br />

year, shareholders’ equity increased by<br />

CZK 11.5 billion (+24.8%). Overall,<br />

current liabilities grew by CZK 4.2 billion<br />

year-on-year (+16.3%), while non-current<br />

liabilities declined (by CZK 2.3 billion, or<br />

-19.6%) compared to the previous period.<br />

An increase in overall spending on<br />

tangible and intangible fixed assets was<br />

CZK 8.2 billion in <strong>2006</strong>. Total capital<br />

spending was CZK 0.4 billion (-4.7%) less<br />

than in the previous period, due to the<br />

cyclical nature of the Company’s business,<br />

as new products enter production. Like in<br />

the previous year, cash flow from operating<br />

activities (CZK 24.2 billion) was sufficient<br />

to cover overall capital expenditures. The<br />

net liquidity liquidity indicator stood at<br />

CZK 19.4 billion.<br />

Profits<br />

Compared to the previous year, sales<br />

revenues were up CZK 12.0 billion (+6.7%)<br />

to reach CZK 189.8 billion. The biggest<br />

contributors to this record-breaking rise in<br />

revenues were increased demand for<br />

vehicles with more features and increased<br />

sales of genuine parts. Sales revenues can<br />

be broken down as follows: vehicles,<br />

89.8%; genuine parts and accessories,<br />

5.9%; components deliveries, 3.2%; and<br />

other goods and services accounted for<br />

the remaining 1.1%.<br />

Higher sales volume and a worldwide<br />

growth in raw materials prices had an<br />

impact on the overall level of costs of<br />

products, goods, and services sold.<br />

Compared to the previous year they<br />

increased by 5.4%. Thanks to optimising<br />

measures taken in the production<br />

function, the ratio of production costs to<br />

overall sales revenues was reduced by<br />

1.2%. Distribution expenses were up 5.3%<br />

from the previous year, driven in<br />

particular by increased marketing support<br />

and advertising costs. Administrative<br />

expenses saw a moderate decline<br />

(-5.0% year-on-year).<br />

As a result, the operating result grew by<br />

37.7%, or CZK 3.8 billion. The financial<br />

result, too, continued to move in<br />

a positive direction. Primarily as a result<br />

of lower interest costs, the loss was<br />

CZK 348 million (–61.7%) lower than the<br />

previous year’s figure. After deduction of<br />

income tax due and deferred totalling<br />

CZK 2.7 billion, the profit after income<br />

tax came to CZK 10.9 billion (2005:<br />

CZK 7.4 billion), an improvement of 47.8%.<br />

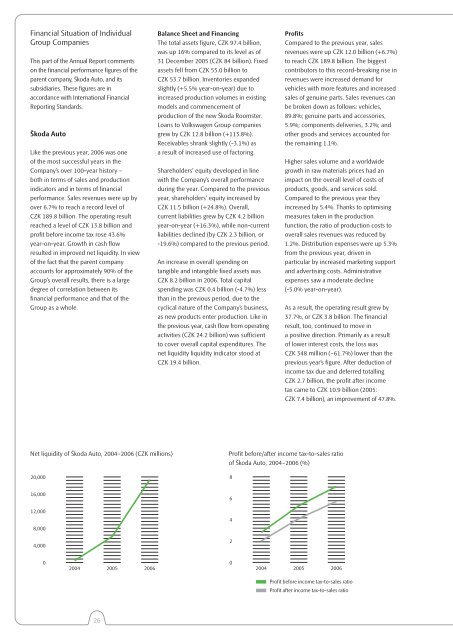

Net liquidity of Škoda <strong>Auto</strong>, 2004–<strong>2006</strong> (CZK millions)<br />

20,000<br />

Profit before/after income tax-to-sales ratio<br />

of Škoda <strong>Auto</strong>, 2004–<strong>2006</strong> (%)<br />

8<br />

16,000<br />

12,000<br />

8,000<br />

4,000<br />

6<br />

4<br />

2<br />

0<br />

2004 2005 <strong>2006</strong><br />

0<br />

2004 2005 <strong>2006</strong><br />

Profit before income tax-to-sales ratio<br />

Profit after income tax-to-sales ratio<br />

26