Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

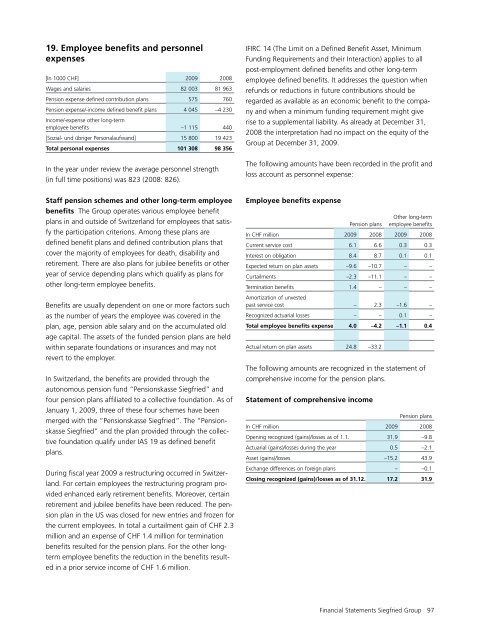

19. Employee benefits and personnel<br />

expenses<br />

[In 1000 CHF] <strong>2009</strong> 2008<br />

Wages and salaries 82 003 81 963<br />

Pension expense defined contribution plans 575 760<br />

Pension expense/-income defined benefit plans 4 045 –4 230<br />

Income/-expense other long-term<br />

employee benefits –1 115 440<br />

[Sozial- und übriger Personalaufwand] 15 800 19 423<br />

Total personal expenses 101 308 98 356<br />

In the year under review the average personnel strength<br />

(in full time positions) was 823 (2008: 826).<br />

IFIRC 14 (The Limit on a Defined Benefit Asset, Minimum<br />

Funding Requirements and their Interaction) applies to all<br />

post-employment defined benefits and other long-term<br />

employee defined benefits. It addresses the question when<br />

refunds or reductions in future contributions should be<br />

regarded as available as an economic benefit to the company<br />

and when a minimum funding requirement might give<br />

rise to a supplemental liability. As already at December 31,<br />

2008 the interpretation had no impact on the equity of the<br />

Group at December 31, <strong>2009</strong>.<br />

The following amounts have been recorded in the profit and<br />

loss account as personnel expense:<br />

Staff pension schemes and other long-term employee<br />

benefits The Group operates various employee benefit<br />

plans in and outside of Switzerland for employees that satisfy<br />

the participation criterions. Among these plans are<br />

defined benefit plans and defined contribution plans that<br />

cover the majority of employees for death, disability and<br />

retirement. There are also plans for jubilee benefits or other<br />

year of service depending plans which qualify as plans for<br />

other long-term employee benefits.<br />

Benefits are usually dependent on one or more factors such<br />

as the number of years the employee was covered in the<br />

plan, age, pension able salary and on the accumulated old<br />

age capital. The assets of the funded pension plans are held<br />

within separate foundations or insurances and may not<br />

revert to the employer.<br />

In Switzerland, the benefits are provided through the<br />

autonomous pension fund “Pensionskasse <strong>Siegfried</strong>” and<br />

four pension plans affiliated to a collective foundation. As of<br />

January 1, <strong>2009</strong>, three of these four schemes have been<br />

merged with the “Pensionskasse <strong>Siegfried</strong>”. The “Pensionskasse<br />

<strong>Siegfried</strong>” and the plan provided through the collective<br />

foundation qualify under IAS 19 as defined benefit<br />

plans.<br />

During fiscal year <strong>2009</strong> a restructuring occurred in Switzerland.<br />

For certain employees the restructuring program provided<br />

enhanced early retirement benefits. Moreover, certain<br />

retirement and jubilee benefits have been reduced. The pension<br />

plan in the US was closed for new entries and frozen for<br />

the current employees. In total a curtailment gain of CHF 2.3<br />

million and an expense of CHF 1.4 million for termination<br />

benefits resulted for the pension plans. For the other longterm<br />

employee benefits the reduction in the benefits resulted<br />

in a prior service income of CHF 1.6 million.<br />

Employee benefits expense<br />

Pension plans<br />

Other long-term<br />

employee benefits<br />

In CHF million <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Current service cost 6.1 6.6 0.3 0.3<br />

Interest on obligation 8.4 8.7 0.1 0.1<br />

Expected return on plan assets –9.6 –10.7 – –<br />

Curtailments –2.3 –11.1 – –<br />

Termination benefits 1.4 – – –<br />

Amortization of unvested<br />

past service cost – 2.3 –1.6 –<br />

Recognized actuarial losses – – 0.1 –<br />

Total employee benefits expense 4.0 –4.2 –1.1 0.4<br />

Actual return on plan assets 24.8 –33.2<br />

The following amounts are recognized in the statement of<br />

comprehensive income for the pension plans.<br />

Statement of comprehensive income<br />

Pension plans<br />

In CHF million <strong>2009</strong> 2008<br />

Opening recognized (gains)/losses as of 1.1. 31.9 –9.8<br />

Actuarial (gains)/losses during the year 0.5 –2.1<br />

Asset (gains)/losses –15.2 43.9<br />

Exchange differences on foreign plans – –0.1<br />

Closing recognized (gains)/losses as of 31.12. 17.2 31.9<br />

Financial Statements <strong>Siegfried</strong> Group 97