Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial instruments, such as interest rate swaps, are used<br />

by the Group to hedge in part the risks from interest rate<br />

movements, by exchanging fixed and floating rate risks<br />

(see Note 11).<br />

Market value risk Changes in the market value of financial<br />

assets and derivative financial instruments can affect the<br />

financial position and net profit of the Group. Non-current<br />

financial investments, such as investments in subsidiaries,<br />

are held primarily for strategic reasons. Risks of loss in value<br />

are minimized by thorough analysis before purchase and<br />

by continuously monitoring the performance and risks of<br />

the investments. The financial assets consist essentially of<br />

the shares in Arena Pharmaceuticals Inc., San Diego, USA<br />

(see Note 6). They are listed on NASDAQ and are therefore<br />

subject to general market movements and company specific<br />

risks (in particular realization of the “Lead compound<br />

Lorcaserin”).<br />

Liquidity risk Group companies need to have sufficient<br />

access to cash to meet their obligations. The corporate<br />

finance department manages the raising of current and noncurrent<br />

debt. Cash flow forecasting is performed in the<br />

operating entities of the Group and aggregated and monitored<br />

by group finance. The management of excess liquidity<br />

is also centralized.<br />

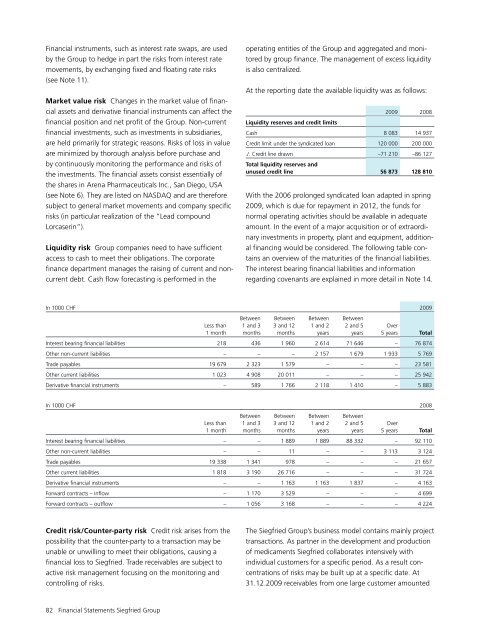

At the reporting date the available liquidity was as follows:<br />

<strong>2009</strong> 2008<br />

Liquidity reserves and credit limits<br />

Cash 8 083 14 937<br />

Credit limit under the syndicated loan 120 000 200 000<br />

./. Credit line drawn –71 210 –86 127<br />

Total liquidity reserves and<br />

unused credit line 56 873 128 810<br />

With the 2006 prolonged syndicated loan adapted in spring<br />

<strong>2009</strong>, which is due for repayment in 2012, the funds for<br />

normal operating activities should be available in adequate<br />

amount. In the event of a major acquisition or of extraordinary<br />

investments in property, plant and equipment, additional<br />

financing would be considered. The following table contains<br />

an overview of the maturities of the financial liabilities.<br />

The interest bearing financial liabilities and information<br />

regarding covenants are explained in more detail in Note 14.<br />

In 1000 CHF <strong>2009</strong><br />

Between Between Between Between<br />

Less than 1 and 3 3 and 12 1 and 2 2 and 5 Over<br />

1 month months months years years 5 years Total<br />

Interest bearing financial liabilities 218 436 1 960 2 614 71 646 – 76 874<br />

Other non-current liabilities – – – 2 157 1 679 1 933 5 769<br />

Trade payables 19 679 2 323 1 579 – – – 23 581<br />

Other current liabilities 1 023 4 908 20 011 – – – 25 942<br />

Derivative financial instruments – 589 1 766 2 118 1 410 – 5 883<br />

In 1000 CHF 2008<br />

Between Between Between Between<br />

Less than 1 and 3 3 and 12 1 and 2 2 and 5 Over<br />

1 month months months years years 5 years Total<br />

Interest bearing financial liabilities – – 1 889 1 889 88 332 – 92 110<br />

Other non-current liabilities – – 11 – – 3 113 3 124<br />

Trade payables 19 338 1 341 978 – – – 21 657<br />

Other current liabilities 1 818 3 190 26 716 – – – 31 724<br />

Derivative financial instruments – – 1 163 1 163 1 837 – 4 163<br />

Forward contracts – inflow – 1 170 3 529 – – – 4 699<br />

Forward contracts – outflow – 1 056 3 168 – – – 4 224<br />

Credit risk/Counter-party risk Credit risk arises from the<br />

possibility that the counter-party to a transaction may be<br />

unable or unwilling to meet their obligations, causing a<br />

financial loss to <strong>Siegfried</strong>. Trade receivables are subject to<br />

active risk management focusing on the monitoring and<br />

controlling of risks.<br />

The <strong>Siegfried</strong> Group’s business model contains mainly project<br />

transactions. As partner in the development and production<br />

of medicaments <strong>Siegfried</strong> collaborates intensively with<br />

individual customers for a specific period. As a result concentrations<br />

of risks may be built up at a specific date. At<br />

31.12.<strong>2009</strong> receivables from one large customer amounted<br />

82 Financial Statements <strong>Siegfried</strong> Group