Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial risk management<br />

Financial risk management within the Group is governed by<br />

policies and guidelines approved by management. These<br />

policies cover foreign exchange risk, interest rate risk, market<br />

risk, credit risk and liquidity risk. Group policies also cover<br />

the investment of excess funds and the raising of debts.<br />

Both the investment of excess funds and the raising of current<br />

and non-current debts are centralized. Risk management<br />

strives to minimize the potential negative effects on<br />

the Group‘s financial position.<br />

Market risk <strong>Siegfried</strong> is exposed to market risks which consist<br />

mainly of foreign exchange risk, interest rate risk and<br />

market value risk.<br />

Foreign exchange risk <strong>Siegfried</strong> operates across the world<br />

and is exposed to movements in foreign currencies affecting<br />

its reporting in Swiss francs. Foreign exchange risks arise on<br />

business transactions that are not conducted in the Group‘s<br />

functional currency. <strong>Siegfried</strong> continues to monitor its currency<br />

exposures and, when appropriate, uses forward contracts,<br />

swaps or currency options to hedge its risks. Specific<br />

net investments in Group companies are hedged through<br />

bank credits in the same foreign currencies.<br />

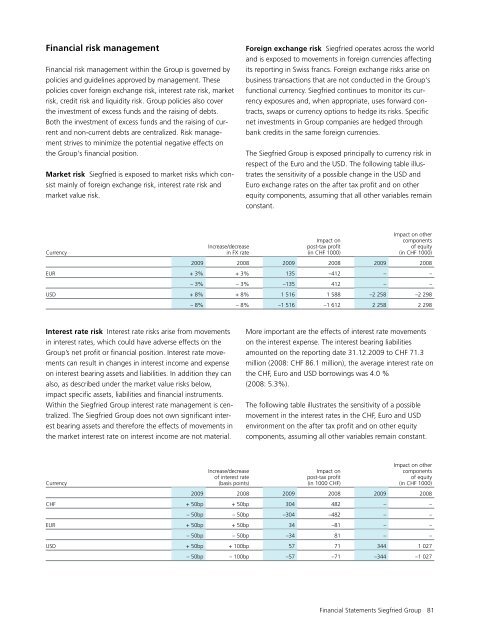

The <strong>Siegfried</strong> Group is exposed principally to currency risk in<br />

respect of the Euro and the USD. The following table illustrates<br />

the sensitivity of a possible change in the USD and<br />

Euro exchange rates on the after tax profit and on other<br />

equity components, assuming that all other variables remain<br />

constant.<br />

Impact on other<br />

Impact on<br />

components<br />

Increase/decrease post-tax profit of equity<br />

Currency in FX rate (in CHF 1000) (in CHF 1000)<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

EUR + 3% + 3% 135 –412 – –<br />

– 3% – 3% –135 412 – –<br />

USD + 8% + 8% 1 516 1 588 –2 258 –2 298<br />

– 8% – 8% –1 516 –1 612 2 258 2 298<br />

Interest rate risk Interest rate risks arise from movements<br />

in interest rates, which could have adverse effects on the<br />

Group’s net profit or financial position. Interest rate movements<br />

can result in changes in interest income and expense<br />

on interest bearing assets and liabilities. In addition they can<br />

also, as described under the market value risks below,<br />

impact specific assets, liabilities and financial instruments.<br />

Within the <strong>Siegfried</strong> Group interest rate management is centralized.<br />

The <strong>Siegfried</strong> Group does not own significant interest<br />

bearing assets and therefore the effects of movements in<br />

the market interest rate on interest income are not material.<br />

More important are the effects of interest rate movements<br />

on the interest expense. The interest bearing liabilities<br />

amounted on the reporting date 31.12.<strong>2009</strong> to CHF 71.3<br />

million (2008: CHF 86.1 million), the average interest rate on<br />

the CHF, Euro and USD borrowings was 4.0 %<br />

(2008: 5.3%).<br />

The following table illustrates the sensitivity of a possible<br />

movement in the interest rates in the CHF, Euro and USD<br />

environment on the after tax profit and on other equity<br />

components, assuming all other variables remain constant.<br />

Impact on other<br />

Increase/decrease Impact on components<br />

of interest rate post-tax profit of equity<br />

Currency (basis points) (in 1000 CHF) (in CHF 1000)<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

CHF + 50bp + 50bp 304 482 – –<br />

– 50bp – 50bp –304 –482 – –<br />

EUR + 50bp + 50bp 34 –81 – –<br />

– 50bp – 50bp –34 81 – –<br />

USD + 50bp + 100bp 57 71 344 1 027<br />

– 50bp – 100bp –57 –71 –344 –1 027<br />

Financial Statements <strong>Siegfried</strong> Group 81