Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

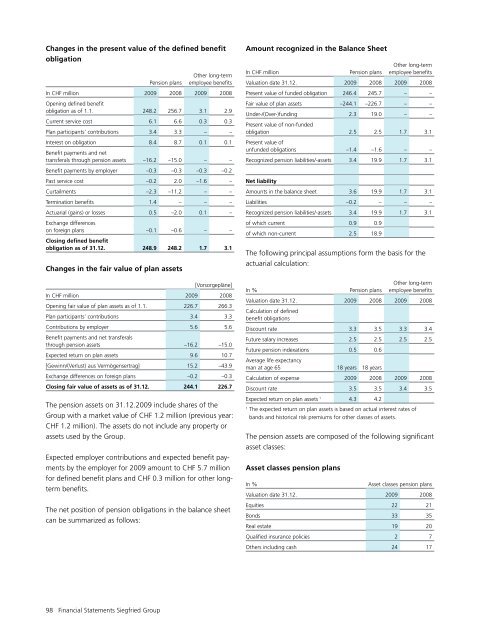

Changes in the present value of the defined benefit<br />

obligation<br />

Pension plans<br />

Other long-term<br />

employee benefits<br />

In CHF million <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Opening defined benefit<br />

obligation as of 1.1. 248.2 256.7 3.1 2.9<br />

Current service cost 6.1 6.6 0.3 0.3<br />

Plan participants’ contributions 3.4 3.3 – –<br />

Interest on obligation 8.4 8.7 0.1 0.1<br />

Benefit payments and net<br />

transferals through pension assets –16.2 –15.0 – –<br />

Benefit payments by employer –0.3 –0.3 –0.3 –0.2<br />

Past service cost –0.2 2.0 –1.6 –<br />

Curtailments –2.3 –11.2 – –<br />

Termination benefits 1.4 – – –<br />

Actuarial (gains) or losses 0.5 –2.0 0.1 –<br />

Exchange differences<br />

on foreign plans –0.1 –0.6 – –<br />

Closing defined benefit<br />

obligation as of 31.12. 248.9 248.2 1.7 3.1<br />

Changes in the fair value of plan assets<br />

[Vorsorgepläne]<br />

In CHF million <strong>2009</strong> 2008<br />

Opening fair value of plan assets as of 1.1. 226.7 266.3<br />

Plan participants’ contributions 3.4 3.3<br />

Contributions by employer 5.6 5.6<br />

Benefit payments and net transferals<br />

through pension assets –16.2 –15.0<br />

Expected return on plan assets 9.6 10.7<br />

[Gewinn/(Verlust) aus Vermögensertrag] 15.2 –43.9<br />

Exchange differences on foreign plans –0.2 –0.3<br />

Closing fair value of assets as of 31.12. 244.1 226.7<br />

The pension assets on 31.12.<strong>2009</strong> include shares of the<br />

Group with a market value of CHF 1.2 million (previous year:<br />

CHF 1.2 million). The assets do not include any property or<br />

assets used by the Group.<br />

Expected employer contributions and expected benefit payments<br />

by the employer for <strong>2009</strong> amount to CHF 5.7 million<br />

for defined benefit plans and CHF 0.3 million for other longterm<br />

benefits.<br />

The net position of pension obligations in the balance sheet<br />

can be summarized as follows:<br />

Amount recognized in the Balance Sheet<br />

Other long-term<br />

In CHF million Pension plans employee benefits<br />

Valuation date 31.12. <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Present value of funded obligation 246.4 245.7 – –<br />

Fair value of plan assets –244.1 –226.7 – –<br />

Under-/(Over-)funding 2.3 19.0 – –<br />

Present value of non-funded<br />

obligation 2.5 2.5 1.7 3.1<br />

Present value of<br />

unfunded obligations –1.4 –1.6 – –<br />

Recognized pension liabilities/-assets 3.4 19.9 1.7 3.1<br />

Net liability<br />

Amounts in the balance sheet 3.6 19.9 1.7 3.1<br />

Liabilities –0.2 – – –<br />

Recognized pension liabilities/-assets 3.4 19.9 1.7 3.1<br />

of which current 0.9 0.9<br />

of which non-current 2.5 18.9<br />

The following principal assumptions form the basis for the<br />

actuarial calculation:<br />

Other long-term<br />

In % Pension plans employee benefits<br />

Valuation date 31.12. <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Calculation of defined<br />

benefit obligations<br />

Discount rate 3.3 3.5 3.3 3.4<br />

Future salary increases 2.5 2.5 2.5 2.5<br />

Future pension indexations 0.5 0.6<br />

Average life expectancy<br />

man at age 65 18 years 18 years<br />

Calculation of expense <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Discount rate 3.5 3.5 3.4 3.5<br />

Expected return on plan assets 1 4.3 4.2<br />

1<br />

The expected return on plan assets is based on actual interest rates of<br />

bands and historical risk premiums for other classes of assets.<br />

The pension assets are composed of the following significant<br />

asset classes:<br />

Asset classes pension plans<br />

In %<br />

Asset classes pension plans<br />

Valuation date 31.12. <strong>2009</strong> 2008<br />

Equities 22 21<br />

Bonds 33 35<br />

Real estate 19 20<br />

Qualified insurance policies 2 7<br />

Others including cash 24 17<br />

98 Financial Statements <strong>Siegfried</strong> Group