Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

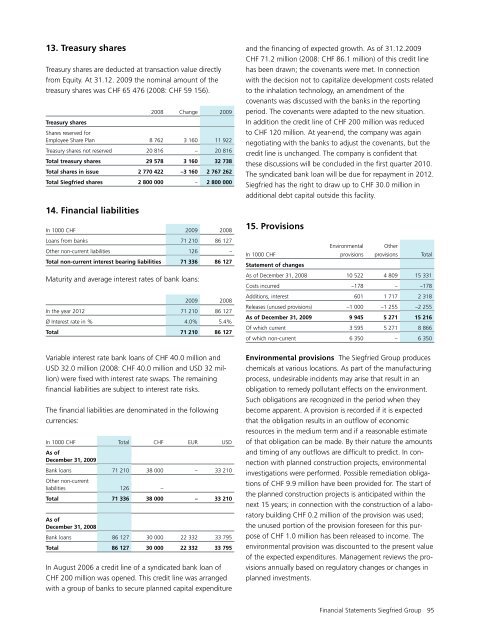

13. Treasury shares<br />

Treasury shares are deducted at transaction value directly<br />

from Equity. At 31.12. <strong>2009</strong> the nominal amount of the<br />

treasury shares was CHF 65 476 (2008: CHF 59 156).<br />

2008 Change <strong>2009</strong><br />

Treasury shares<br />

Shares reserved for<br />

Employee Share Plan 8 762 3 160 11 922<br />

Treasury shares not reserved 20 816 – 20 816<br />

Total treasury shares 29 578 3 160 32 738<br />

Total shares in issue 2 770 422 –3 160 2 767 262<br />

Total <strong>Siegfried</strong> shares 2 800 000 – 2 800 000<br />

and the financing of expected growth. As of 31.12.<strong>2009</strong><br />

CHF 71.2 million (2008: CHF 86.1 million) of this credit line<br />

has been drawn; the covenants were met. In connection<br />

with the decision not to capitalize development costs related<br />

to the inhalation technology, an amendment of the<br />

covenants was discussed with the banks in the reporting<br />

period. The covenants were adapted to the new situation.<br />

In addition the credit line of CHF 200 million was reduced<br />

to CHF 120 million. At year-end, the company was again<br />

negotiating with the banks to adjust the covenants, but the<br />

credit line is unchanged. The company is confident that<br />

these discussions will be concluded in the first quarter 2010.<br />

The syndicated bank loan will be due for repayment in 2012.<br />

<strong>Siegfried</strong> has the right to draw up to CHF 30.0 million in<br />

additional debt capital outside this facility.<br />

14. Financial liabilities<br />

In 1000 CHF <strong>2009</strong> 2008<br />

Loans from banks 71 210 86 127<br />

Other non-current liabilities 126 –<br />

Total non-current interest bearing liabilities 71 336 86 127<br />

Maturity and average interest rates of bank loans:<br />

<strong>2009</strong> 2008<br />

In the year 2012 71 210 86 127<br />

Ø Interest rate in % 4.0% 5.4%<br />

Total 71 210 86 127<br />

15. Provisions<br />

Environmental Other<br />

In 1000 CHF provisions provisions Total<br />

Statement of changes<br />

As of December 31, 2008 10 522 4 809 15 331<br />

Costs incurred –178 – –178<br />

Additions, interest 601 1 717 2 318<br />

Releases (unused provisions) –1 000 –1 255 –2 255<br />

As of December 31, <strong>2009</strong> 9 945 5 271 15 216<br />

Of which current 3 595 5 271 8 866<br />

of which non-current 6 350 – 6 350<br />

Variable interest rate bank loans of CHF 40.0 million and<br />

USD 32.0 million (2008: CHF 40.0 million and USD 32 million)<br />

were fixed with interest rate swaps. The remaining<br />

financial liabilities are subject to interest rate risks.<br />

The financial liabilities are denominated in the following<br />

currencies:<br />

In 1000 CHF Total CHF EUR USD<br />

As of<br />

December 31, <strong>2009</strong><br />

Bank loans 71 210 38 000 – 33 210<br />

Other non-current<br />

liabilities 126 –<br />

Total 71 336 38 000 – 33 210<br />

As of<br />

December 31, 2008<br />

Bank loans 86 127 30 000 22 332 33 795<br />

Total 86 127 30 000 22 332 33 795<br />

In August 2006 a credit line of a syndicated bank loan of<br />

CHF 200 million was opened. This credit line was arranged<br />

with a group of banks to secure planned capital expenditure<br />

Environmental provisions The <strong>Siegfried</strong> Group produces<br />

chemicals at various locations. As part of the manufacturing<br />

process, undesirable incidents may arise that result in an<br />

obligation to remedy pollutant effects on the environment.<br />

Such obligations are recognized in the period when they<br />

become apparent. A provision is recorded if it is expected<br />

that the obligation results in an outflow of economic<br />

resources in the medium term and if a reasonable estimate<br />

of that obligation can be made. By their nature the amounts<br />

and timing of any outflows are difficult to predict. In connection<br />

with planned construction projects, environmental<br />

investigations were performed. Possible remediation obligations<br />

of CHF 9.9 million have been provided for. The start of<br />

the planned construction projects is anticipated within the<br />

next 15 years; in connection with the construction of a laboratory<br />

building CHF 0.2 million of the provision was used;<br />

the unused portion of the provision foreseen for this purpose<br />

of CHF 1.0 million has been released to income. The<br />

environmental provision was discounted to the present value<br />

of the expected expenditures. Management reviews the provisions<br />

annually based on regulatory changes or changes in<br />

planned investments.<br />

Financial Statements <strong>Siegfried</strong> Group 95