Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

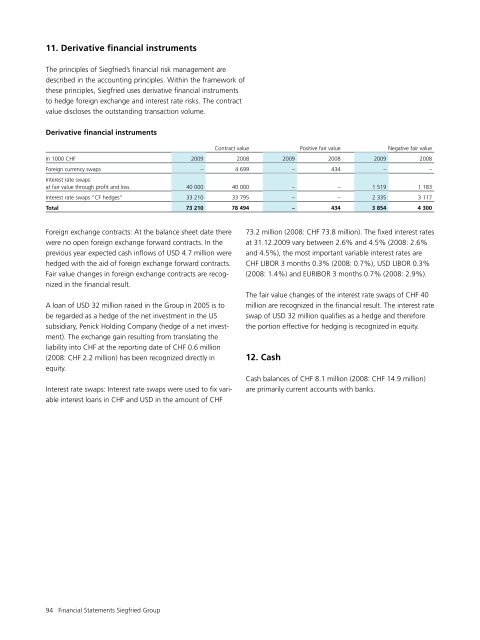

11. Derivative financial instruments<br />

The principles of <strong>Siegfried</strong>’s financial risk management are<br />

described in the accounting principles. Within the framework of<br />

these principles, <strong>Siegfried</strong> uses derivative financial instruments<br />

to hedge foreign exchange and interest rate risks. The contract<br />

value discloses the outstanding transaction volume.<br />

Derivative financial instruments<br />

Contract value Positive fair value Negative fair value<br />

In 1000 CHF <strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

Foreign currency swaps – 4 699 – 434 – –<br />

Interest rate swaps<br />

at fair value through profit and loss 40 000 40 000 – – 1 519 1 183<br />

Interest rate swaps “CF hedges” 33 210 33 795 – – 2 335 3 117<br />

Total 73 210 78 494 – 434 3 854 4 300<br />

Foreign exchange contracts: At the balance sheet date there<br />

were no open foreign exchange forward contracts. In the<br />

previous year expected cash inflows of USD 4.7 million were<br />

hedged with the aid of foreign exchange forward contracts.<br />

Fair value changes in foreign exchange contracts are recognized<br />

in the financial result.<br />

A loan of USD 32 million raised in the Group in 2005 is to<br />

be regarded as a hedge of the net investment in the US<br />

subsidiary, Penick Holding Company (hedge of a net investment).<br />

The exchange gain resulting from translating the<br />

liability into CHF at the reporting date of CHF 0.6 million<br />

(2008: CHF 2.2 million) has been recognized directly in<br />

equity.<br />

Interest rate swaps: Interest rate swaps were used to fix variable<br />

interest loans in CHF and USD in the amount of CHF<br />

73.2 million (2008: CHF 73.8 million). The fixed interest rates<br />

at 31.12.<strong>2009</strong> vary between 2.6% and 4.5% (2008: 2.6%<br />

and 4.5%), the most important variable interest rates are<br />

CHF LIBOR 3 months 0.3% (2008: 0.7%), USD LIBOR 0.3%<br />

(2008: 1.4%) and EURIBOR 3 months 0.7% (2008: 2.9%).<br />

The fair value changes of the interest rate swaps of CHF 40<br />

million are recognized in the financial result. The interest rate<br />

swap of USD 32 million qualifies as a hedge and therefore<br />

the portion effective for hedging is recognized in equity.<br />

12. Cash<br />

Cash balances of CHF 8.1 million (2008: CHF 14.9 million)<br />

are primarily current accounts with banks.<br />

94 Financial Statements <strong>Siegfried</strong> Group