Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

to 20.5% (2008: 17.7%) and 13.4% (2008: 11.3%) of<br />

the aggregate trade receivables. The customers concerned<br />

are major pharmaceutical companies with first class credit<br />

ratings.<br />

Credit risks on other financial assets are controlled by a<br />

policy of limiting the exposure only to partners with high<br />

credit ratings, by on-going review of credit ratings and<br />

by limiting individual aggregate balances. At 31.12.<strong>2009</strong><br />

CHF 5 million/62% in cash was invested with a single<br />

financial institution (2008: CHF 8.1 million/55%).<br />

Capital risk The capital of the <strong>Siegfried</strong> Group is managed<br />

with a view to ensuring the continuation of operations,<br />

to earning an adequate yield for the shareholders and to<br />

optimizing the capital structure in order to reduce the cost<br />

of capital.<br />

The capital structure can be influenced by changing the dividend<br />

distribution, by repayments of capital, capital increases,<br />

by sales of assets and repayment of liabilities.<br />

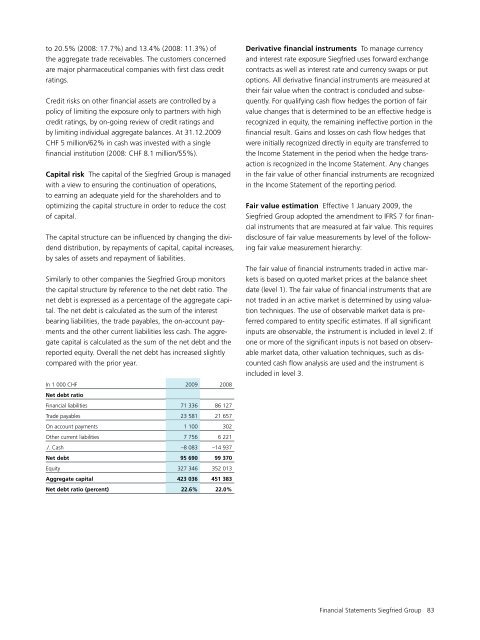

Similarly to other companies the <strong>Siegfried</strong> Group monitors<br />

the capital structure by reference to the net debt ratio. The<br />

net debt is expressed as a percentage of the aggregate capital.<br />

The net debt is calculated as the sum of the interest<br />

bearing liabilities, the trade payables, the on-account payments<br />

and the other current liabilities less cash. The aggregate<br />

capital is calculated as the sum of the net debt and the<br />

reported equity. Overall the net debt has increased slightly<br />

compared with the prior year.<br />

In 1 000 CHF <strong>2009</strong> 2008<br />

Net debt ratio<br />

Financial liabilities 71 336 86 127<br />

Trade payables 23 581 21 657<br />

On account payments 1 100 302<br />

Other current liabilities 7 756 6 221<br />

./. Cash –8 083 –14 937<br />

Net debt 95 690 99 370<br />

Equity 327 346 352 013<br />

Aggregate capital 423 036 451 383<br />

Net debt ratio (percent) 22.6% 22.0%<br />

Derivative financial instruments To manage currency<br />

and interest rate exposure <strong>Siegfried</strong> uses forward exchange<br />

contracts as well as interest rate and currency swaps or put<br />

options. All derivative financial instruments are measured at<br />

their fair value when the contract is concluded and subsequently.<br />

For qualifying cash flow hedges the portion of fair<br />

value changes that is determined to be an effective hedge is<br />

recognized in equity, the remaining ineffective portion in the<br />

financial result. Gains and losses on cash flow hedges that<br />

were initially recognized directly in equity are transferred to<br />

the Income Statement in the period when the hedge transaction<br />

is recognized in the Income Statement. Any changes<br />

in the fair value of other financial instruments are recognized<br />

in the Income Statement of the reporting period.<br />

Fair value estimation Effective 1 January <strong>2009</strong>, the<br />

<strong>Siegfried</strong> Group adopted the amendment to IFRS 7 for financial<br />

instruments that are measured at fair value. This requires<br />

disclosure of fair value measurements by level of the following<br />

fair value measurement hierarchy:<br />

The fair value of financial instruments traded in active markets<br />

is based on quoted market prices at the balance sheet<br />

date (level 1). The fair value of financial instruments that are<br />

not traded in an active market is determined by using valuation<br />

techniques. The use of observable market data is preferred<br />

compared to entity specific estimates. If all significant<br />

inputs are observable, the instrument is included in level 2. If<br />

one or more of the significant inputs is not based on observable<br />

market data, other valuation techniques, such as discounted<br />

cash flow analysis are used and the instrument is<br />

included in level 3.<br />

Financial Statements <strong>Siegfried</strong> Group 83