Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

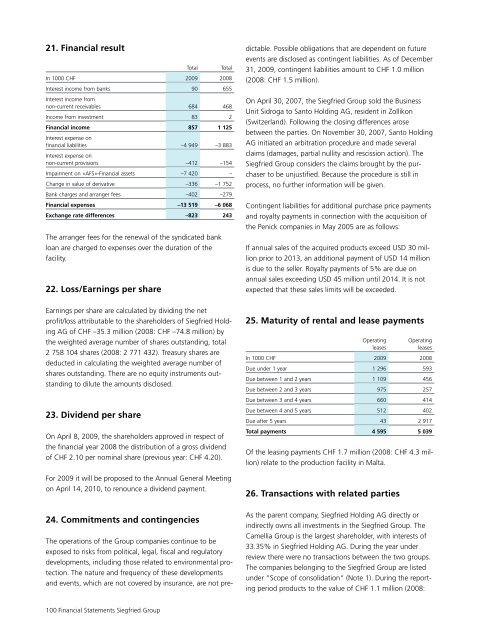

21. Financial result<br />

Total<br />

Total<br />

In 1000 CHF <strong>2009</strong> 2008<br />

Interest income from banks 90 655<br />

Interest income from<br />

non-current receivables 684 468<br />

Income from investment 83 2<br />

Financial income 857 1 125<br />

Interest expense on<br />

financial liabilities –4 949 –3 883<br />

Interest expense on<br />

non-current provisions –412 –154<br />

Impairment on «AFS»-Financial assets –7 420 –<br />

Change in value of derivative –336 –1 752<br />

Bank charges and arranger fees –402 –279<br />

Financial expenses –13 519 –6 068<br />

Exchange rate differences –823 243<br />

The arranger fees for the renewal of the syndicated bank<br />

loan are charged to expenses over the duration of the<br />

facility.<br />

22. Loss/Earnings per share<br />

Earnings per share are calculated by dividing the net<br />

profit/loss attributable to the shareholders of <strong>Siegfried</strong> Holding<br />

AG of CHF –35.3 million (2008: CHF –74.8 million) by<br />

the weighted average number of shares outstanding, total<br />

2 758 104 shares (2008: 2 771 432). Treasury shares are<br />

deducted in calculating the weighted average number of<br />

shares outstanding. There are no equity instruments outstanding<br />

to dilute the amounts disclosed.<br />

23. Dividend per share<br />

On April 8, <strong>2009</strong>, the shareholders approved in respect of<br />

the financial year 2008 the distribution of a gross dividend<br />

of CHF 2.10 per nominal share (previous year: CHF 4.20).<br />

For <strong>2009</strong> it will be proposed to the <strong>Annual</strong> General Meeting<br />

on April 14, 2010, to renounce a dividend payment.<br />

24. Commitments and contingencies<br />

The operations of the Group companies continue to be<br />

exposed to risks from political, legal, fiscal and regulatory<br />

developments, including those related to environmental protection.<br />

The nature and frequency of these developments<br />

and events, which are not covered by insurance, are not predictable.<br />

Possible obligations that are dependent on future<br />

events are disclosed as contingent liabilities. As of December<br />

31, <strong>2009</strong>, contingent liabilities amount to CHF 1.0 million<br />

(2008: CHF 1.5 million).<br />

On April 30, 2007, the <strong>Siegfried</strong> Group sold the Business<br />

Unit Sidroga to Santo Holding AG, resident in Zollikon<br />

(Switzerland). Following the closing differences arose<br />

between the parties. On November 30, 2007, Santo Holding<br />

AG initiated an arbitration procedure and made several<br />

claims (damages, partial nullity and rescission action). The<br />

<strong>Siegfried</strong> Group considers the claims brought by the purchaser<br />

to be unjustified. Because the procedure is still in<br />

process, no further information will be given.<br />

Contingent liabilities for additional purchase price payments<br />

and royalty payments in connection with the acquisition of<br />

the Penick companies in May 2005 are as follows:<br />

If annual sales of the acquired products exceed USD 30 million<br />

prior to 2013, an additional payment of USD 14 million<br />

is due to the seller. Royalty payments of 5% are due on<br />

annual sales exceeding USD 45 million until 2014. It is not<br />

expected that these sales limits will be exceeded.<br />

25. Maturity of rental and lease payments<br />

Operating<br />

leases<br />

Operating<br />

leases<br />

In 1000 CHF <strong>2009</strong> 2008<br />

Due under 1 year 1 296 593<br />

Due between 1 and 2 years 1 109 456<br />

Due between 2 and 3 years 975 257<br />

Due between 3 and 4 years 660 414<br />

Due between 4 and 5 years 512 402<br />

Due after 5 years 43 2 917<br />

Total payments 4 595 5 039<br />

Of the leasing payments CHF 1.7 million (2008: CHF 4.3 million)<br />

relate to the production facility in Malta.<br />

26. Transactions with related parties<br />

As the parent company, <strong>Siegfried</strong> Holding AG directly or<br />

indirectly owns all investments in the <strong>Siegfried</strong> Group. The<br />

Camellia Group is the largest shareholder, with interests of<br />

33.35% in <strong>Siegfried</strong> Holding AG. During the year under<br />

review there were no transactions between the two groups.<br />

The companies belonging to the <strong>Siegfried</strong> Group are listed<br />

under “Scope of consolidation“ (Note 1). During the reporting<br />

period products to the value of CHF 1.1 million (2008:<br />

100 Financial Statements <strong>Siegfried</strong> Group