Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

exchange rates prevailing on the transaction dates. The<br />

exchange rate differences arising from the translation of the<br />

Financial Statements are recognized directly in consolidated<br />

equity. Exchange rate differences arising on intercompany<br />

loans that, in substance, form part of the net investment in<br />

that subsidiary as well as financial liabilities that are designated<br />

as hedges of these investments, are also recognized in<br />

equity. Intercompany loans are regarded as part of a net<br />

investment in a subsidiary, if the settlement of these loans is<br />

neither planned nor likely to occur in the foreseeable future.<br />

All other exchange rate differences are included in the<br />

Income Statement.<br />

Translation differences on non-monetary financial assets and<br />

liabilities such as equities held at fair value through profit or<br />

loss are recognized in the income statement as part of the<br />

fair value gain or loss. Translation differences on non-monetary<br />

financial assets such as equities classified as availablefor-sale<br />

are included in the reserve for value fluctuations of<br />

financial instruments in equity.<br />

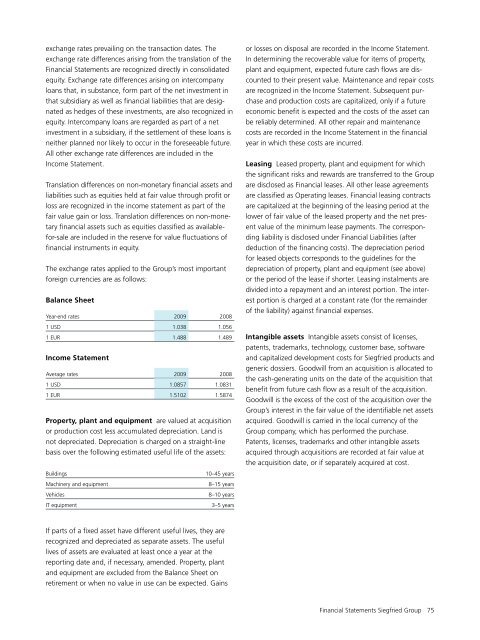

The exchange rates applied to the Group’s most important<br />

foreign currencies are as follows:<br />

Balance Sheet<br />

Year-end rates <strong>2009</strong> 2008<br />

1 USD 1.038 1.056<br />

1 EUR 1.488 1.489<br />

Income Statement<br />

Average rates <strong>2009</strong> 2008<br />

1 USD 1.0857 1.0831<br />

1 EUR 1.5102 1.5874<br />

Property, plant and equipment are valued at acquisition<br />

or production cost less accumulated depreciation. Land is<br />

not depreciated. Depreciation is charged on a straight-line<br />

basis over the following estimated useful life of the assets:<br />

Buildings<br />

Machinery and equipment<br />

Vehicles<br />

IT equipment<br />

10–45 years<br />

8–15 years<br />

8–10 years<br />

3–5 years<br />

or losses on disposal are recorded in the Income Statement.<br />

In determining the recoverable value for items of property,<br />

plant and equipment, expected future cash flows are discounted<br />

to their present value. Maintenance and repair costs<br />

are recognized in the Income Statement. Subsequent purchase<br />

and production costs are capitalized, only if a future<br />

economic benefit is expected and the costs of the asset can<br />

be reliably determined. All other repair and maintenance<br />

costs are recorded in the Income Statement in the financial<br />

year in which these costs are incurred.<br />

Leasing Leased property, plant and equipment for which<br />

the significant risks and rewards are transferred to the Group<br />

are disclosed as Financial leases. All other lease agreements<br />

are classified as Operating leases. Financial leasing contracts<br />

are capitalized at the beginning of the leasing period at the<br />

lower of fair value of the leased property and the net present<br />

value of the minimum lease payments. The corresponding<br />

liability is disclosed under Financial Liabilities (after<br />

deduction of the financing costs). The depreciation period<br />

for leased objects corresponds to the guidelines for the<br />

depreciation of property, plant and equipment (see above)<br />

or the period of the lease if shorter. Leasing instalments are<br />

divided into a repayment and an interest portion. The interest<br />

portion is charged at a constant rate (for the remainder<br />

of the liability) against financial expenses.<br />

Intangible assets Intangible assets consist of licenses,<br />

patents, trademarks, technology, customer base, software<br />

and capitalized development costs for <strong>Siegfried</strong> products and<br />

generic dossiers. Goodwill from an acquisition is allocated to<br />

the cash-generating units on the date of the acquisition that<br />

benefit from future cash flow as a result of the acquisition.<br />

Goodwill is the excess of the cost of the acquisition over the<br />

Group’s interest in the fair value of the identifiable net assets<br />

acquired. Goodwill is carried in the local currency of the<br />

Group company, which has performed the purchase.<br />

Patents, licenses, trademarks and other intangible assets<br />

acquired through acquisitions are recorded at fair value at<br />

the acquisition date, or if separately acquired at cost.<br />

If parts of a fixed asset have different useful lives, they are<br />

recognized and depreciated as separate assets. The useful<br />

lives of assets are evaluated at least once a year at the<br />

reporting date and, if necessary, amended. Property, plant<br />

and equipment are excluded from the Balance Sheet on<br />

retirement or when no value in use can be expected. Gains<br />

Financial Statements <strong>Siegfried</strong> Group 75