Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

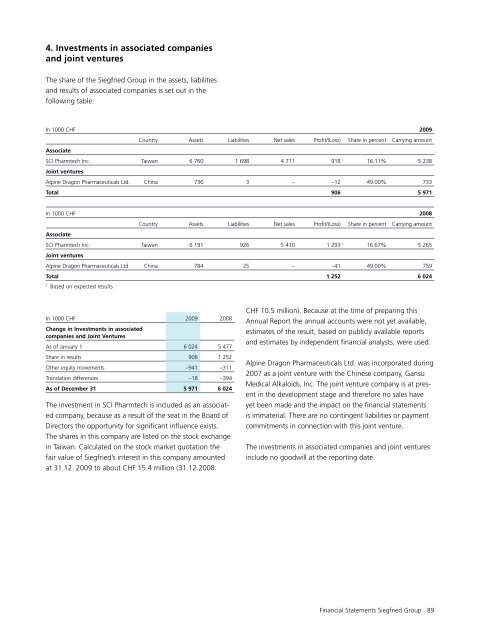

4. Investments in associated companies<br />

and joint ventures<br />

The share of the <strong>Siegfried</strong> Group in the assets, liabilities<br />

and results of associated companies is set out in the<br />

following table:<br />

In 1000 CHF <strong>2009</strong><br />

Country Assets Liabilities Net sales Profit/(Loss) Share in percent Carrying amount<br />

Associate<br />

SCI Pharmtech Inc. Taiwan 6 760 1 698 4 711 918 1 16.11% 5 238<br />

Joint ventures<br />

Alpine Dragon Pharmaceuticals Ltd. China 736 3 – –12 49.00% 733<br />

Total 906 5 971<br />

In 1000 CHF 2008<br />

Country Assets Liabilities Net sales Profit/(Loss) Share in percent Carrying amount<br />

Associate<br />

SCI Pharmtech Inc. Taiwan 6 191 926 5 410 1 293 1 16.67% 5 265<br />

Joint ventures<br />

Alpine Dragon Pharmaceuticals Ltd. China 784 25 – –41 49.00% 759<br />

Total 1 252 6 024<br />

1<br />

Based on expected results<br />

In 1000 CHF <strong>2009</strong> 2008<br />

Change in Investments in associated<br />

companies and Joint Ventures<br />

As of January 1 6 024 5 477<br />

Share in results 906 1 252<br />

Other equity movements –941 –311<br />

Translation differences –18 –394<br />

As of December 31 5 971 6 024<br />

The investment in SCI Pharmtech is included as an associated<br />

company, because as a result of the seat in the Board of<br />

Directors the opportunity for significant influence exists.<br />

The shares in this company are listed on the stock exchange<br />

in Taiwan. Calculated on the stock market quotation the<br />

fair value of <strong>Siegfried</strong>’s interest in this company amounted<br />

at 31.12. <strong>2009</strong> to about CHF 15.4 million (31.12.2008:<br />

CHF 10.5 million). Because at the time of preparing this<br />

<strong>Annual</strong> <strong>Report</strong> the annual accounts were not yet available,<br />

estimates of the result, based on publicly available reports<br />

and estimates by independent financial analysts, were used.<br />

Alpine Dragon Pharmaceuticals Ltd. was incorporated during<br />

2007 as a joint venture with the Chinese company, Gansu<br />

Medical Alkaloids, Inc. The joint venture company is at present<br />

in the development stage and therefore no sales have<br />

yet been made and the impact on the financial statements<br />

is immaterial. There are no contingent liabilities or payment<br />

commitments in connection with this joint venture.<br />

The investments in associated companies and joint ventures<br />

include no goodwill at the reporting date.<br />

Financial Statements <strong>Siegfried</strong> Group 89