Siegfried Annual Report 2009

Siegfried Annual Report 2009

Siegfried Annual Report 2009

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Transparency Law Art. 663b and Art. 663c CO<br />

Content and procedure for determining remuneration<br />

and profit participation scheme<br />

The members of the Board of Directors receive for their work<br />

remuneration, which is determined by the entire Board on<br />

motion of the Nomination and Compensation Committee.<br />

The management of the <strong>Siegfried</strong> Group is remunerated on<br />

a performance basis. The variable component foreseen is<br />

between 5% and 40% of the base salary. The effective variable<br />

component depends on achieving business targets in<br />

their area of responsibility and individual objectives. The<br />

achievement of business targets influences the variable component<br />

with a factor of 0 in the worst case and of 1.75 in<br />

the best case. The personal achievement factor lies between<br />

0 and 1.25. The variable component can achieve a maximum<br />

factor of 1.5. The Nomination & Compensation Committee<br />

of the Board of Directors determines the remuneration<br />

of the members of management.<br />

Employee share plan In August 2005 the <strong>Siegfried</strong> Group<br />

initiated for all employees in Switzerland a share savings<br />

plan. Employees may invest at most 10 percent of their base<br />

salary in this share plan and with this purchase <strong>Siegfried</strong><br />

shares. Board members may participate in this share plan up<br />

to a maximum of 90% of their total remuneration. The<br />

shares are subject to a holding period of three years. The<br />

company contributes 30% to the employees’ paid in<br />

amount. The employees may in August of each year withdraw<br />

from the plan or change their participation amounts.<br />

Since September 2005 the amounts fixed by the employees<br />

themselves each August are deducted monthly from their<br />

pay.<br />

In aggregate, in <strong>2009</strong> 123 (2008: 153) employees and<br />

6 (2008: 6) board members participated in the share<br />

savings plan.<br />

Compensation to members of executive bodies in<br />

office The members of the Board of Directors receive annual<br />

compensation of CHF 50 000 plus a lump-sum CHF 5 000<br />

for expenses, the Chairman of the Board CHF 270 000 plus<br />

CHF 20 000 lump-sum expenses and the Deputy Chairman<br />

CHF 60 000, plus CHF 10 000 lump-sum expenses. The<br />

compensation paid to members of the Board of Directors<br />

therefore amounts to CHF 635 000 (2008: CHF 635 000).<br />

Under the terms of the Employee Share Plan board members<br />

were also entitled to purchase shares with a rebate of 30%<br />

financed by the firm. The individual members receive compensation<br />

as follows:<br />

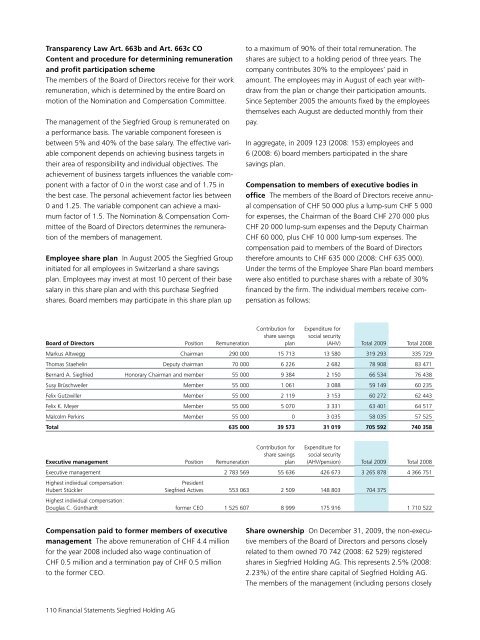

Contribution for Expenditure for<br />

share savings social security<br />

Board of Directors Position Remuneration plan (AHV) Total <strong>2009</strong> Total 2008<br />

Markus Altwegg Chairman 290 000 15 713 13 580 319 293 335 729<br />

Thomas Staehelin Deputy chairman 70 000 6 226 2 682 78 908 83 471<br />

Bernard A. <strong>Siegfried</strong> Honorary Chairman and member 55 000 9 384 2 150 66 534 76 438<br />

Susy Brüschweiler Member 55 000 1 061 3 088 59 149 60 235<br />

Felix Gutzwiller Member 55 000 2 119 3 153 60 272 62 443<br />

Felix K. Meyer Member 55 000 5 070 3 331 63 401 64 517<br />

Malcolm Perkins Member 55 000 0 3 035 58 035 57 525<br />

Total 635 000 39 573 31 019 705 592 740 358<br />

Contribution for Expenditure for<br />

share savings social security<br />

Executive management Position Remuneration plan (AHV/pension) Total <strong>2009</strong> Total 2008<br />

Executive management 2 783 569 55 636 426 673 3 265 878 4 366 751<br />

Highest individual compensation:<br />

President<br />

Hubert Stückler <strong>Siegfried</strong> Actives 553 063 2 509 148 803 704 375<br />

Highest individual compensation:<br />

Douglas C. Günthardt former CEO 1 525 607 8 999 175 916 1 710 522<br />

Compensation paid to former members of executive<br />

management The above remuneration of CHF 4.4 million<br />

for the year 2008 included also wage continuation of<br />

CHF 0.5 million and a termination pay of CHF 0.5 million<br />

to the former CEO.<br />

Share ownership On December 31, <strong>2009</strong>, the non-executive<br />

members of the Board of Directors and persons closely<br />

related to them owned 70 742 (2008: 62 529) registered<br />

shares in <strong>Siegfried</strong> Holding AG. This represents 2.5% (2008:<br />

2.23%) of the entire share capital of <strong>Siegfried</strong> Holding AG.<br />

The members of the management (including persons closely<br />

110 Financial Statements <strong>Siegfried</strong> Holding AG