2008 Amendments to the Uniform Interstate Family Support Act ...

2008 Amendments to the Uniform Interstate Family Support Act ...

2008 Amendments to the Uniform Interstate Family Support Act ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

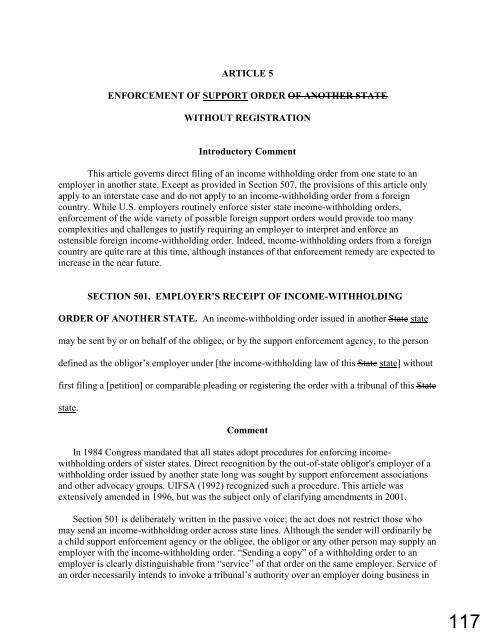

ARTICLE 5<br />

ENFORCEMENT OF SUPPORT ORDER OF ANOTHER STATE<br />

WITHOUT REGISTRATION<br />

Introduc<strong>to</strong>ry Comment<br />

This article governs direct filing of an income withholding order from one state <strong>to</strong> an<br />

employer in ano<strong>the</strong>r state. Except as provided in Section 507, <strong>the</strong> provisions of this article only<br />

apply <strong>to</strong> an interstate case and do not apply <strong>to</strong> an income-withholding order from a foreign<br />

country. While U.S. employers routinely enforce sister state income-withholding orders,<br />

enforcement of <strong>the</strong> wide variety of possible foreign support orders would provide <strong>to</strong>o many<br />

complexities and challenges <strong>to</strong> justify requiring an employer <strong>to</strong> interpret and enforce an<br />

ostensible foreign income-withholding order. Indeed, income-withholding orders from a foreign<br />

country are quite rare at this time, although instances of that enforcement remedy are expected <strong>to</strong><br />

increase in <strong>the</strong> near future.<br />

SECTION 501. EMPLOYER’S RECEIPT OF INCOME-WITHHOLDING<br />

ORDER OF ANOTHER STATE. An income-withholding order issued in ano<strong>the</strong>r State state<br />

may be sent by or on behalf of <strong>the</strong> obligee, or by <strong>the</strong> support enforcement agency, <strong>to</strong> <strong>the</strong> person<br />

defined as <strong>the</strong> obligor’s employer under [<strong>the</strong> income-withholding law of this State state] without<br />

first filing a [petition] or comparable pleading or registering <strong>the</strong> order with a tribunal of this State<br />

state.<br />

Comment<br />

In 1984 Congress mandated that all states adopt procedures for enforcing incomewithholding<br />

orders of sister states. Direct recognition by <strong>the</strong> out-of-state obligor's employer of a<br />

withholding order issued by ano<strong>the</strong>r state long was sought by support enforcement associations<br />

and o<strong>the</strong>r advocacy groups. UIFSA (1992) recognized such a procedure. This article was<br />

extensively amended in 1996, but was <strong>the</strong> subject only of clarifying amendments in 2001.<br />

Section 501 is deliberately written in <strong>the</strong> passive voice; <strong>the</strong> act does not restrict those who<br />

may send an income-withholding order across state lines. Although <strong>the</strong> sender will ordinarily be<br />

a child support enforcement agency or <strong>the</strong> obligee, <strong>the</strong> obligor or any o<strong>the</strong>r person may supply an<br />

employer with <strong>the</strong> income-withholding order. “Sending a copy” of a withholding order <strong>to</strong> an<br />

employer is clearly distinguishable from “service” of that order on <strong>the</strong> same employer. Service of<br />

an order necessarily intends <strong>to</strong> invoke a tribunal’s authority over an employer doing business in<br />

117