Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Etex <strong>Annual</strong> <strong>Report</strong> <strong>2014</strong><br />

Financial report<br />

Consolidated financial statements<br />

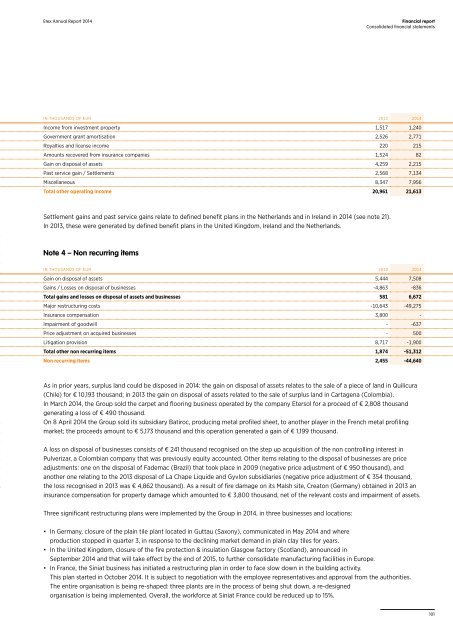

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Income from investment property 1,517 1,240<br />

Government grant amortisation 2,526 2,771<br />

Royalties and license income 220 215<br />

Amounts recovered from insurance companies 1,524 82<br />

Gain on disposal of assets 4,259 2,215<br />

Past service gain / Settlements 2,568 7,134<br />

Miscellaneous 8,347 7,956<br />

Total other operating income 20,961 21,613<br />

Settlement gains and past service gains relate to defined benefit plans in the Netherlands and in Ireland in <strong>2014</strong> (see note 21).<br />

In 2013, these were generated by defined benefit plans in the United Kingdom, Ireland and the Netherlands.<br />

Note 4 – Non recurring items<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Gain on disposal of assets 5,444 7,508<br />

Gains / Losses on disposal of businesses -4,863 -836<br />

Total gains and losses on disposal of assets and businesses 581 6,672<br />

Major restructuring costs -10,643 -49,275<br />

Insurance compensation 3,800 -<br />

Impairment of goodwill - -637<br />

Price adjustment on acquired businesses - 500<br />

Litigation provision 8,717 -1,900<br />

Total other non recurring items 1,874 -51,312<br />

Non recurring items 2,455 -44,640<br />

As in prior years, surplus land could be disposed in <strong>2014</strong>: the gain on disposal of assets relates to the sale of a piece of land in Quilicura<br />

(Chile) for € 10,193 thousand; in 2013 the gain on disposal of assets related to the sale of surplus land in Cartagena (Colombia).<br />

In March <strong>2014</strong>, the Group sold the carpet and flooring business operated by the company Etersol for a proceed of € 2,808 thousand<br />

generating a loss of € 490 thousand.<br />

On 8 April <strong>2014</strong> the Group sold its subsidiary Batiroc, producing metal profiled sheet, to another player in the French metal profiling<br />

market; the proceeds amount to € 5,173 thousand and this operation generated a gain of € 1,199 thousand.<br />

A loss on disposal of businesses consists of € 241 thousand recognised on the step up acquisition of the non controlling interest in<br />

Pulverizar, a Colombian company that was previously equity accounted. Other items relating to the disposal of businesses are price<br />

adjustments: one on the disposal of Fademac (Brazil) that took place in 2009 (negative price adjustment of € 950 thousand), and<br />

another one relating to the 2013 disposal of La Chape Liquide and Gyvlon subsidiaries (negative price adjustment of € 354 thousand,<br />

the loss recognised in 2013 was € 4,862 thousand). As a result of fire damage on its Malsh site, Creaton (Germany) obtained in 2013 an<br />

insurance compensation for property damage which amounted to € 3,800 thousand, net of the relevant costs and impairment of assets.<br />

Three significant restructuring plans were implemented by the Group in <strong>2014</strong>, in three businesses and locations:<br />

• In Germany, closure of the plain tile plant located in Guttau (Saxony), communicated in May <strong>2014</strong> and where<br />

production stopped in quarter 3, in response to the declining market demand in plain clay tiles for years.<br />

• In the United Kingdom, closure of the fire protection & insulation Glasgow factory (Scotland), announced in<br />

September <strong>2014</strong> and that will take effect by the end of 2015, to further consolidate manufacturing facilities in Europe.<br />

• In France, the Siniat business has initiated a restructuring plan in order to face slow down in the building activity.<br />

This plan started in October <strong>2014</strong>. It is subject to negotiation with the employee representatives and approval from the authorities.<br />

The entire organisation is being re-shaped: three plants are in the process of being shut down, a re-designed<br />

organisation is being implemented. Overall, the workforce at Siniat France could be reduced up to 15%.<br />

101