Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Etex <strong>Annual</strong> <strong>Report</strong> <strong>2014</strong><br />

Financial report<br />

Consolidated financial statements<br />

Impairment testing<br />

In December <strong>2014</strong>, impairment reviews were performed for a certain number of assets where impairment indicators arose. The carrying<br />

value of capital employed has been compared with the recoverable amount of the cash-generating unit. This review did not result in<br />

any impairment. The recoverable amount of the cash-generating units was based on its value in use. The value in use was determined<br />

by discounting the future cash flows generated from the continuing use of the unit and was based on the following key assumptions,<br />

excluding Argentina (where discount rate amounts to 29.5 % and growth rate is consistent with inflation):<br />

• Cash flows were projected based on actual operating results and the 3 year business plan (extended to 10 years<br />

when the financial projections of a long-term strategy development is available for the cash-generating unit),<br />

• Cash flows for further periods were extrapolated using a constant growth rate in a range of 1.5 % to 5 %<br />

depending on the countries involved and their respective inflation rates,<br />

• Cash flows are discounted using the weighted average cost of capital (WACC) in a range of 7.9 % to 12.0 %<br />

depending on the countries involved (a range of 9.83 % to 12.75 % in 2013).<br />

In connection with the impairment testing process, the future cash flows were subjected to stress tests that included changes<br />

in individual macroeconomic parameters as part of a sensitivity analysis. More specifically, an increase of 100 basis points in<br />

the WACC indicated a potential need for an impairment charge of € 7.8 million.<br />

Note 8 – Goodwill and business combinations<br />

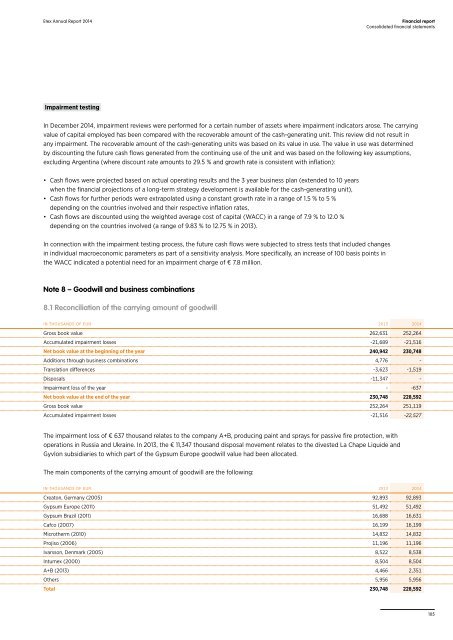

8.1 Reconciliation of the carrying amount of goodwill<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Gross book value 262,631 252,264<br />

Accumulated impairment losses -21,689 -21,516<br />

Net book value at the beginning of the year 240,942 230,748<br />

Additions through business combinations 4,776 -<br />

Translation differences -3,623 -1,519<br />

Disposals -11,347 -<br />

Impairment loss of the year - -637<br />

Net book value at the end of the year 230,748 228,592<br />

Gross book value 252,264 251,119<br />

Accumulated impairment losses -21,516 -22,527<br />

The impairment loss of € 637 thousand relates to the company A+B, producing paint and sprays for passive fire protection, with<br />

operations in Russia and Ukraine. In 2013, the € 11,347 thousand disposal movement relates to the divested La Chape Liquide and<br />

Gyvlon subsidiaries to which part of the Gypsum Europe goodwill value had been allocated.<br />

The main components of the carrying amount of goodwill are the following:<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Creaton, Germany (2005) 92,893 92,893<br />

Gypsum Europe (2011) 51,492 51,492<br />

Gypsum Brazil (2011) 16,688 16,631<br />

Cafco (2007) 16,199 16,199<br />

Microtherm (2010) 14,832 14,832<br />

Projiso (2006) 11,196 11,196<br />

Ivarsson, Denmark (2005) 8,522 8,538<br />

Intumex (2000) 8,504 8,504<br />

A+B (2013) 4,466 2,351<br />

Others 5,956 5,956<br />

Total 230,748 228,592<br />

105