Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial report<br />

Consolidated financial statements<br />

Transaction costs on the syndicated loan of 2011 amounting to € 13,921 thousand, on the restructuring of the syndicated loan in <strong>2014</strong><br />

amounting to € 4,233 thousand and on the retail bond of 2012 amounting to € 5,700 thousand have been deducted from the loan at<br />

initial recognition and are being amortised over the life of the extended loan.<br />

In 2012 the Chilean subsidiaries of the Group entered into four amortising term loan facilities:<br />

• A 3-year term loan of € 32 million entered by Inversiones Etex Chile Limitada to refinance existing bank loans at a more favourable<br />

rate. The loan was drawn in euro and a cross currency and interest rate swap was entered into that exactly matched the capital and<br />

interest payments on the loan, so converting the interest and capital flows into Chilean Peso. The loan has a final maturity in June<br />

2015. The loan is available for general corporate purpose. The financial covenants include required ratios of consolidated net debt to<br />

consolidated EBITDA of the Group.<br />

• Three term loans entered by Empresas Pizarreño SA for a total of CLP 49 billion in July 2012. The loans are available for use for<br />

general corporate purposes. Covenants all relate to the Empresas Pizarreño Group and include the usual operating covenants (see<br />

above). Financial covenants include required ratios of consolidated net debt to consolidated EBITDA of the Group, the ratio of total<br />

debt to net income plus depreciation and of total debt to total equity. The loans are drawn in Chilean pesos. The loans have a final<br />

maturity in July <strong>2014</strong>, June 2017 and August 2017.<br />

The Colombian subsidiaries of the Group entered into three long term amortising loan facilities and several short term loans.<br />

One loan started in 2013 and two in <strong>2014</strong>:<br />

• A 5-year term loan entered by Skinco Colombit SA for a total of COP 20 billion in December 2013 of which COP 17 billion<br />

is drawn in December <strong>2014</strong>. The loan is available for use for general corporate purposes. There are no covenants on this loan.<br />

The loan has a final maturity in November 2018.<br />

• Two 7-year term loans of COP 45 billion and COP 14 billion entered by Ceramica San Lorenzo Industrial de Colombia SA.<br />

Both loans have a final maturity in December 2021. The loan is available for general corporate purpose.<br />

The covenants relate to Ceramica San Lorenzo Industrial de Colombia SA. The loans have a final maturity in December 2021.<br />

• All other loans are short term loans for a total of COP 61 billion and USD 14 million. For the USD loans forward contracts are drawn<br />

to match the repayments of the capital and interest charges, converting the interest and capital flows into Colombian Peso.<br />

A put option was granted to Lafarge Group (November 2011) in the context of the acquisition of the European and Latin American<br />

gypsum activities. After a standstill period of five years Lafarge Group had the right to exercise its put option in April 2017 or in April<br />

2018. This put option was estimated at the end of 2012 based on expected future EBITDA by the time of put exercise for the acquired<br />

gypsum activities in Europe and Latin America. In 2013, Lafarge Group expressed its willingness to anticipate the originally agreed<br />

exercise date and both parties could agree on a lower transaction price. On 12 February <strong>2014</strong> the transaction was completed and Etex<br />

bought their remaining 20 per cent stake in the European and South American gypsum operations for € 145,000 thousand in cash.<br />

Therefore, this amount was used as the best estimate for the put option in the balance sheet as at 31 December 2013.<br />

The management of interest rate risk is described in Note 16.<br />

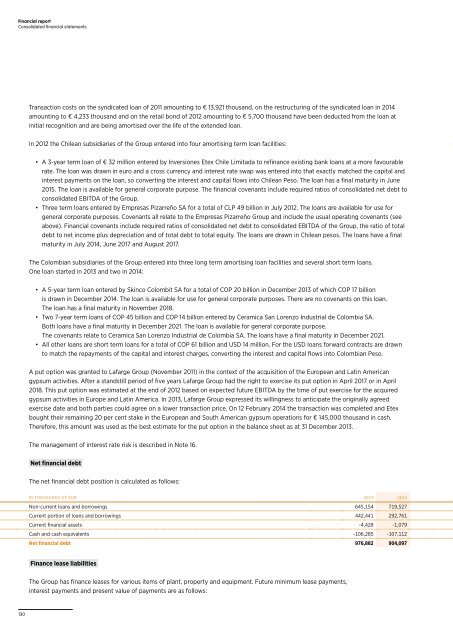

Net financial debt<br />

The net financial debt position is calculated as follows:<br />

IN THOUSANDS OF EUR 2013 <strong>2014</strong><br />

Non-current loans and borrowings 645,154 719,527<br />

Current portion of loans and borrowings 442,441 292,761<br />

Current financial assets -4,428 -1,079<br />

Cash and cash equivalents -106,285 -107,112<br />

Net financial debt 976,882 904,097<br />

Finance lease liabilities<br />

The Group has finance leases for various items of plant, property and equipment. Future minimum lease payments,<br />

interest payments and present value of payments are as follows:<br />

130