Annual Report 2014

This is the 2014 annual report of Etex Group

This is the 2014 annual report of Etex Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Etex <strong>Annual</strong> <strong>Report</strong> <strong>2014</strong><br />

Financial report<br />

Consolidated financial statements<br />

Note 16 – Risk management and financial derivatives<br />

16.1 Risk management<br />

A. Market risk<br />

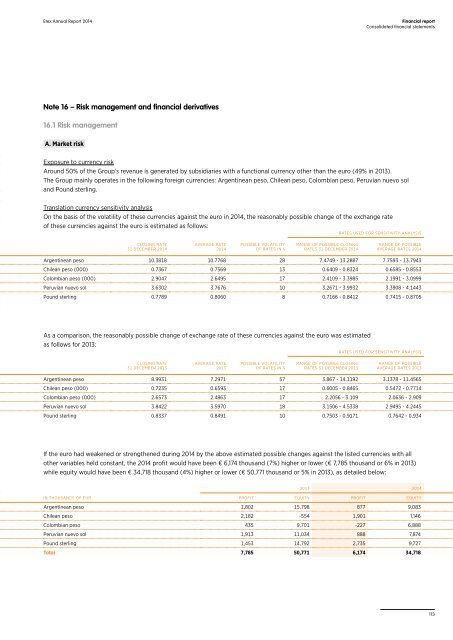

Exposure to currency risk<br />

Around 50% of the Group’s revenue is generated by subsidiaries with a functional currency other than the euro (49% in 2013).<br />

The Group mainly operates in the following foreign currencies: Argentinean peso, Chilean peso, Colombian peso, Peruvian nuevo sol<br />

and Pound sterling.<br />

Translation currency sensitivity analysis<br />

On the basis of the volatility of these currencies against the euro in <strong>2014</strong>, the reasonably possible change of the exchange rate<br />

of these currencies against the euro is estimated as follows:<br />

RATES USED FOR SENSITIVITY ANALYSIS<br />

CLOSING RATE<br />

31 DECEMBER <strong>2014</strong><br />

AVERAGE RATE<br />

<strong>2014</strong><br />

POSSIBLE VOLATILITY<br />

OF RATES IN %<br />

RANGE OF POSSIBLE CLOSING<br />

RATES 31 DECEMBER <strong>2014</strong><br />

RANGE OF POSSIBLE<br />

AVERAGE RATES <strong>2014</strong><br />

Argentinean peso 10.3818 10.7768 28 7.4749 - 13.2887 7.7593 - 13.7943<br />

Chilean peso (000) 0.7367 0.7569 13 0.6409 - 0.8324 0.6585 - 0.8553<br />

Colombian peso (000) 2.9047 2.6495 17 2.4109 - 3.3985 2.1991 - 3.0999<br />

Peruvian nuevo sol 3.6302 3.7676 10 3.2671 - 3.9932 3.3908 - 4.1443<br />

Pound sterling 0.7789 0.8060 8 0.7166 - 0.8412 0.7415 - 0.8705<br />

As a comparison, the reasonably possible change of exchange rate of these currencies against the euro was estimated<br />

as follows for 2013:<br />

RATES USED FOR SENSITIVITY ANALYSIS<br />

CLOSING RATE<br />

31 DECEMBER 2013<br />

AVERAGE RATE<br />

2013<br />

POSSIBLE VOLATILITY<br />

OF RATES IN %<br />

RANGE OF POSSIBLE CLOSING<br />

RATES 31 DECEMBER 2013<br />

RANGE OF POSSIBLE<br />

AVERAGE RATES 2013<br />

Argentinean peso 8.9931 7.2971 57 3.867 - 14.1192 3.1378 - 11.4565<br />

Chilean peso (000) 0.7235 0.6593 17 0.6005 - 0.8465 0.5472 - 0.7714<br />

Colombian peso (000) 2.6573 2.4863 17 2.2056 - 3.109 2.0636 - 2.909<br />

Peruvian nuevo sol 3.8422 3.5970 18 3.1506 - 4.5338 2.9495 - 4.2445<br />

Pound sterling 0.8337 0.8491 10 0.7503 - 0.9171 0.7642 - 0.934<br />

If the euro had weakened or strengthened during <strong>2014</strong> by the above estimated possible changes against the listed currencies with all<br />

other variables held constant, the <strong>2014</strong> profit would have been € 6,174 thousand (7%) higher or lower (€ 7,785 thousand or 6% in 2013)<br />

while equity would have been € 34,718 thousand (4%) higher or lower (€ 50,771 thousand or 5% in 2013), as detailed below:<br />

2013 <strong>2014</strong><br />

IN THOUSANDS OF EUR PROFIT EQUITY PROFIT EQUITY<br />

Argentinean peso 1,802 15,798 877 9,083<br />

Chilean peso 2,182 -554 1,901 1,146<br />

Colombian peso 435 9,701 -227 6,888<br />

Peruvian nuevo sol 1,913 11,034 888 7,874<br />

Pound sterling 1,453 14,792 2,735 9,727<br />

Total 7,785 50,771 6,174 34,718<br />

113